Altcoin

ASM crypto up +40% in 24 hours – What’s next for the Assemble AI token?

ASM crypto holders’ unrealized profit increased after recent upswing. Will they take profit?

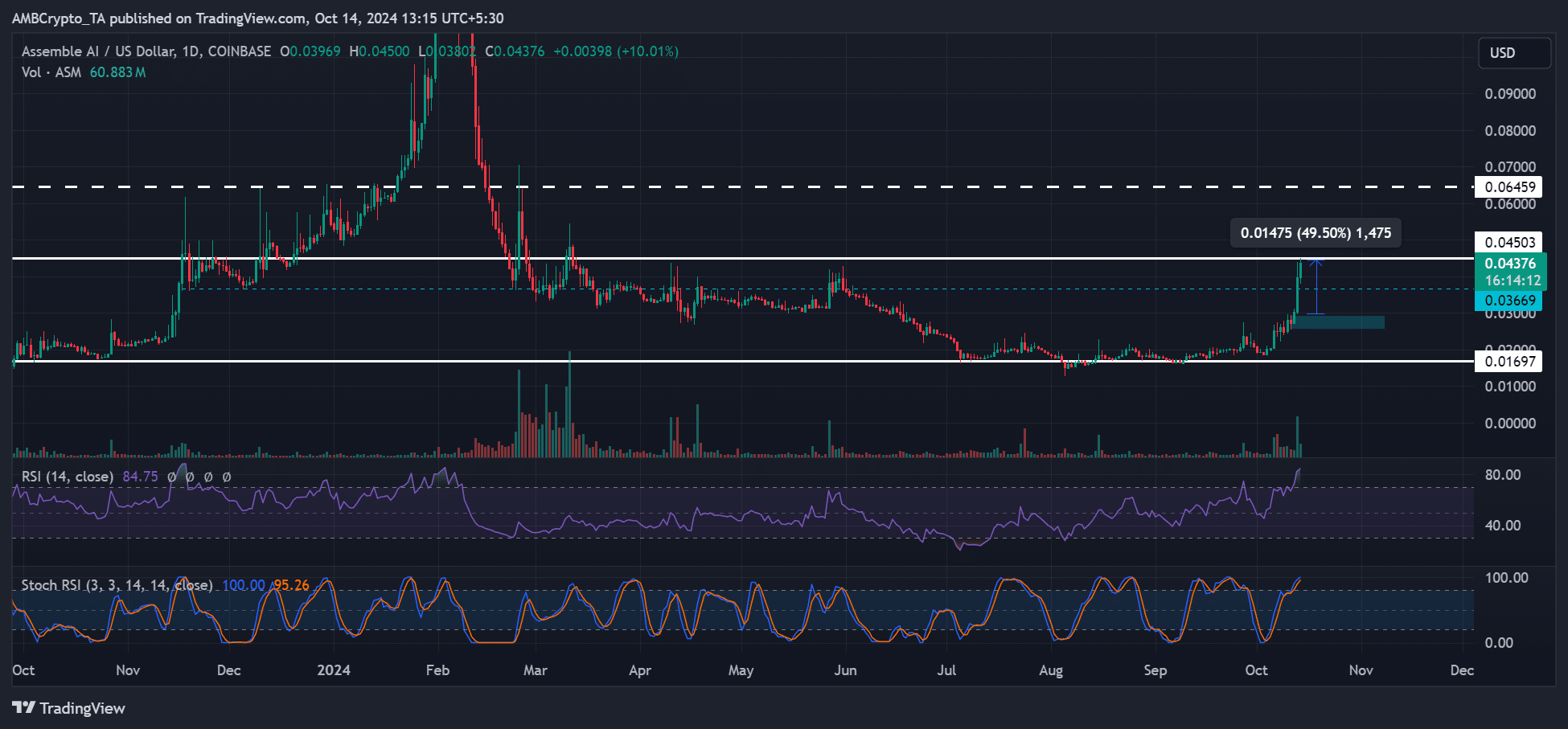

- ASM crypto rallied nearly 50% in 48 hours.

- ASM saw massive accumulation since August; will the uptrend extend?

ASM crypto, the native token of Assemble AI, the global reward point and AI-powered news insights platform, emerged as one of the top daily gainers on 14th October.

The token surged nearly 50% within 48 hours. The rally was part of the broader market recovery led by Bitcoin’s [BTC] upswing to $64K.

But the uptrend faced an overhead roadblock. Can bulls could push through?

ASM crypto roadblock

Memecoins and AI categories have been exceptionally dominant in the markets, especially during the Q4 recovery. So, the explosive rally in ASM crypto might not be surprising, as speculative fervor hit a fever pitch.

However, daily chart indicators flashed overbought signals following the early week upswing. Both RSI and stochastic RSI entered overbought territories. This meant high buying pressure but also cautioned of a likely price reversal.

If it blasts the $0.045 roadblock, ASM could add another 40% potential gain if it reaches $0.064.

However, the $0.045 level has been a resistance level in early 2024 and late 2023. If buyer exhaustion crept in, a price rejection could be likely at that level. If so, $0.03 would be the next support.

Wild accumulation since August

Since August, ASM has been on a strong accumulation spree, as shown by declining supply on exchanges (red) and rising supply outside exchanges (yellow). This illustrates a supply crunch on exchanges as users move assets off CEXs.

However, there was a slight uptick in supply-on-exchange (supply pressure) at press time. If the sell pressure intensified, the uptrend could be derailed.

The high unrealized profit amongst short and medium-term investors further painted the above cautious outlook. Those who held the token for a month and three months had +40% and nearly 70% in unrealized profit. This could trigger profit-taking.

The recent upswing has flipped short and medium holders into double-digit unrealized profit and could further make $0.045 a key roadblock to watch.