Assessing Dogecoin’s potential to rebound from its defending zone

- Dogecoin strived to breach its 50-day MA resistance, can it find renewed buying pressure?

- The meme-coin marked a decline in daily active users and development activity

Since reversing from the $0.3 level in September last year, Dogecoin [DOGE] correlated with the market-wide meltdown and consistently declined. This decline phase led the dog-themed crypto to match its yearly lows in June and September this year.

The buyers seemingly found reliable grounds in the $0.057-$0.059 range over the last few days.

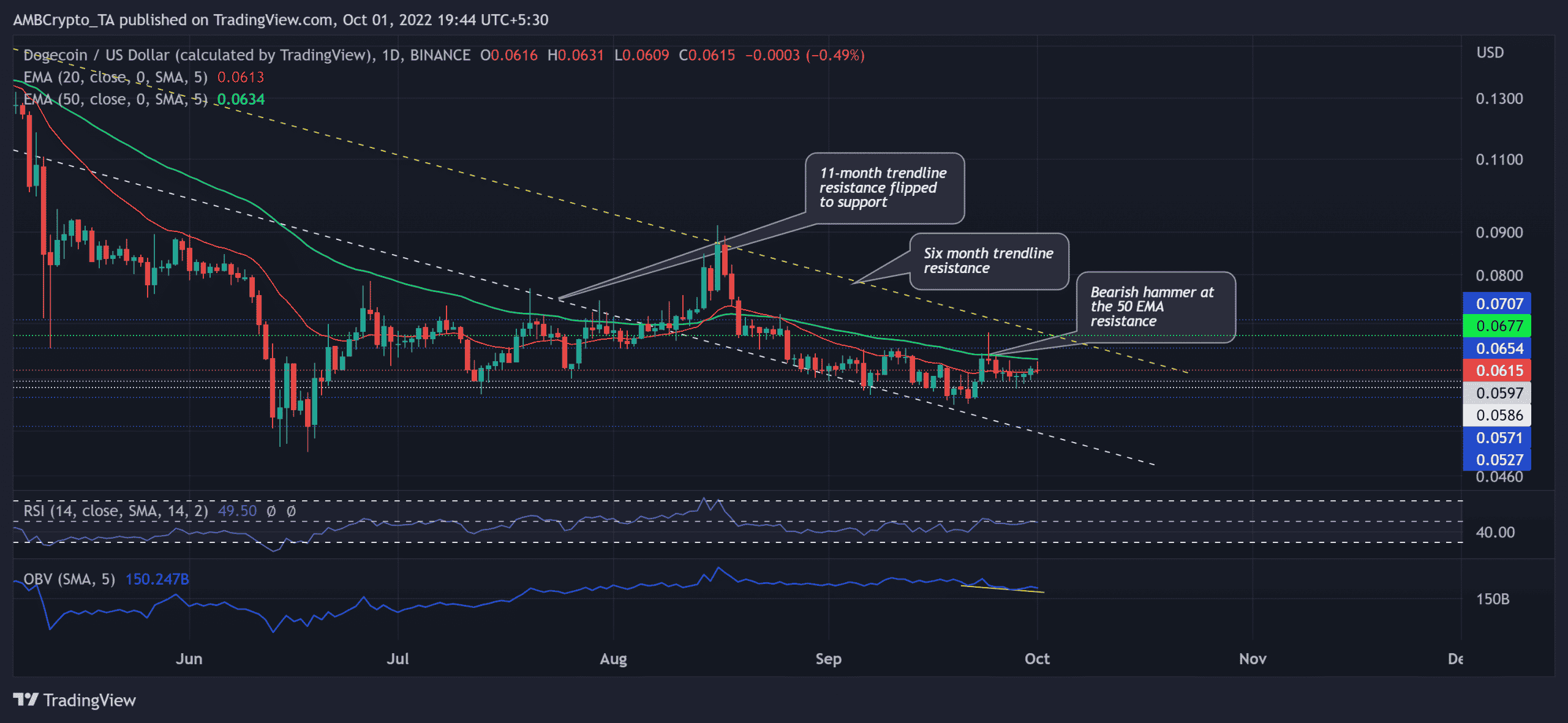

In its previous bull run, the meme coin’s breakout led to a retest of the six-month trendline resistance (yellow, dashed). The recent bearish pull has realigned the altcoin below its 50 EMA (cyan) barrier.

A plausible retest of the $0.059 zone can set the stage for a buying renewal. At press time, DOGE was trading at $0.0615.

DOGE enters a low volatility phase

While the bearish pressure seemed to revive near the 50 EMA, the resultant reversal has kept DOGE bulls under control. The $0.067 zone highlights the high liquidity area that the bulls would strive to retest in the coming sessions. But the bearish hammer from the 50 EMA made the near-term bearish inclinations quite apparent.

Given the recent tendencies of DOGE to revive from its long-term trendline support, the buyers would look to induce a rally. Any incline above the 50 EMA could help buyers test the $0.065-$0.068 range before a likely rebound.

A continued pull below the $0.058 mark would put DOGE in a position to book further losses. The sellers would aim to inflict a pulldown toward the 11-month trendline support in the $0.052-$0.055 range.

Nonetheless, the buyers should look for the RSIs close above the midline to gauge the chances of a bull run. A continued sway near the midline would hint at consolidation tendencies. Interestingly, the OBV’s lower peaks bullishly diverged with the price action.

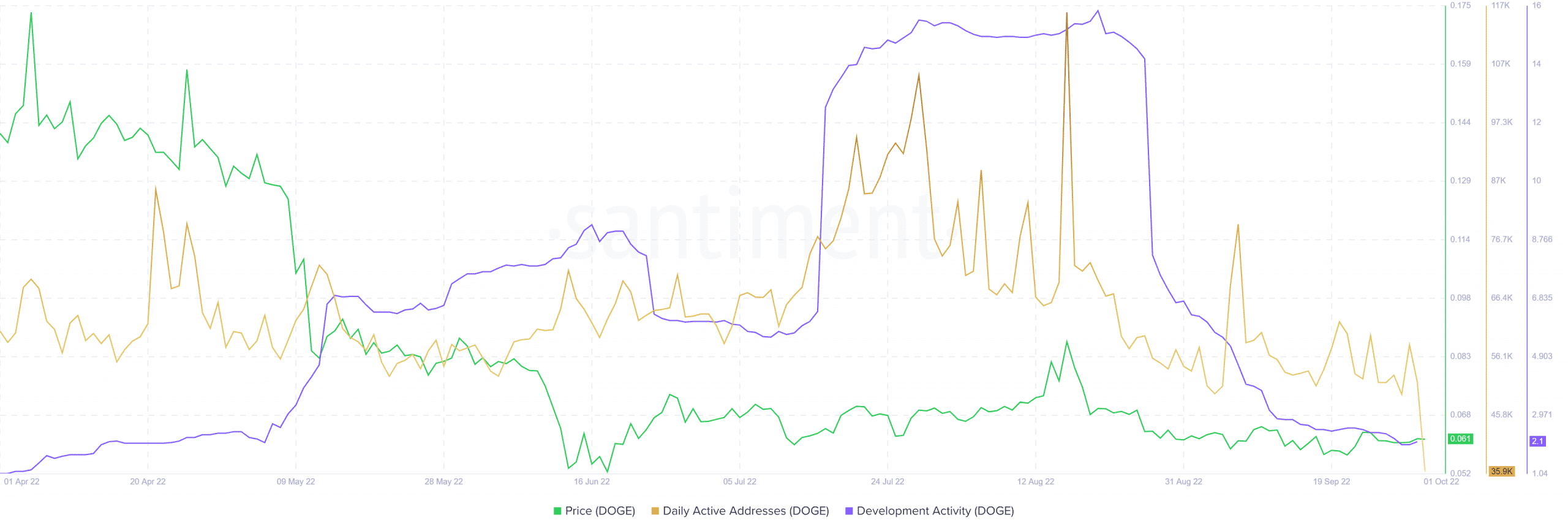

Diminishing Daily active users and Development Activity

With the development activity and the daily active users taking a plunge, DOGE has struggled to drive up its demand over the last two months. Not surprisingly, the price action has relatively entered into low volatility while exhibiting fragility.

Conclusion

Basically, DOGE stood at a critical spot. Its current technical readings hint at decreased volumes and a fragile movement. A close above 50 EMA could reignite near-term bullishness. In either case, the selling triggers and targets would remain the same as discussed above.

Finally, the dog-themed coin shares a 57% 30-day correlation with the king coin. Thus, keeping an eye on Bitcoin’s movement would complement these technical factors.

![Dogecoin [DOGE] drops 16% – But is a $0.25 rally now loading?](https://ambcrypto.com/wp-content/uploads/2025/06/08519350-41B0-4D47-8530-DADB272A4AD3-400x240.webp)