Assessing impact of opBNB launch on BNB Chain

- As per Artemis’ tweet, the number of codes committed in the BNB sub-ecosystem has increased.

- Most of the market indicators suggested that BNB’s price might not rise further.

BNB Chain [BNB] recently launched its layer 2 solution opBNB testnet to overcome the limitations of its L1 chain. Thanks to that, BNB’s development activity has remained high.

Is your portfolio green? Check the BNB Profit Calculator

However, BNB’s other network stats have been dwindling, which meant there was less usage of the chain. Will the opBNB testnet be enough to lure new users into the network and turn the tables in BNB’s favor?

Say thanks to opBNB

Artemis’ tweet of 21 June showed that the BNB sub-ecosystem remained quite engaging. As per the tweet, the number of codes committed in BNB’s sub-ecosystem increased considerably over the last few days. The hike in the metric can be attributed to the launch of opBNB.

ICYMI: @BNBCHAIN announced their L2 scaling solution for their L1, Binance Smart Chain. https://t.co/AddHX5gNcY pic.twitter.com/rvdiJSfGhV

— Artemis (@Artemis__xyz) June 21, 2023

For starters, opBNB is an Ethereum [ETH] Virtual Machine (EVM) compatible layer 2 chain, based on Optimism [OP] Stack. Notably, the testnet looks to enhance BSC’s scalability while preserving affordability and security. It was launched on 19 June 2023, and brought with it several benefits and advantages, most importantly scalability.

A sneak peek at opBNB’s stats

opBNB’s official website mentioned that the testnet has a transmission speed of more than 4,000 TPS with an average gas fee of $0.005. As per opBNBScan, a blockchain explorer and analytics platform, the testnet has already completed more than 2.9 million transactions. The numbers looked encouraging, as it suggested increased usage and adoption.

Though opBNB’s metric was promising, BNB, on the other hand, did not benefit from it. Artemis’ data revealed that BNB’s daily active addresses have been declining since mid-May.

The same trend was also seen in the blockchain’s number of daily transactions. Additionally, BNB’s revenue also plummeted. However, things can change in the future when the opBNB mainnet launches.

BNB investors are not the happiest

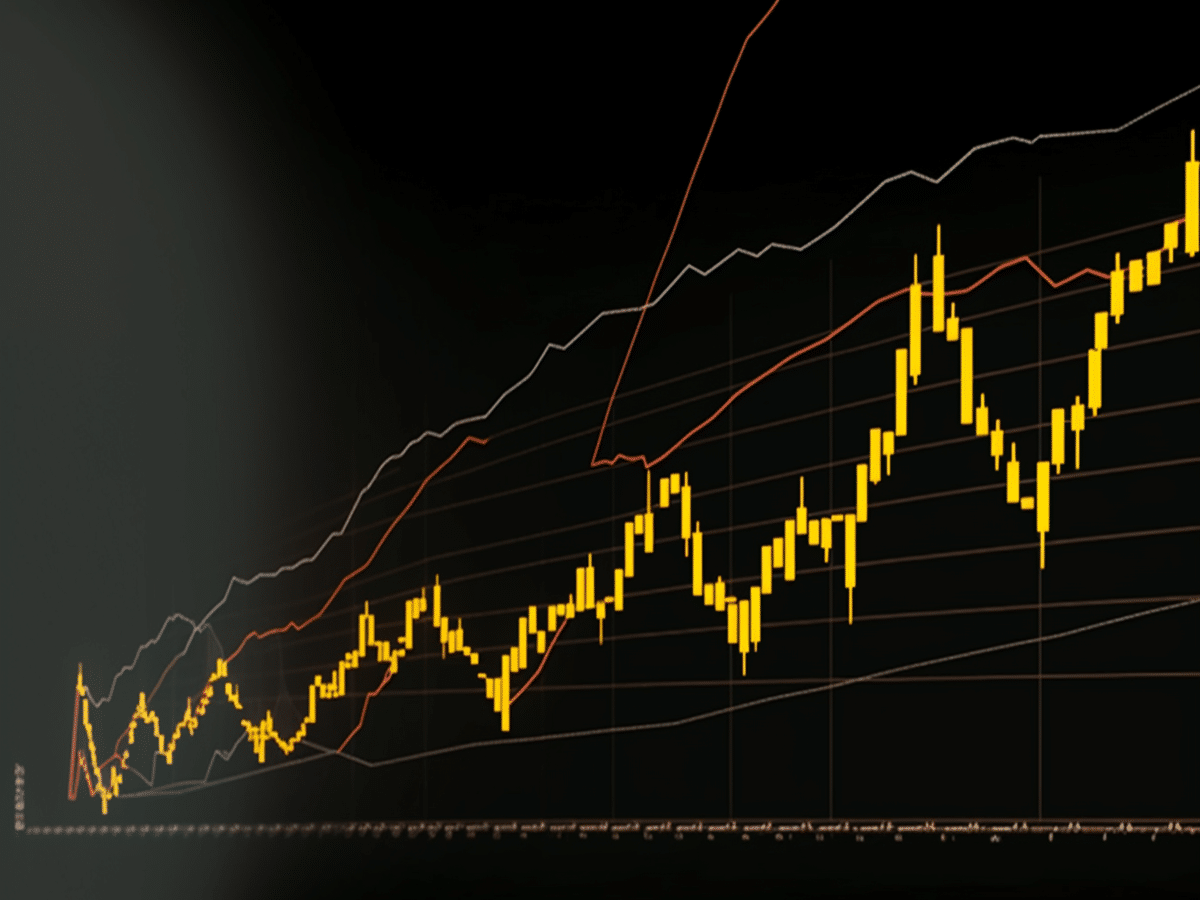

Investors, however, must have expected more from BNB in the bullish market. Though BNB’s daily and weekly charts were green, its price only increased by over 1% in the last 24 hours.

At the time of writing, it was trading at $254.39 with a market capitalization of over $39 billion. A look at its daily chart gave an idea of what went wrong.

Read BNB’s Price Prediction 2023-24

The Bollinger Bands revealed that BNB’s price was entering a less volatile zone. The Exponential Moving Average (EMA) Ribbon was also bearish, as the 20-day EMA was below the 55-day EMA.

Moreover, BNB’s Chaikin Money Flow (CMF) was below the neutral mark, which was bearish. Nonetheless, the MACD displayed a bullish crossover, which could help increase BNB’s price in the coming days.