Assessing if Bitcoin [BTC] traders will change their tune after FOMC

![Assessing if Bitcoin [BTC] traders will change their tune after FOMC](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-01T093512.958.png)

- Bitcoin traders’ decision to open short or long positions could depend on the FOMC outcome.

- Whales have been taking profits since 17 January but the tides might change.

Historically, the Federal Open Market Committee (FOMC) conclusion has had several impacts on Bitcoin’s [BTC] price. In most cases, the decision to increase interest rates leads to reduced liquidity in the market and a possible downtrend. On the other hand, the Fed’s decision to tighten the rates could help sustain BTC’s green momentum.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Can’t put your money where your mouth is

In the lead up to the 1 February FOMC meeting, BTC traders’ action was that of indecisiveness. According to Santiment’s January recap report, these traders enjoyed an average of 10.6% profit in the last 30 days. This was due to the incredible BTC rally of the last month.

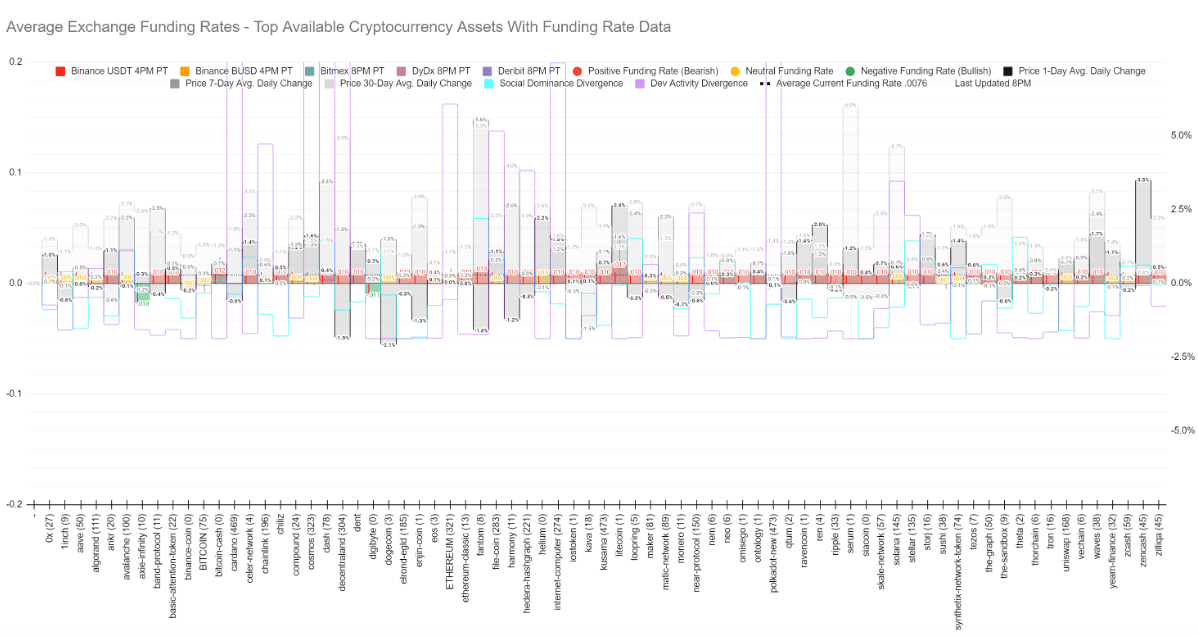

However, traders have recently failed to hold a specific stance despite notable market capitalization increases all around the market.

The above image indicated that long positions held by traders earlier had subdued. While shorts have not taken over, traders’ sentiment evidently showed that they were not expectant of an immediate green recovery.

On evaluating the derivatives’ market activity, Coinglass revealed that over $14 million worth of BTC had been liquidated in the last 24 hours. However, the wipeout was not a close call between longs and shorts.

The derivatives information portal showed that longs had severely suffered the expunge. And, of course, BTC’s recent inconsistency in creating a consistent rally has been responsible for the outcome.

Utility decline but whales and sharks have…

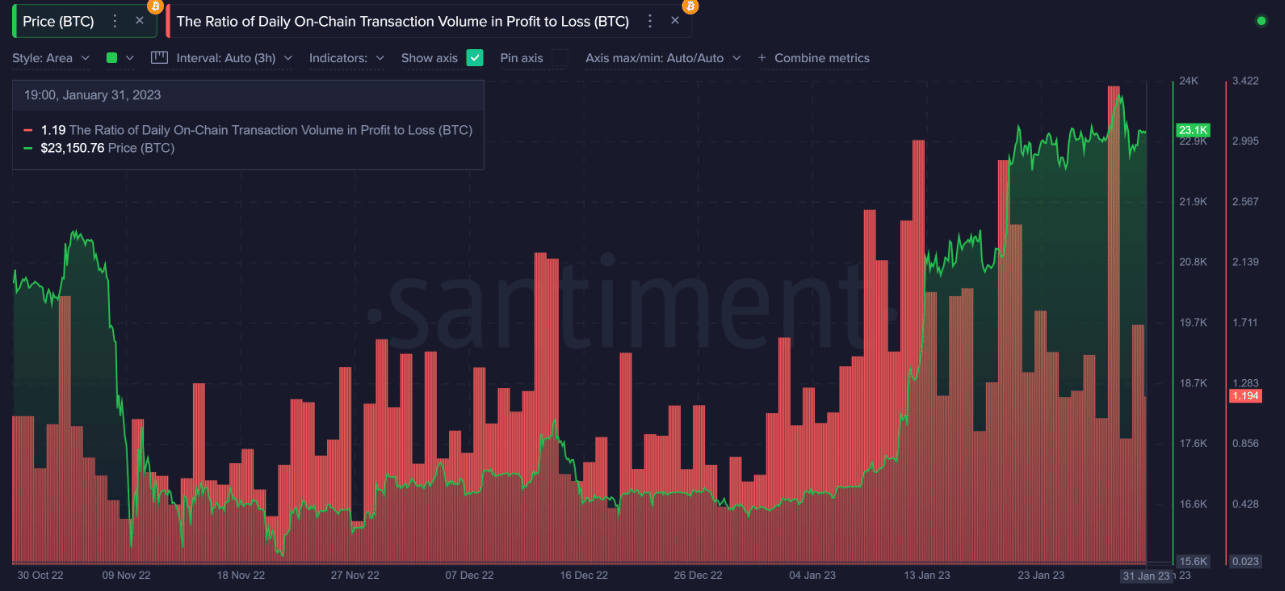

Further, Santiment’s report pointed out the way Bitcoin has been used of late. Notably, the amount of Bitcoin moving around the network was massively underwhelming.

How many are 1,10,100 BTCs worth today?

This has also affected the coin circulation negatively. Additionally, the massive profit taking on 30 January was also part of the reasons BTC could find it hard to immediately recover from its meltdown.

While there has been an impressive uptick in the last month, it would require a significant utility rate for the BTC price to rise in the long-term. The Santiment report read,

“We have seen the occasional pump in spite of low circulation in the past, but probabilities say that a viable long-lasting price rise can’t occur until a justified amount of utility begins.”

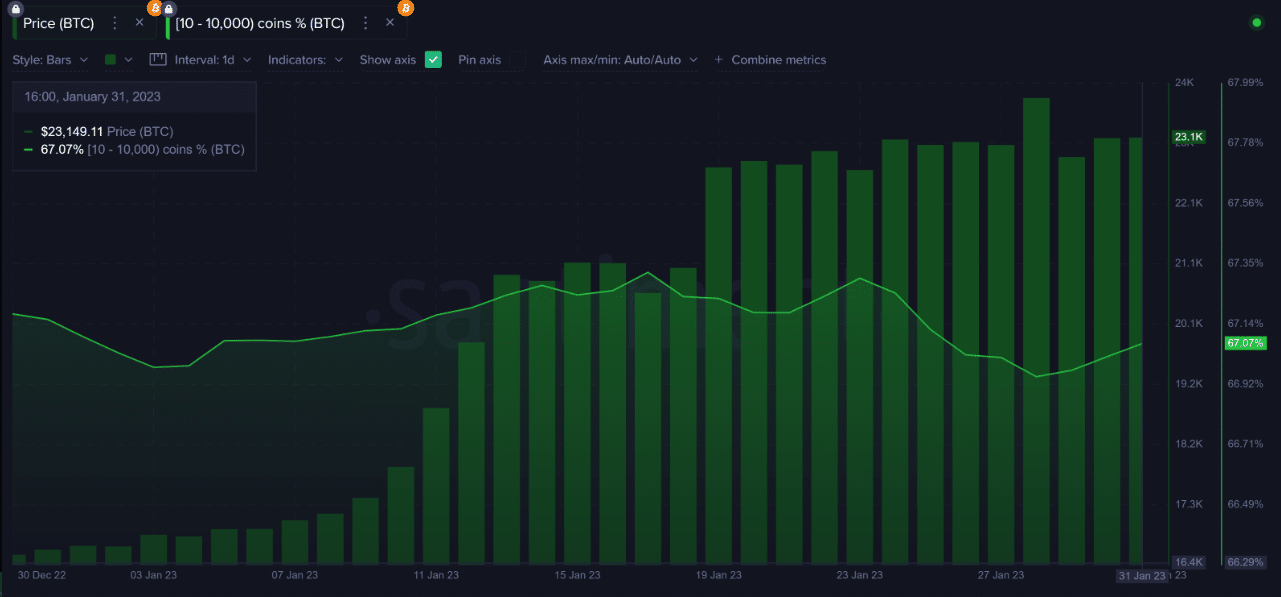

Concerning whales and sharks’ reaction, there has also been instability. While addresses holding between 10 to 10000 BTC actively accumulated between 1 – 16 January, the same group began making profits on 17 January.

Although the BTC price has jumped after, investors may need to be cautious of a continuous bullish direction. In conclusion, the FOMC would most likely influence the short-term BTC price. As the meeting ends in hours from press time, investors would hope that the outcome doesn’t end up hawkish.