Assessing Polkadot’s developmental decline and everything overlooked

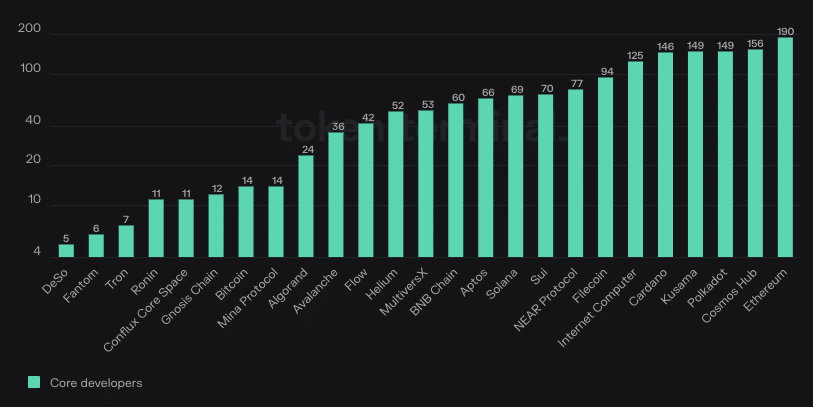

- Cosmos Hub and Ethereum surpassed Polkadot per core developers count.

- The DOT price action could become stagnant in the short term.

One key aspect where Polkdaot [DOT] has consistently thrived is the pace of development within its ecosystem. For a long while, the cross-chain interoperability has had to fend off competition from projects like Cardano [ADA] while ensuring its sister-network Kusama [KSM] edges out others.

Realistic or not, here’s DOT’s market cap in ETH terms

Despite the traction and viscosity, Token Terminal showed that the project lost out in terms of core developers to Ethereum [ETH] and Cosmos [ATOM].

Playing, deputing and losing belief

When measuring the core developer metric, on-chain data focuses on the number of developers committing codes to keep the fundamentals of a protocol running. At press time, Ethereum was top with 190 core developers.

Cosmos, which solves the problem of interoperability like Polkadot was in second place with 156. Polkadot and Kusama followed though in third and fourth.

Well, one reason Ethereum may have led the pack could be its recent major upgrade which activated staked Ether [stETH] withdrawals.

For the self-proclaimed internet of blockchains, its latest unlock of several decentralized Applications (dApps) could have helped it rank higher.

However, Polkadot’s 13.46% 30-day decline in development activity seems to have kept traders’ view of the pessimism in the token.

According to Coinglass, the DOT Open Interest (OI)-weighted funding rate was -0.0127%. Usually, a positive funding rate means that long-positioned traders are willing to pay shorts to keep their buy positions.

But when the metric is negative, it implies that traders are mostly bearish. Therefore, the DOT funding rate depicts shorts’ willingness to pay longs to keep their open sell contracts.

DOT’s price action

However, the traders’ actions might be justified based on DOT’s recent performance. At the time of writing, the token had lost 16.39% in the last 30 days even though the value was consolidating in more recent times. But where could DOT head next?

Based on the daily chart, the Bollinger Bands showed that DOT’s volatility was considerably high. While it was already closing in on the extremity, the indicator showed that DOT price exited its touch on the lower band.

This signals that DOT was neither overbought nor oversold. In a situation where the value touched the upper band, it would have been considered overbought and vice versa.

Read Polkadot’s [DOT] Price Prediction 2023-2024

In terms of momentum, the Awesome Oscillator (AO) revealed that the token was mostly bearish. At press time, the AO was -0.487.

Basically, a negative reading implies that the market momentum was moving slower. Thus, DOT lacked support, and the price could become stagnant or hover around the same region for the time being.

![Polkadot [DOT] funding rate](https://ambcrypto.com/wp-content/uploads/2023/05/Screenshot-2023-05-20-at-08.23.32.png)

![Polkadot [DOT] price action](https://ambcrypto.com/wp-content/uploads/2023/05/DOTUSD_2023-05-20_08-40-34.png)