Ethereum [ETH]: Assessing the withdrawal patterns on centralized exchanges since Shapella

![Ethereum [ETH]: Assessing the withdrawal patterns on centralized exchanges since Shapella](https://ambcrypto.com/wp-content/uploads/2023/05/Ethereum-staking.jpg)

- Kraken accounted for nearly 25% of all principal ETH withdrawals since the upgrade.

- 89% of all transfers classified as CEX were exchanges redistributing among their wallets, indicating low selling pressure.

Almost a month has passed since the much-awaited launch of the Shapella Upgrade, a significant milestone which allowed stakers to withdraw their locked Ethereum [ETH]. Blockchain analytics firm Nansen published a report on 9 May which provides an overview of the network post-Shapella.

Read Ethereum’s [ETH] Price Prediction 2023-24

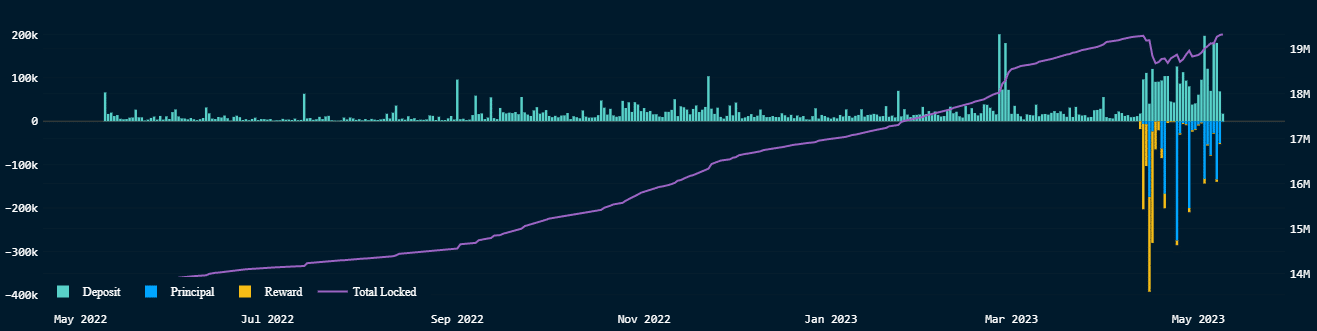

As per the analysis, the amount of ETH staked on the Beacon chain increased from what it was during the time of the Shapella update on 12 April, demonstrating that deposits on the proof-of-stake (PoS) chain have only grown.

As per the Nansen dashboard, Ethereum’s smart contracts held 19.4 million ETH at the time of writing.

CEXs stand first in the queue

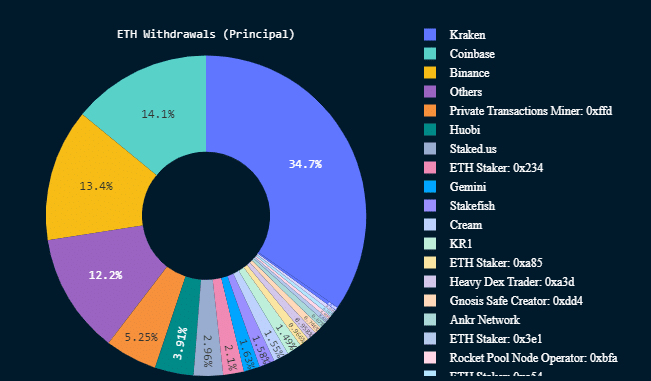

Nansen’s report also shared some interesting observations on the withdrawal patterns. Centralized crypto exchanges (CEXs) took the lead in withdrawals, accounting for nearly 73% of the withdrawals as of 8 May.

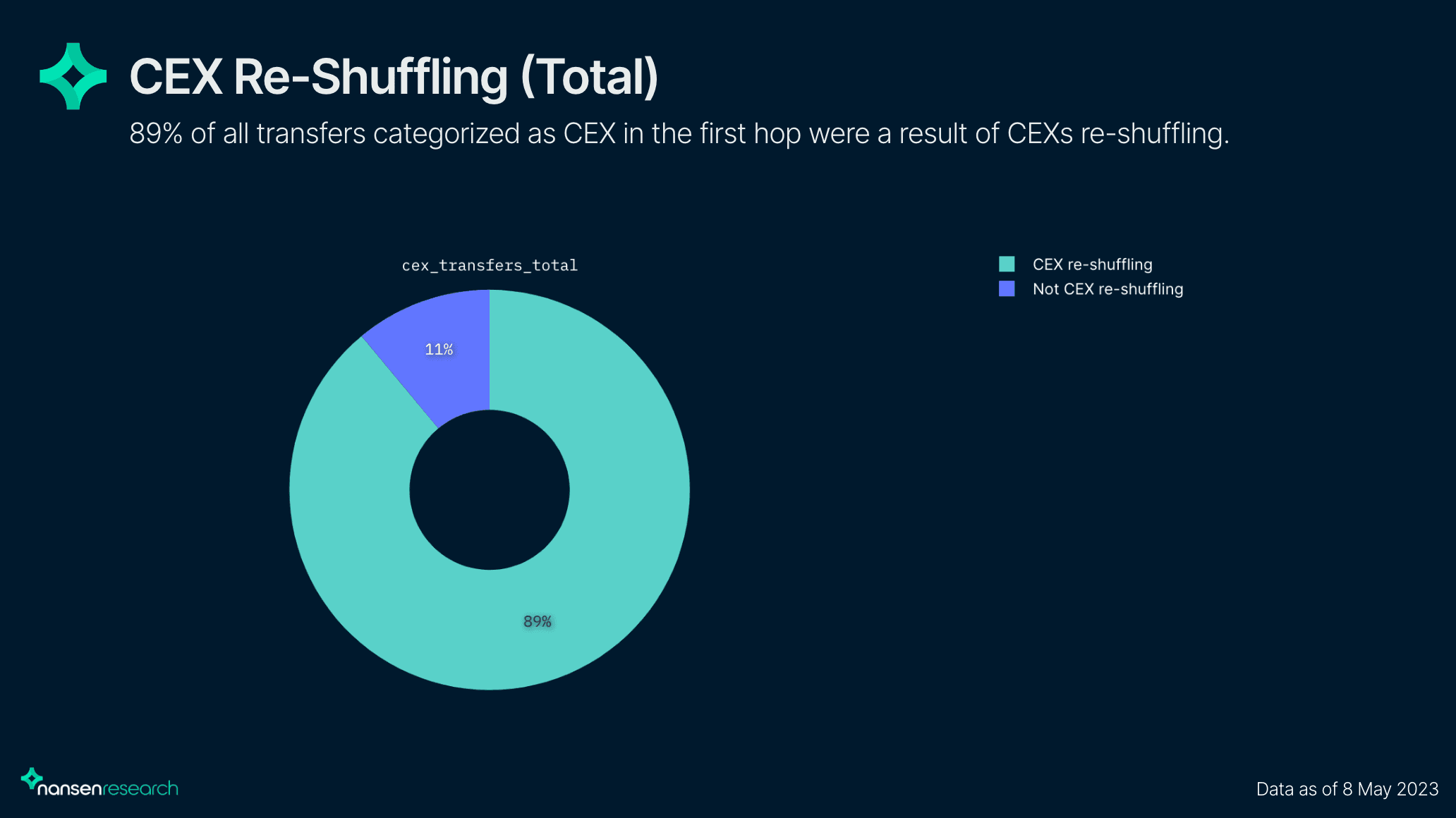

However, contrary to fears of a mass sell-off, most of the ETH getting unstaked was for the exchange’s internal operations.

For instance, Kraken, which accounted for nearly 25% of all principal ETH withdrawals since the upgrade, was doing so because of the regulatory action by the U.S. Securities and Exchange Commission (SEC) which resulted in Kraken ending its crypto staking services in the U.S.

Similarly, Coinbase, which received a Wells Notice from SEC over its staking offerings, was the second-largest entity in terms of withdrawal volume, capturing a 14% share.

Moreover, the idea that the majority of the withdrawn ETH was not intended for sale was strengthened by the fact that 89% of all transfers classified as CEX were CEXs redistributing among their wallets.

Is ETH really bullish?

ETH jumped 13% in the first week after the upgrade, breaking past the $2000 level. However, broader market conditions cut the rally short and dragged it to $1841.82 at the time of writing, data from CoinMarketCap revealed.

Is your portfolio green? Check out the Ethereum Profit Calculator

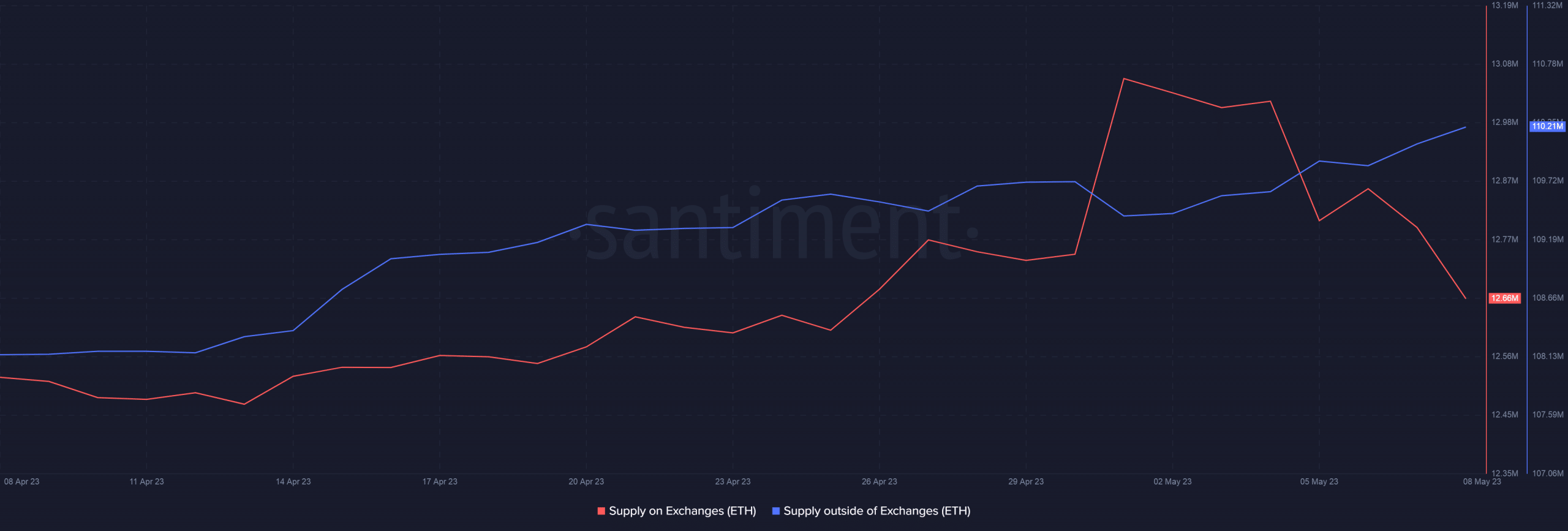

Nevertheless, the sentiment for ETH still looked bullish. The supply outside of exchanges continued to grow in the month of May, in contrast to the depleting supply on exchanges. This implied that ETH’s long-term bulls were optimistic on the second-largest crypto by market cap.

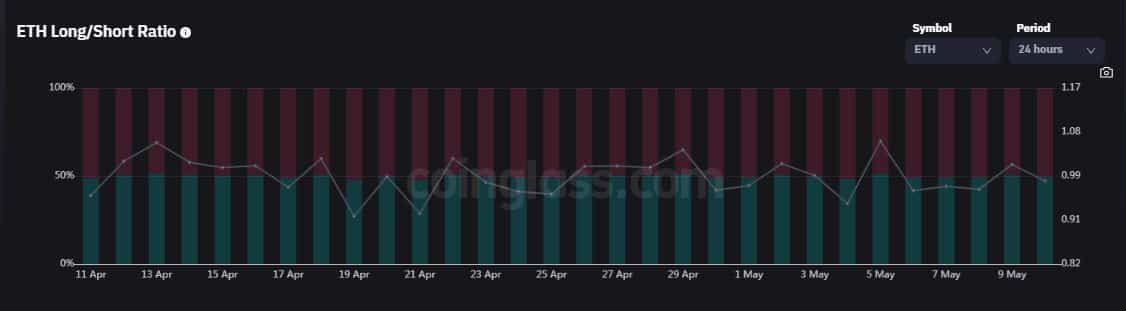

To the contrary, the number of long positions taken for ETH in the futures market decreased when compared to the bearish short-term positions. This was demonstrated by the Longs/Shorts Ratio from Coinglass.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)