Altcoin

Assessing Polkadot’s Q2 and what Q3 might look like

Funding for R&D activities on Polkadot registered a decline in Q2 2023. However, its price action turned bullish, and that may be promising.

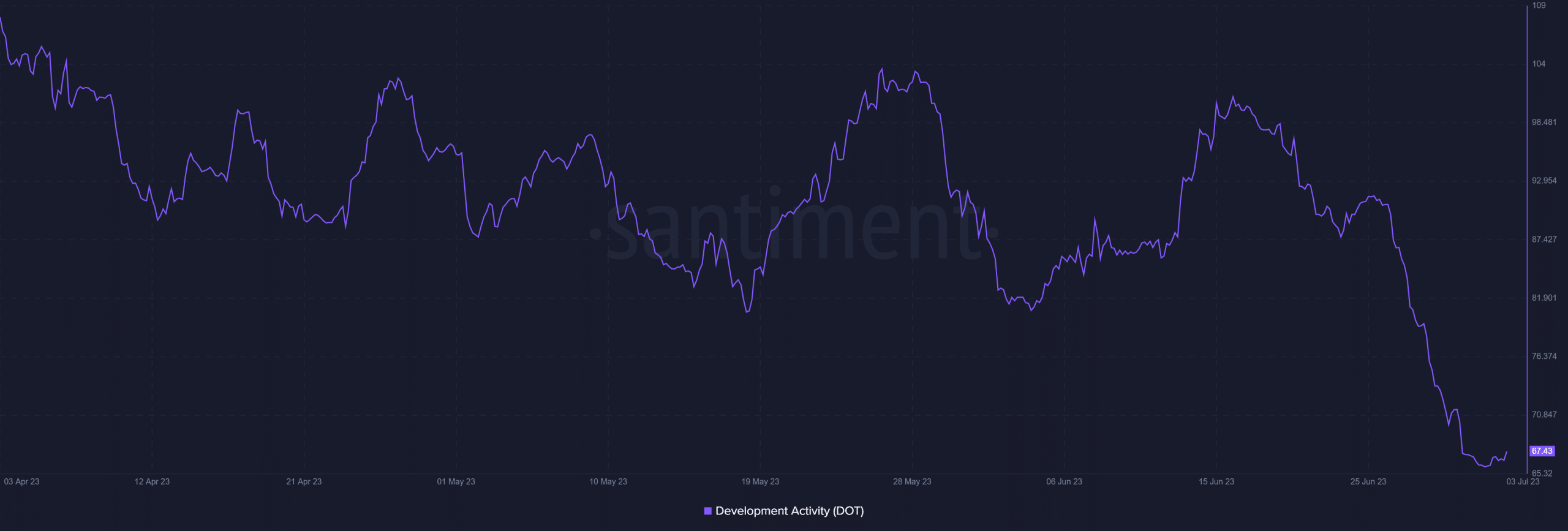

- Like funding, the blockchain’s development activity also declined in Q2

- Market indicators seem to be bullish on DOT, suggesting a further uptrend

Polkadot [DOT] has been known for its development activity and its parachains, which have grown over the last few months. In fact, a recent tweet from Polkadot Insider pointed out how funding for its R&D activity has been over the last few years.

However, the last quarter for Polkadot was not the best in terms of its price action as it plummeted on the charts. Will the new quarter be any better for DOT?

Read Polkadot’s [DOT] Price Prediction 2023-24

A decline in Polkadot’s funding

Polkadot Insider, a popular Twitter handle that posts updates related to the Polkadot ecosystem, recently revealed in a tweet how funding for the network’s R&D activity has risen. As per the same, funding has registered an increase since the last quarter of 2021. The tweet highlighted that Astar Network, Unique Network, and Darwinia received the most funding.

However, while the growth was promising, the graph declined in Q2 2023, which has been concerning. Not only did funding decline in the last quarter, but the same trend was also seen for the blockchain’s development activity.

Polkadot investors had a hard time

The blockchain saw a decline in its popularity in the last quarter too, which was evident from its low social volume. Additionally, sentiment around DOT remained primarily bearish as the weighted sentiment chart mostly remained on the negative side.

The token’s price also recorded a similar decline. After hitting the quarter’s highest level in mid-April, the price action turned bearish. At the time of writing, DOT was

trading at $5.49 with a market capitalization of over $6.7 billion. However, the new quarter can look different for the token, as its price action just turned bullish.For instance – According to CoinMarketCap, DOT’s price went up by more than 4% in just the last 24 hours, which looked promising. DOT’s demand in the derivatives market also rose as its Binance funding rate turned green. Its 4-week price volatility also went up slightly after a decline, increasing the chances of a sustained uptrend.

Realistic or not, here’s DOT market cap in BTC‘s terms

Will Polkadot sustain the uptrend?

A look at DOT’s daily chart revealed that the bulls have been stepping up their game. The distance between the 30-day Exponential Moving Average (EMA) and the 55-day EMA is reducing, which suggests that the chances of a bullish crossover are high.

The token’s MACD was also in the bulls’ favor. However, its Relative Strength Index (RSI) went down slightly, which might be a cause for concern.