ASI flips 50-DMA bullish – What it means for FET’s future price action

- Artificial Superintelligence Alliance is now among top trending searches

- FET’s price action flipped the 50-daily moving average as Open Interest surged

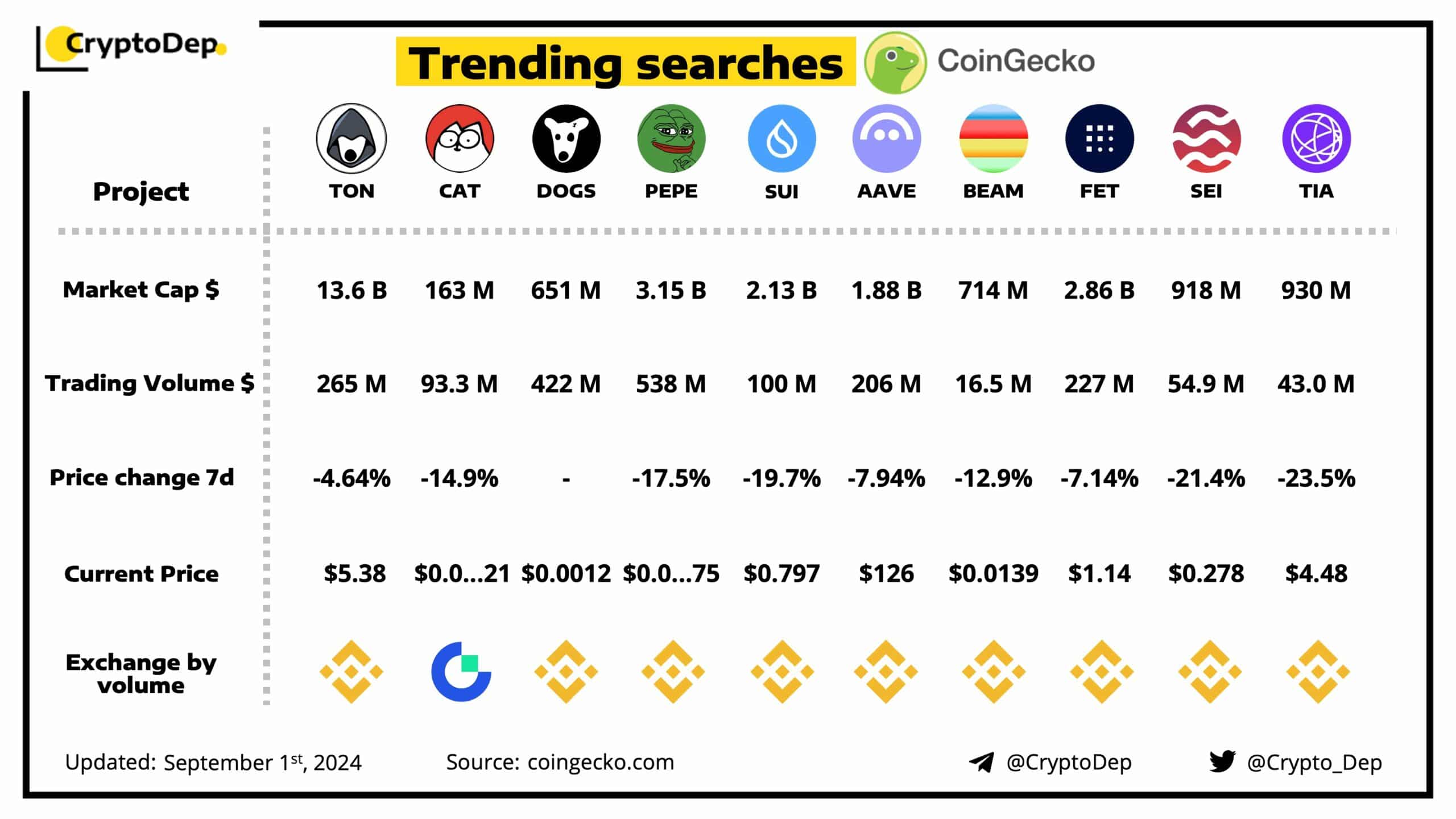

A new memecoin, DOGS on the TON blockchain, has been making waves in trending searches on CoinGecko. However, it’s not the only asset capturing market attention.

AI-focused coins, including the likes of FET, are also seeing greater interest. Artificial Superintelligence Alliance or Fetch.AI [FET] focuses on the safe development and deployment of AI technologies.

Fetch.AI [FET] recently became a prominent topic of discussion on CoinGecko. Its position, hence, is a sign of growing market traction and underlines the potential for long-term gains.

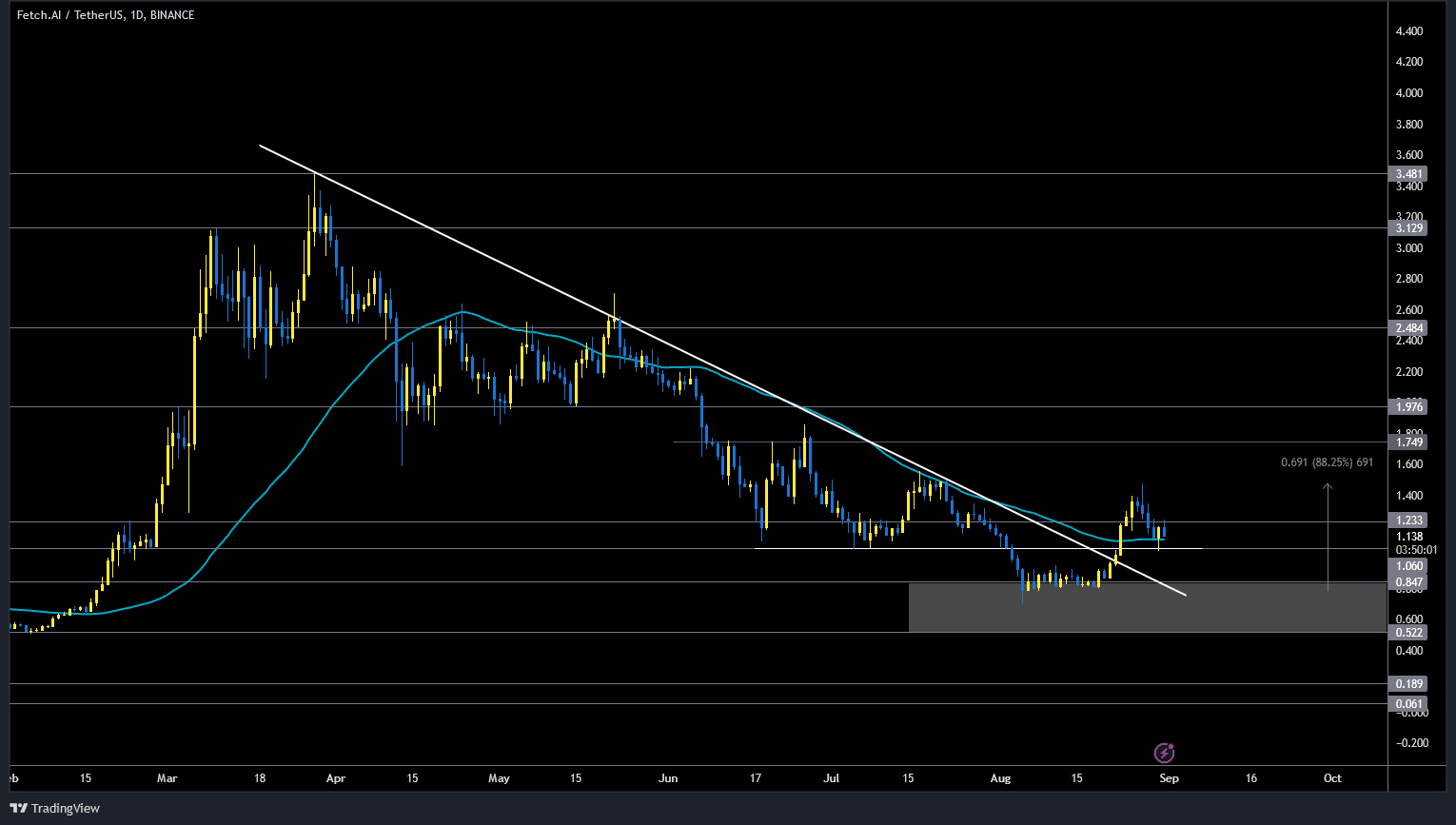

Fetch.AI [FET] has been showing some promising signs for the market this season. In fact, examining the Fetch.AI chart for the FET/USDT trading pair revealed some strong price action.

FET has surged by 80% from its recent low of $0.80 after breaking through a trendline. The bullish trend for FET has already been confirmed on the 50-day moving average (DMA) too.

At the time of writing, FET was testing horizontal support levels, and a strong rebound from this support could signal a significant bullish trend for both FET and the broader AI coin market.

Conversely, if this support level fails, it is essential to assess the impact on the overall market to identify better entry points.

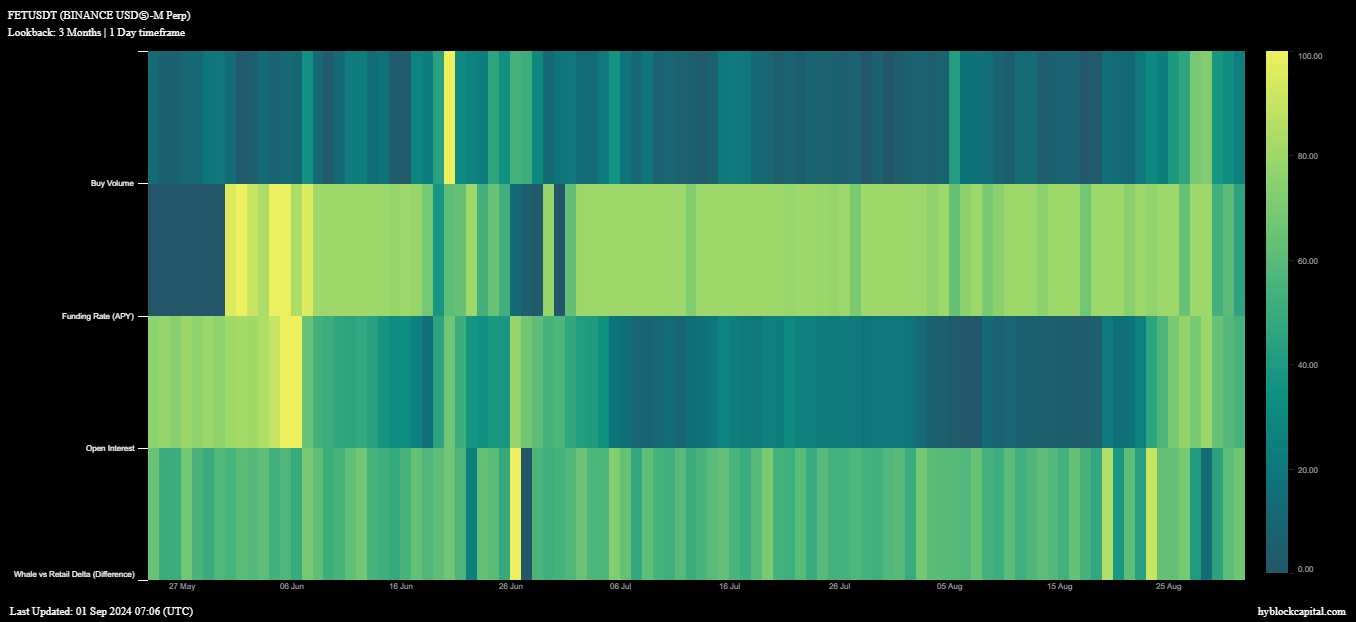

Metric combinations

A deeper dive into Fetch.AI’s metrics highlighted encouraging trends. For example – Buy volume, open interest, funding rates, and the distribution between whale and retail investors, all flashed positive signals.

On 28 August, buy volume peaked at 72%, although it has since fallen to 25%. Stabilizing funding rates pointed to bullish sentiments for FET, while the rising Open Interest underlined growing interest from traders and investors.

How is FET doing?

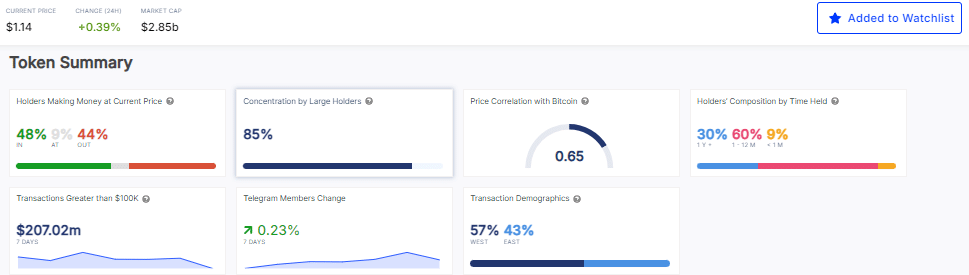

With a market cap of approximately $2.85 billion and a press time price of $1.14, FET appears poised for a potential breakout.

Nvidia’s (NVDA) quarterly earnings exceeding most expectations could further enhance FET’s prospects.

Currently, 48% of FET holders are in profit and 85% of FET is held by large investors. In fact, 60% of holders have held their positions for 1 to 12 months now.

Transactions exceeding $100,000 for FET totalled $207 million too while Telegram’s membership increased by 0.23% over the past week – A sign of growing social engagement.

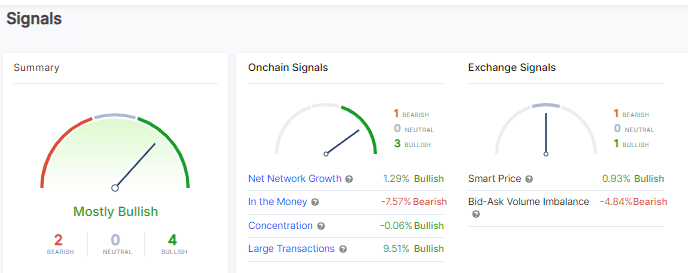

Finally, additional signals for FET seemed to be predominantly bullish too. In fact, on-chain analysis showed net network growth at 1.29% bullish, while the in-the-money indicator was 7.57% bearish.