Assessing Litecoin’s next moves: Rise to $90 or fall to $80?

- If Litecoin turns bullish, then its price might touch $94.

- Most market indicators and metrics looked bullish on LTC.

Litecoin [LTC] bulls were somewhat reluctant to show their full might last week, as the coin’s price didn’t move up exponentially. Will the next week be any different for LTC and allow it to reclaim $90?

Litecoin’s weekly pump

CoinMarketCap’s data revealed that LTC’s price dropped to $78 on the 15th of May. However, the coin gained bullish momentum after that as its price chart moved northward.

Over the last week, the coin’s price increased by over 2%. However, the momentum has declined in the last 24 hours. At press time, it was trading at $83.81 with a market capitalization of over $6.2 billion.

Meanwhile, CRYPTOWZRD, a popular crypto analyst, recently posted a tweet revealing an analysis of LTC performance.

As per the tweet, LTC closed the last day indecisively and was trading in the middle of a daily range area.

The tweet also mentioned that if a bull rally happens, LTC might touch $94. But if LTC moves the opposite way, then its price might plummet to its support level near $80.

LTC to $80 or $90?

Since there were chances of LTC either going above $90 or falling to $80, AMBCrypto then analyzed Litecoin’s metrics to see which outcome was more likely.

Our analysis of Glassnode’s data revealed that LTC’s NVT ratio dropped sharply. A decline in the metric means that an asset is undervalued, hinting at a price drop.

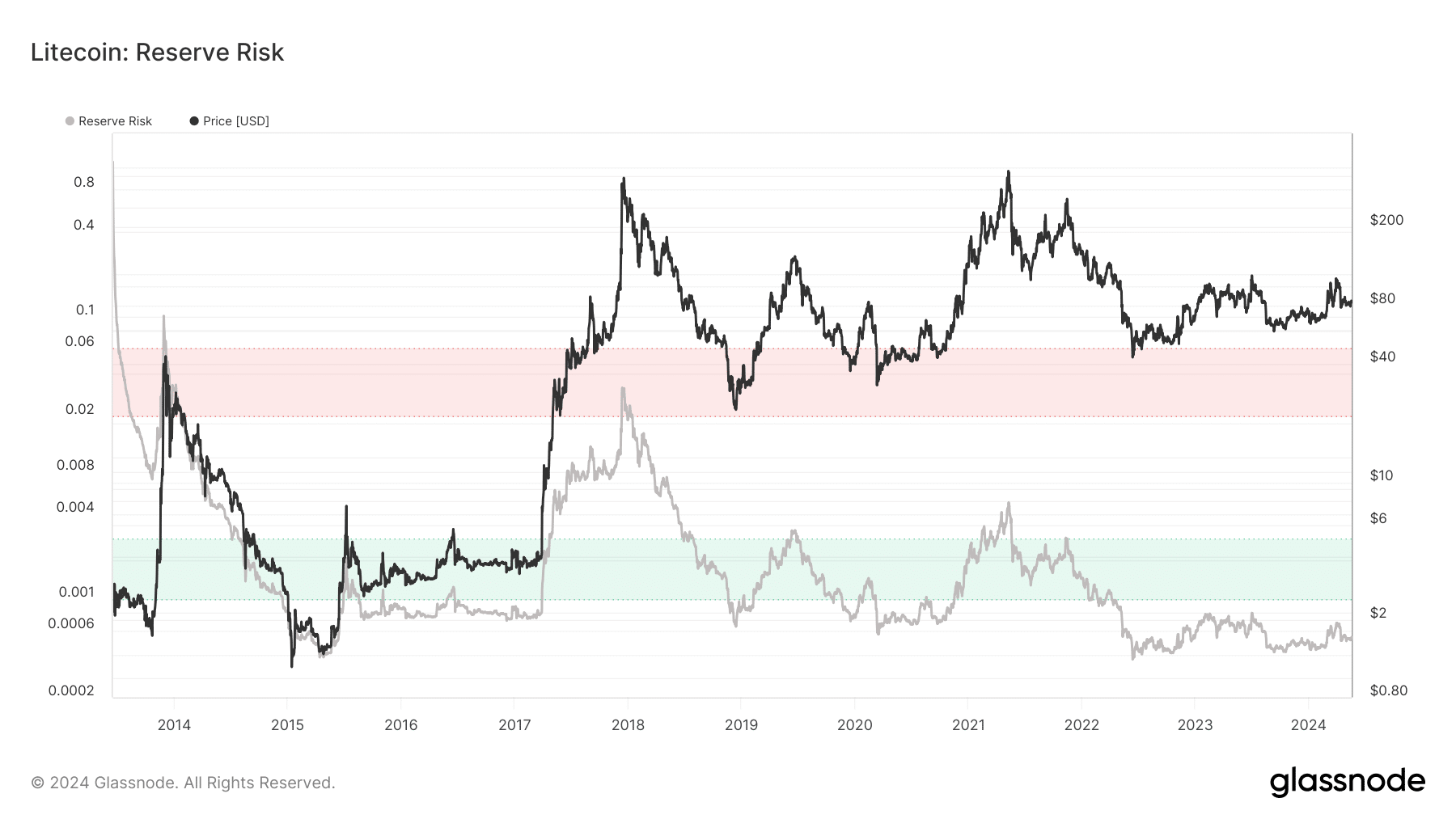

Additionally, LTC’s reserve risk was also near its all-time low, which suggested that the coin might soon gain bullish momentum.

For starters, the metric is used to assess the confidence of long-term holders relative to the price of the native coin at any given point in time.

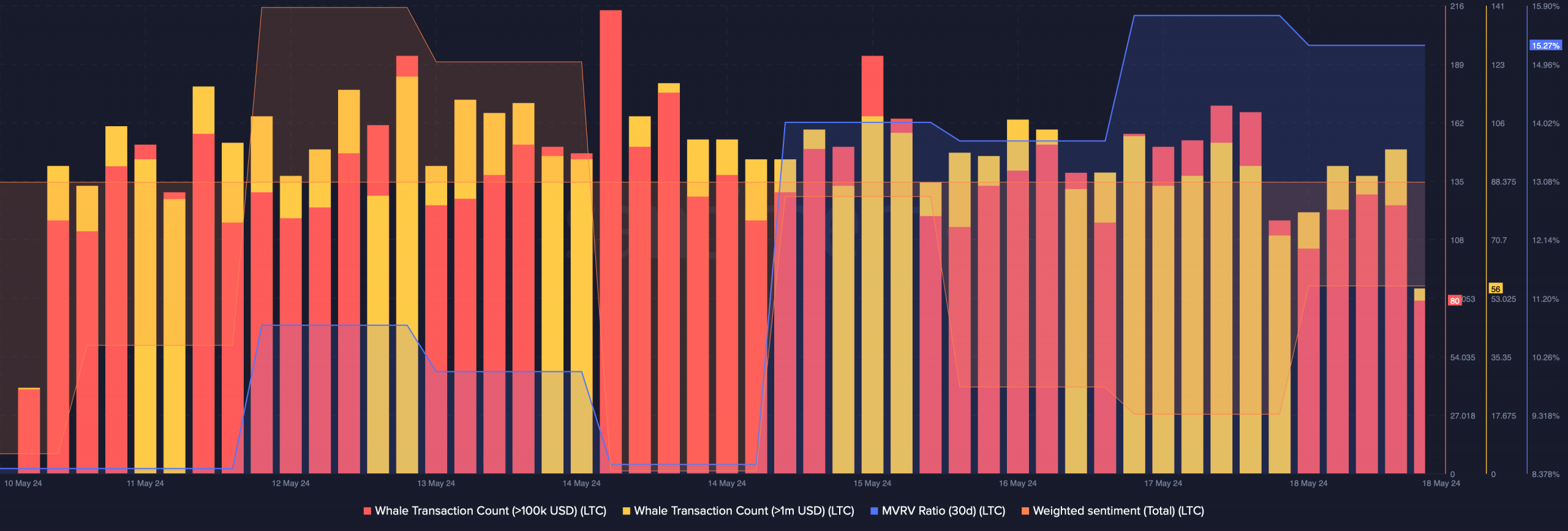

Whale activity around the coin also remained high. This was evident from the rise in its whale transaction count last week. Another bullish metric was the MVRV ratio, as it registered an uptick.

However, sentiment around the coin remained bearish, as evident from the decline in its Weighted Sentiment.

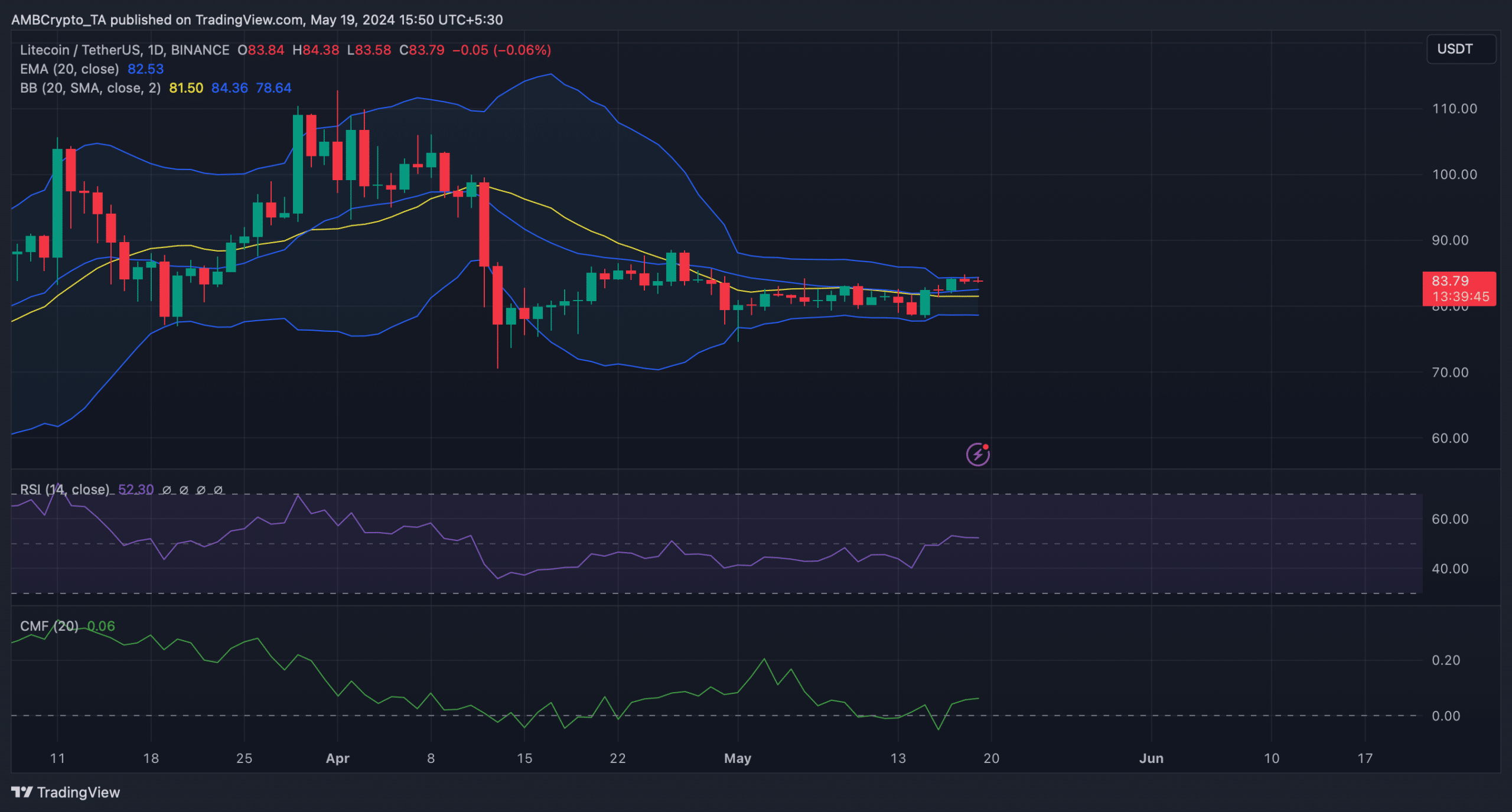

Like metrics, a few of the market indicators also remained bullish. For instance, the Relative Strength Index (RSI) was resting above the neutral mark.

Moreover, the Chaikin Money Flow (CMF) also registered an uptick, hinting at a price increase.

Nonetheless, the Bollinger Bands pointed out that LTC’s price was in a less volatile zone, declining the chances of an unprecedented price rally.

Read Litecoin’s [LTC] Price Prediction 2024-2025

If Litecoin gains bullish momentum, it will be crucial for the coin to go above $85 in order to reach $90. This was the case, as liquidation would rise at that level, which could result in a price correction.

On the contrary, going southward, if LTC fails to test its support at $80, then investors might witness the coin’s price drop to $78.