Assessing the effects of THORChain network’s halt on RUNE

- Node operators of the project paused activities on the network

- Open interest increased as a number of traders chose to long RUNE

THORChain [RUNE], the decentralized liquidity protocol, announced that its network could be prone to vulnerabilities on 28 March. Tweeting with respect to the development, the pseudonymous developer and infrastructure specialist of the project Pluto9r, said that it received “credible reports” about the possibility.

**THORChain Globally Halted**@ninerealms_cap and THORSec have received credible reports of a potential vulnerability affecting @THORChain. Out of an abundance of caution, steps have been taken to halt THORChain globally.

Stand by for more information.

— Pluto (9R) ⚡️?? (@Pluto9r) March 28, 2023

How much are 1,10,100 RUNEs worth today?

No clear cause yet

Although THORChain did not provide specifics at press time, it confirmed that it was necessary to pause activities on the network. Nine Realms, its core development arm, also noted that the action was taken by Node Operators (NOs) to investigate the incident.

Node Operators essentially run a blockchain’s software and help in facilitating transactions on the network. Quoting Pluto9r’s tweet, Nine Realms said,

“Network preemptively paused by NOs to investigate the report; updates will follow.”

Following the development, the RUNE price shred further, as it added to its 5.6% 24-hour decrease, CoinMarketCap revealed. As a decentralized exchange, THORChain has the liberty to receive unique smart contract deposits. However, information from Defi Llama showed that the project has not particularly excelled in this aspect. At press time, THORChain was ranked 63rd with a Total Value Locked (TVL) of 112.84 million.

Apart from receiving deposits, the TVL also measures the health of a protocol. Therefore, the one-day to 30-day decline in TVL implied that the THORchain network health could be threatened. The recent development did not make matters better for the project.

Traders stand in opposition

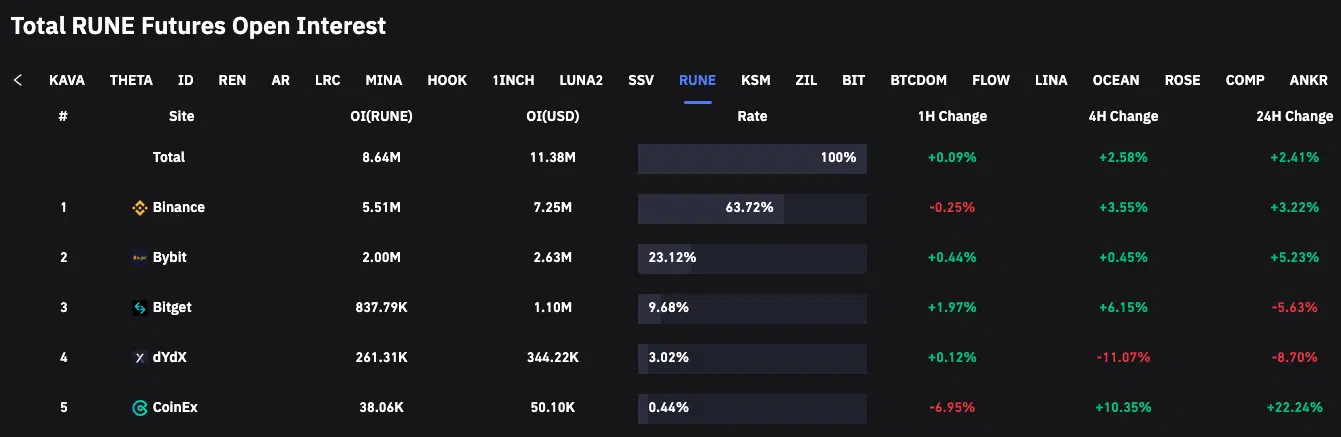

In reaction to the update, traders’ desire to open RUNE contracts suddenly spiked. According to Coinglass, the futures open interest in the one to 24 hours has been green across major exchanges. This indicated that there was a similar market sentiment toward RUNE, and a further increase could pull more strength behind the downtrend.

Is your portfolio green? Check the THORChain Profit Calculator

Surprisingly, not all traders were of the perception that it was a good take to short RUNE. This was because the long vs. short open contracts showed that there was a close margin between those willing to sell and others willing to buy. Hence, this drove the long/short ratio to 1.41, in favor of the longs.

The metric condition above suggesdte that more traders believe that the RUNE dump would only last a while. When the THORChain restores the network, the price action could be positive. However, it remained uncertain if there has been an exploit on the chain or if the team was just trying to take preventive measures.