Assessing how Solana’s ETF application can turn things around for SOL

- Solana has experienced a sustained decline in the last seven days.

- Despite the application of a Solana ETF, negative market sentiment persisted.

After a sustained downtrend, Solana [SOL] caused increased hype after 3iQ, a Canadian digital asset management company, applied for a SOL ETF. In Report, 3iQ reported on X,

“3iQ Corp is pleased to announce that we have submitted a preliminary prospectus for the Solana Fund (QSOL) in Canada in an initial public offering.”

QSOL application is a golden opportunity for traders and enthusiasts, as it will provide opportunities to enjoy profits from SOL staking.

Equally, it increases a pool for investment, thus widening the scope for those seeking to earn incomes while supporting the SOL ecosystem.

The approval of QSOL will bring diversity and open doors for other altcoins.

Essentially, the approval and success of QSOL would inspire other countries, especially the U.S., to open doors for similar arrangements and continually consider approval of ETFs for other small cryptocurrencies.

Market implications of QSOL’s application

In the last seven days, SOL has experienced a considerable downtrend. Despite the news about the QSOL application, markets have failed to show positivity and reverse the trend.

However, various crypto analysts have expressed their positivity with the development. For instance, Ash Crypto shared his analysis on X, stating that,

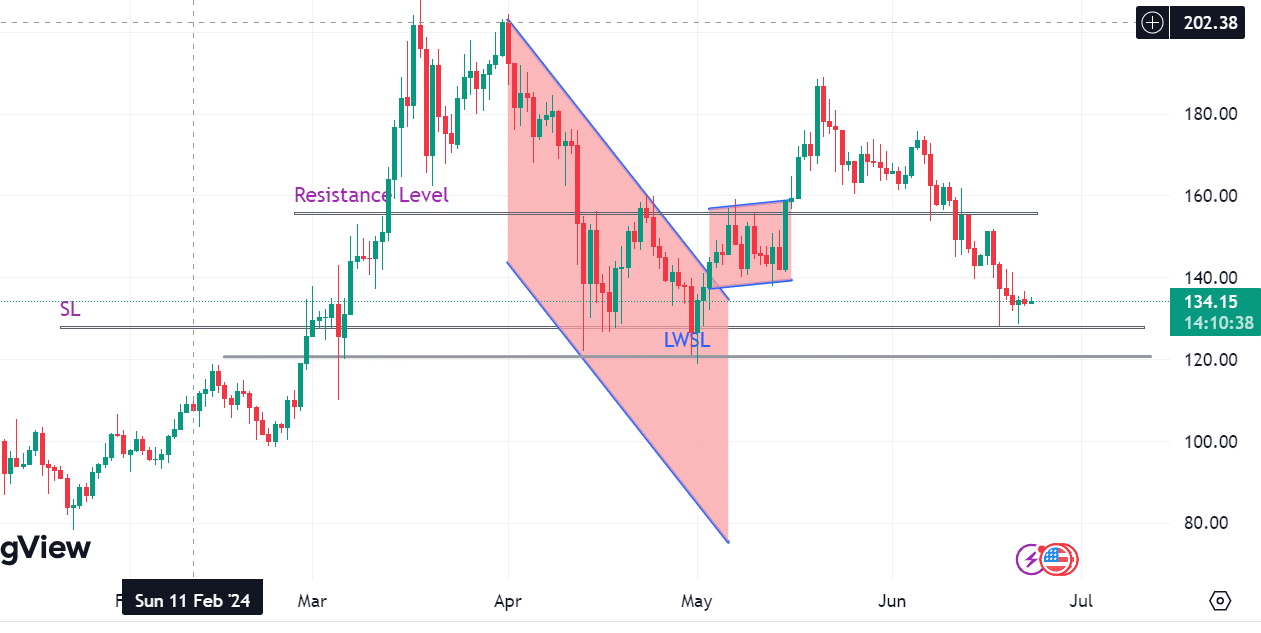

” Sol is now retesting its support level. Everything is screaming bullish for Solana.”

Despite the excitement and bullish news, AMBCrypto’s analysis showed that the market sentiment has remained bearish. At press time, SOL was trading at $134.63, a 0.66% surge in the last 24 hrs.

In the last seven days, it has declined by 6.53%, with a 62% decline in trading volume to $738M. According to CoinMarketCap, SOL’s market cap has surged by 0.59% in 24 hrs to $62.2B.

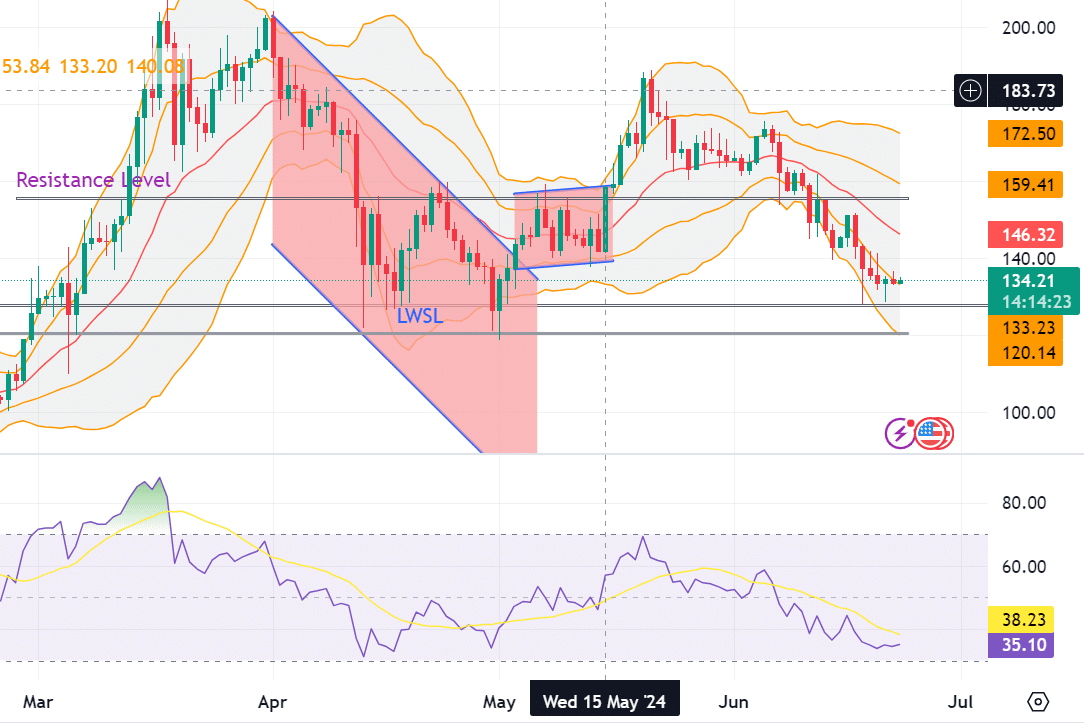

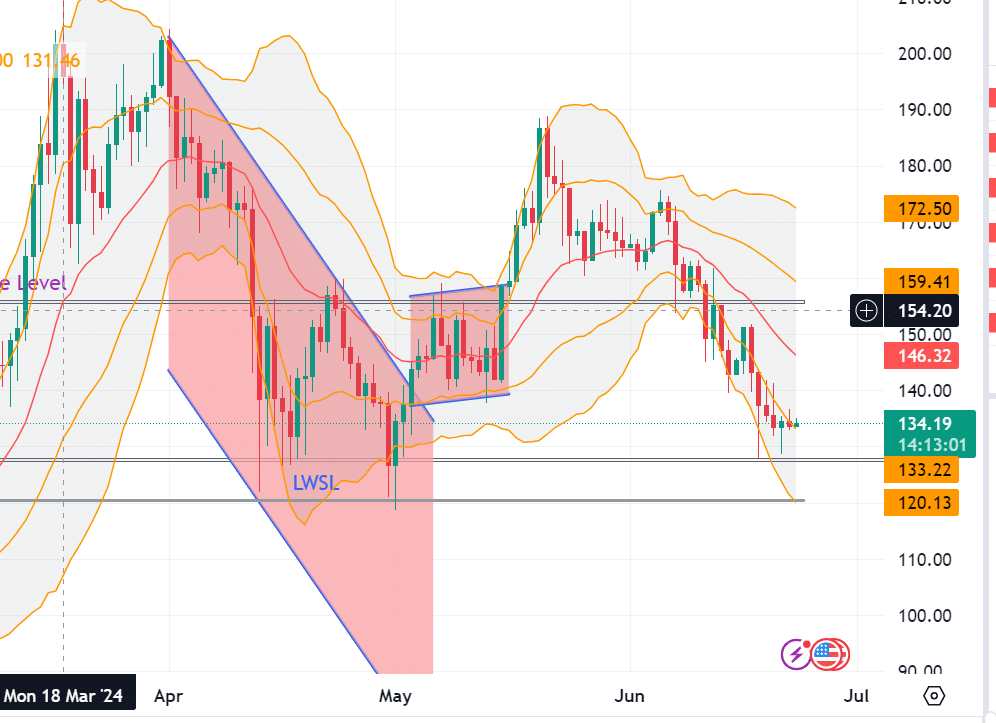

SOL’s RSI has been on a constant decline. At press time, the RSI is 35 below the RSI-based MA of 38. Since going below the based MA on the 6th of June, it has failed to reverse the trend, indicating the selling pressure.

The continued selling pressure showed that SOL was plummeting towards oversold territory at press time.

Per the Bollinger Bands, the next critical support for SOL was around 120. This showed potential for a further decline if it fails to hold the current support level.

Prevailing market sentiment

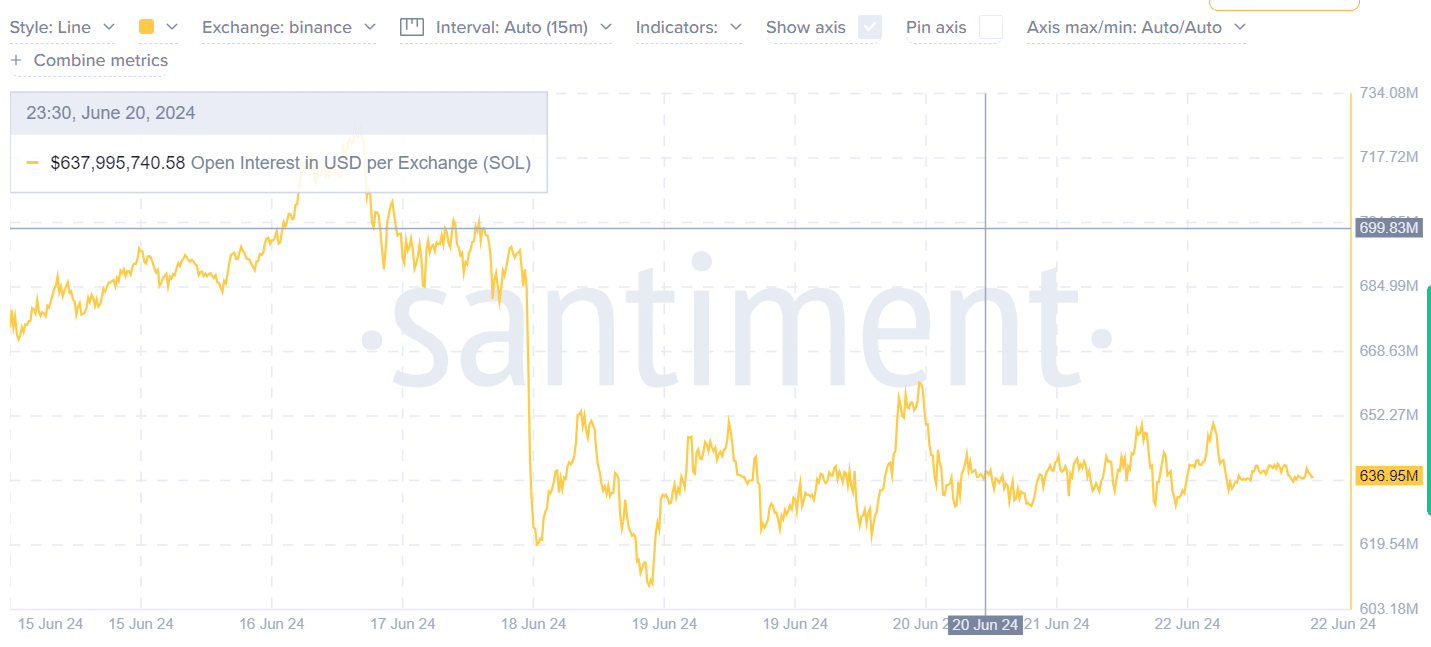

AMBCrypto’s analysis via Santiment showed a constant decline in Open Interest from $728 M to $636M. The continued decline in Open Interest shows reduced appetite and interest for the altcoins.

Lower interest means reduced investors are closing losing positions without opening new ones, which is a bearish market sentiment.

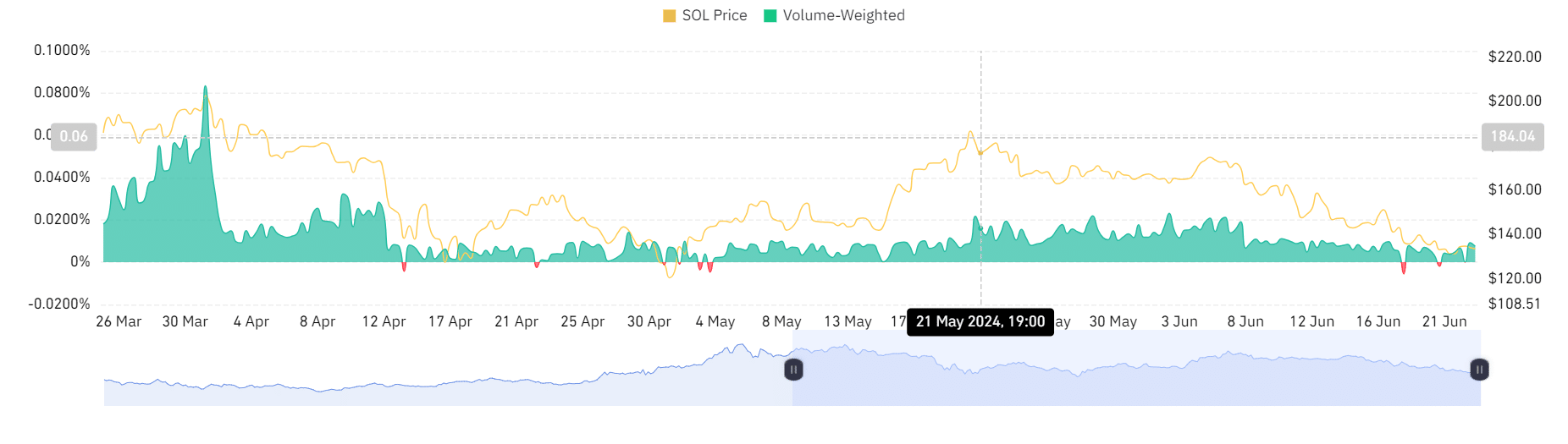

Equally, Coinglass’ Volume-Weighted Funding Rates showed a constant decline. Decreased Funding Rates mean heightened negative sentiment as investors have lower demand for leveraged long positions.

Is your portfolio green? Check out the SOL Profit Calculator

Will SOL recover or decline further?

AMBCrypto’s analysis indicated that SOL was on the downside towards the lower support level of around $127.

If the altcoin holds this support level, it will challenge its resistance level of around $155. However, if the support level doesn’t hold, it will decline to between $121 and $120.