Assessing if Toncoin can overcome the $5.31 barrier, reach $7.9

- Buying pressure on Toncoin increased in the past few days.

- However, whale dominance dropped during the same time.

Like several other cryptos, Toncoin [TON] has also registered promising growth in the last 24 hours. But the token was testing a crucial resistance — a jump above that could lead to a massive surge.

However, an unsuccessful test could cause a price drop. Let’s take a look at what’s going on.

TON tests resistance

As per CoinMarketCap, Toncoin’s price surged by barely 4% in the last 24 hours alone. At the time of writing, TON was trading at $5.31 with a market capitalization of over $13 million, making it the ninth-largest crypto.

However, despite the price increase, only 15.4 million TON addresses were in profit, which accounted for 26% of the total number of addresses.

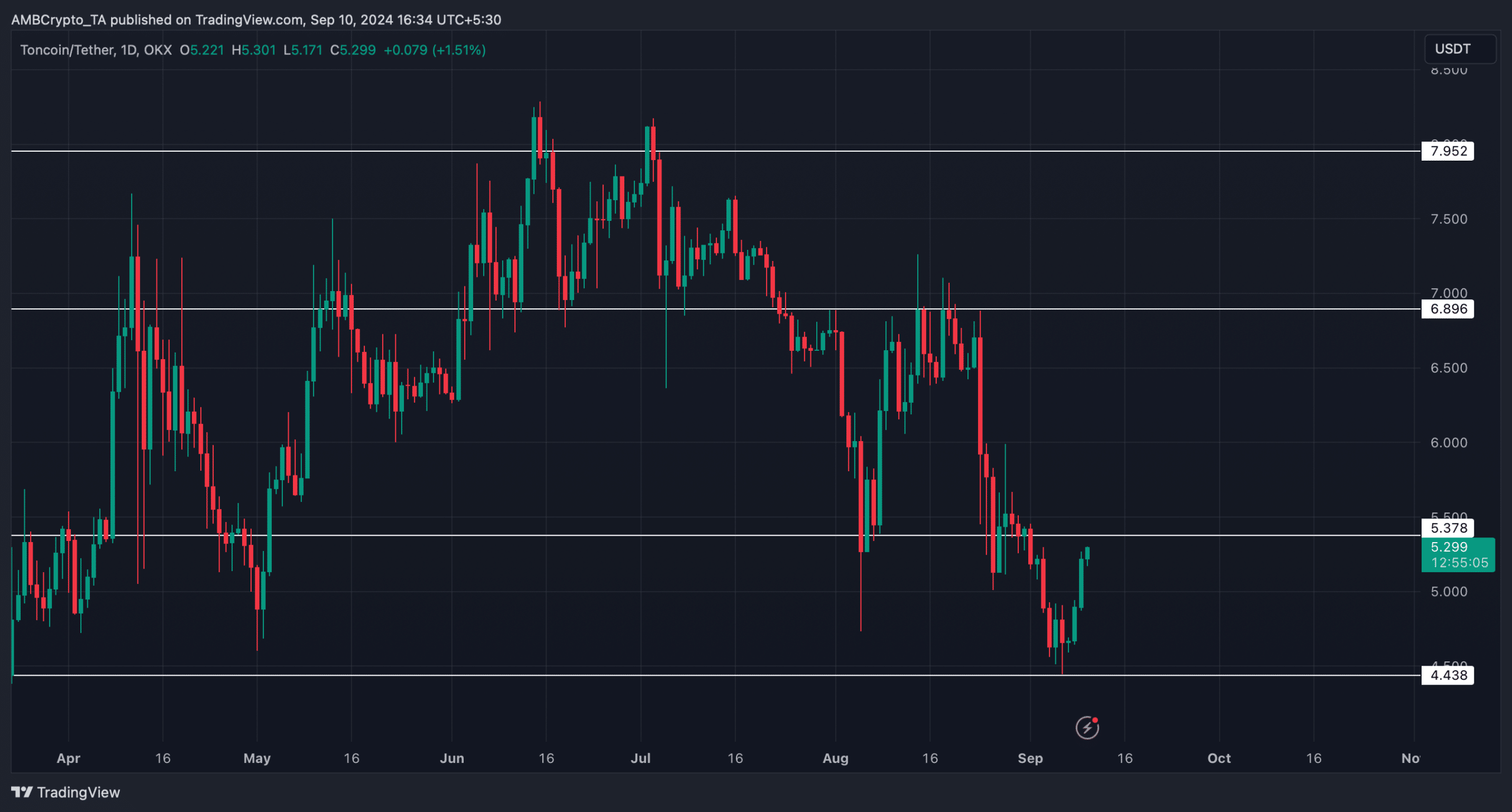

This stat might change soon if the token manages a breakout. AMBCrypto’s analysis of Toncoin’s daily chart revealed that it was about to test a resistance level.

In case of a bullish breakout, then investors might soon see Ton touching $6.8 again. A jump above that could end up in TON reclaiming $7.9.

Will Toncoin breakout?

AMBCrypto then assessed the token’s on-chain data to find out whether metrics also hinted at a price rise. As per our analysis, investors have started to accumulate TON already.

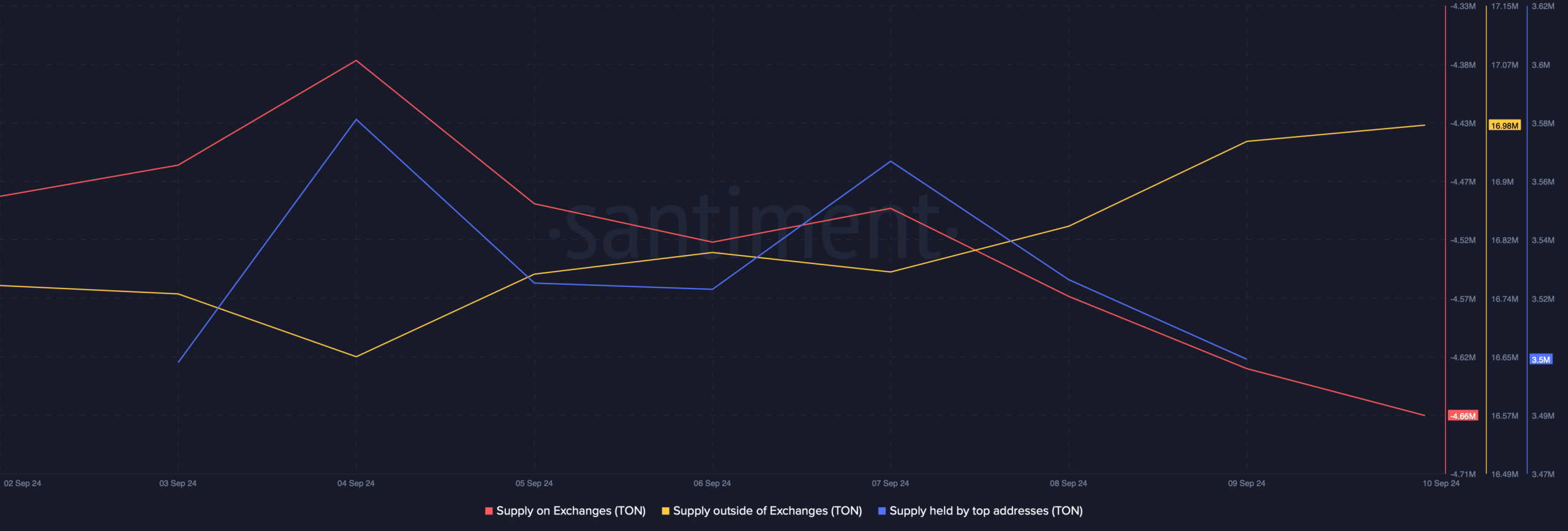

Santiment’s data revealed that Toncoin’s supply on exchanges dropped sharply, while its supply outside of exchanges increased. This clearly indicated a rise in buying pressure.

But the token’s whales chose to move the other way around as the supply held by top addresses dropped. In fact, Hyblock Capital’s data also revealed a similar story.

TON’s whale vs. retail delta dropped from 100 to 59; this clearly indicated that whales’ exposure in the market declined in the last few hours, which can be inferred as a bearish signal.

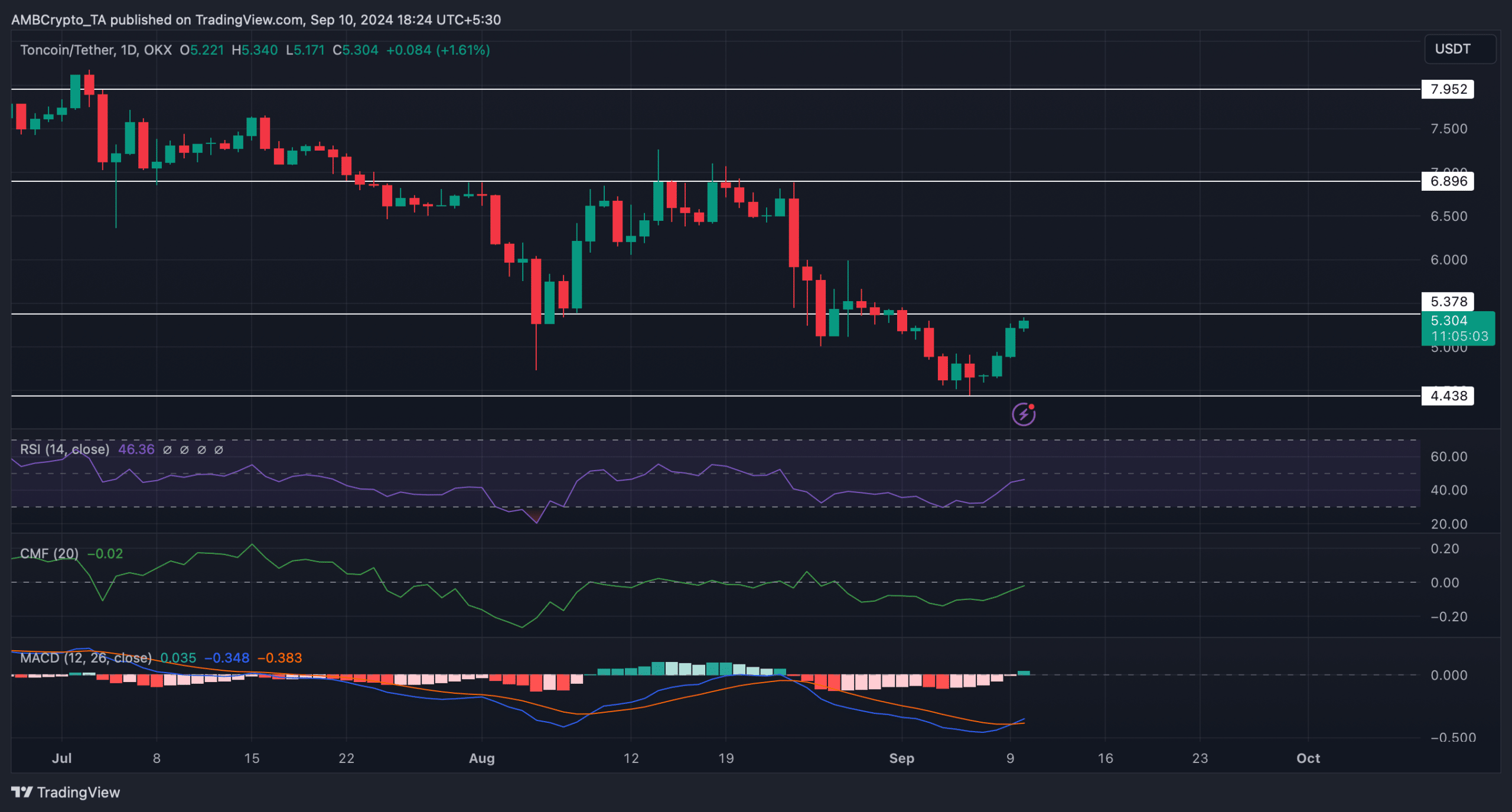

AMBCrypto then assessed the token’s daily chart. We found that the technical indicator MACD displayed a bullish crossover. The Chaikin Money Flow (CMF) also registered an uptick.

TON’s Money Flow Index also followed a similar trend as it went northwards, indicating a price rise in the coming days.

Is your portfolio green? Check out the TON Profit Calculator

Our analysis of Hyblock Capiatl’s data revealed that in case of a continued price increase, Toncoin might soon touch $5.7. At this point, the token might witness a correction as liquidation will rise.

However, in case of a bearish takeover, the token might drop to $3.7 in the coming days.