Stablecoins

As Tether boasts of a successful quarter, here’s how BTC stands to benefit

Revenue generated by Tether rises. At the same time, USDT’s dominance in the stablecoin sector could benefit BTC.

- Tether witnessed a successful Q2 in terms of revenue despite market volatility.

- BTC could benefit from Tether’s investment behavior.

Despite the turbulence that the DeFi sector has witnessed, Tether [USDT] and its associated stablecoins have continued to see growth on various fronts. Due to this, over the last quarter, Tether managed to be profitable in terms of revenue.

Read Bitcoin’s Price Prediction 2023-2024

Tether sees green

Tether has demonstrated impressive strength, boasting net assets surpassing liabilities by $855 million and reporting operational profits of over $1 billion for Q2 2023. The foundation of its operational framework revolved around the USD backing of USDT, which is further utilized for investment in short-term US Treasury bills or reverse repos, effectively generating lucrative interest returns.

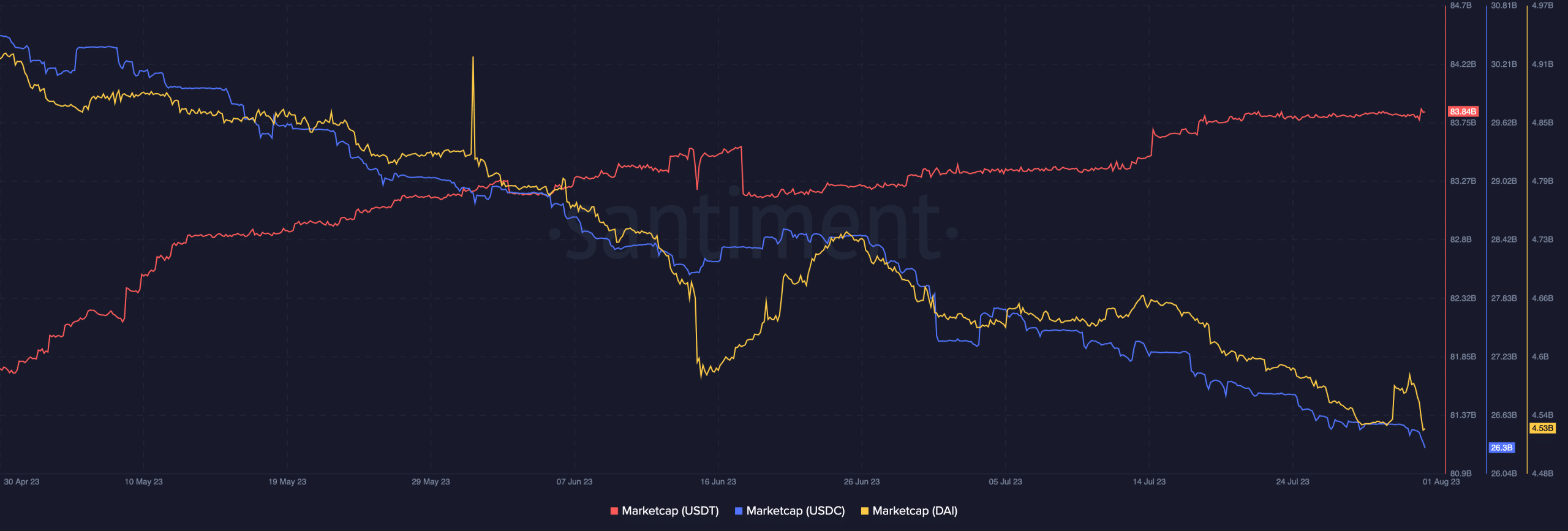

One of the reasons for the dominance of Tether was the surge in growth of USDT’s market cap. Due to various reasons such as the fall of Silicon Valley Bank and the subsequent decline in USDC’s market share, USDT managed to see tremendous growth. Based on Santiment’s data, it was seen that USDT outperformed USDC and DAI significantly.

In terms of network growth, USDT, along with DAI observed growth. This indicated that new addresses were increasingly showing interest in both stablecoins. USDC on the other hand, wasn’t able to witness the same level of growth and failed to attract new addresses.

However, despite its dominance in this sector, the Tether stablecoin still lagged behind USDC in terms of volume. At press time, USDC was responsible for 47.9% of all stablecoin volume according to Dune Analytics.

USDT, however, was only able to capture 37.1% of the overall market share in this segment, despite having the highest market cap.

How can BTC benefit?

Another benefactor of USDT and Tether’s dominance would be Bitcoin. Their financials indicated

that the firm actively accumulated BTC over the past two quarters. If Tether continues to stick to this strategy and accumulates more BTC with its earnings, it may provide some level of support to the ailing Bitcoin.Is your portfolio green? Check out the Bitcoin Profit Calculator

At press time, BTC was still stuck below the $30,000 level and was trading at $28,800. The number of holders of BTC continued to rise, however, they weren’t able to make much of an impact on its falling price.