Assessing BTC’s unusual trajectory in the aftermath of the FED meeting

- Bitcoin’s bullish prospects improve as the FED takes a soft stance on interest rates.

- BTC unexpectedly dips despite bullish expectations as whales play the market.

Bitcoin experienced a substantial amount of selling pressure in the last few weeks. Most of the selling pressure was associated with concerns about the Federal Reserve possibly increasing interest rates.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Fast forward to the present and it is now more than 24 hours since the FED made its announcement. The monetary authority revealed that it would maintain its benchmark interest rate between 5.25% and 5.50%. In other words, the rates would remain unchanged, contrary to concerns of a possible interest rate spike.

The Fed has kept the benchmark interest rate unchanged in the range of 5.25%-5.50%, in line with market expectations.

WSJ:12 officials pencil in one more hike this year; 7 are ready to pause. The median participant projects two cuts in 2024. https://t.co/azBKxgRjqH

— Wu Blockchain (@WuBlockchain) September 20, 2023

Technically, the announcement should trigger more confidence among Bitcoin investors as has been the case in the past. This means it will be easier for Bitcoin to rally back towards the $30,000 price range. Assuming that all factors are held constant and no other sources of FUD affect investor confidence.

Unfortunately for the bulls, recent reports suggested that Bitcoin was currently experiencing block congestion. The network had a backlog of almost half a million transactions at the time of writing due to block fullness.

The Bitcoin network is experiencing the longest period of block fullness in history, Mempool data shows that there are currently more than 458,000 pending transactions, which means continued congestion on the Bitcoin network will further affect the confirmation of low-value…

— Wu Blockchain (@WuBlockchain) September 21, 2023

Bitcoin price recap

Despite the FED’s decision not to raise interest rates, Bitcoin’s price performance was overall bearish in the last 24 hours. This was contrary to the bullish expectations and the selling pressure was triggered after the price interacted with the 50-day moving average following a previous upside. It traded at $26,646 at the time of writing.

So, why is Bitcoin falling contrary to expectations? This could be a classic incident of whales playing the market. The current bullish expectations will likely entice many retail traders to jump back in. Meanwhile, this would offer an opportunity for whales to push prices lower by selling, so they can then jump back in at lower prices.

How many are 1,10,100 BTCs worth today

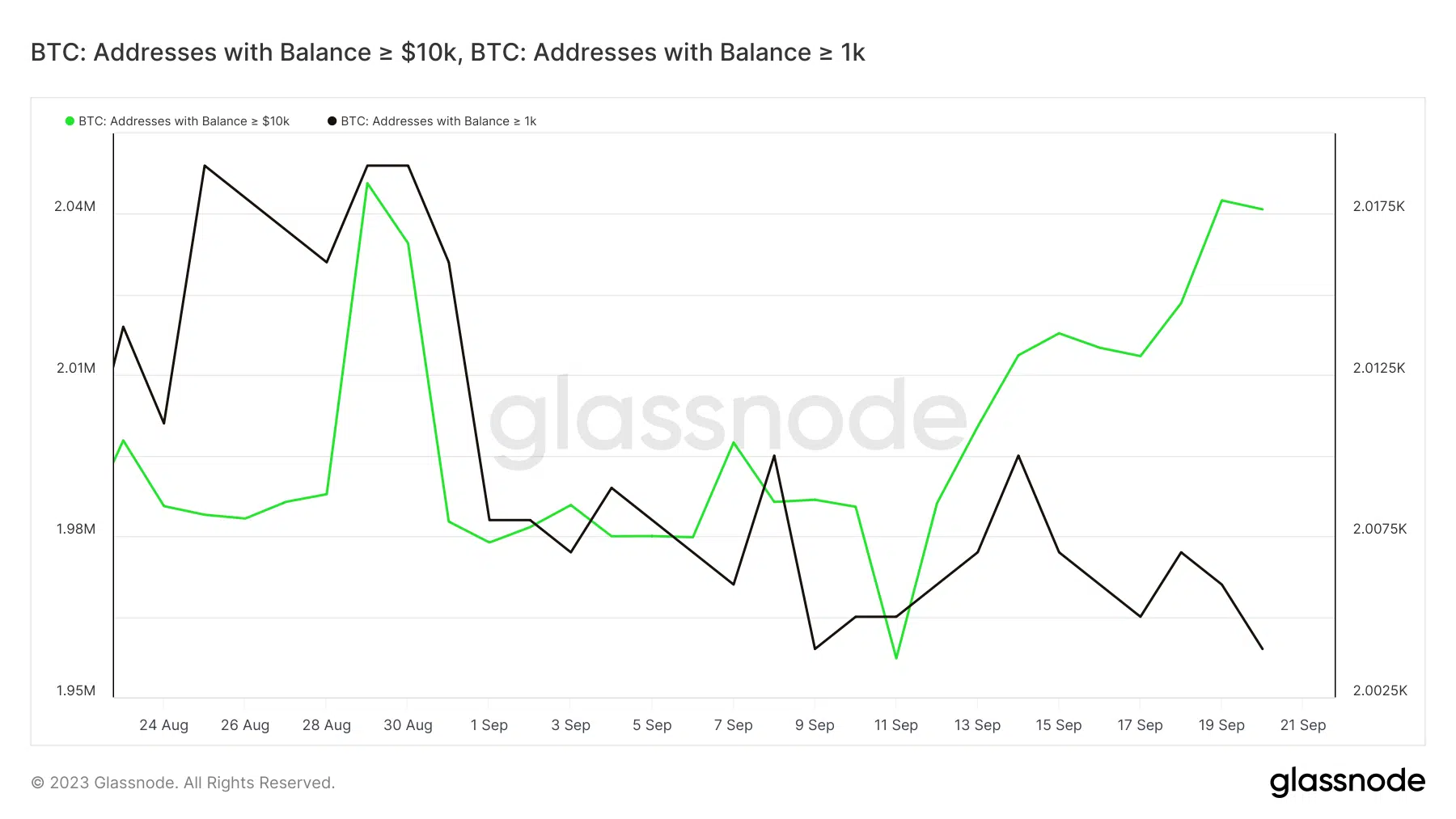

Bitcoin addresses with at least 1,000 BTC recently offloaded some of their coins thus contributing to selling pressure. However, addresses holding over 1,000 BTC still held a substantial amount of the coins accumulated in the last few days.

Is Bitcoin entering a bear trap?

Bitcoin traders should still exercise caution because the current downside could be temporary. As noted earlier, the favorable interest rate decision could result in more demand in the next few weeks.

Demand will likely resume once the whales are done shaking off the leveraged long traders. However, traders should also consider potential downside risks that could arise in the short term, potentially triggering more downside.