Assessing ins and outs of XRP as DEX volume slumps

- XRP liquidity fell on DEXes despite the token’s resistance to the SEC onslaught.

- Both retail holders and whales have increased their balance.

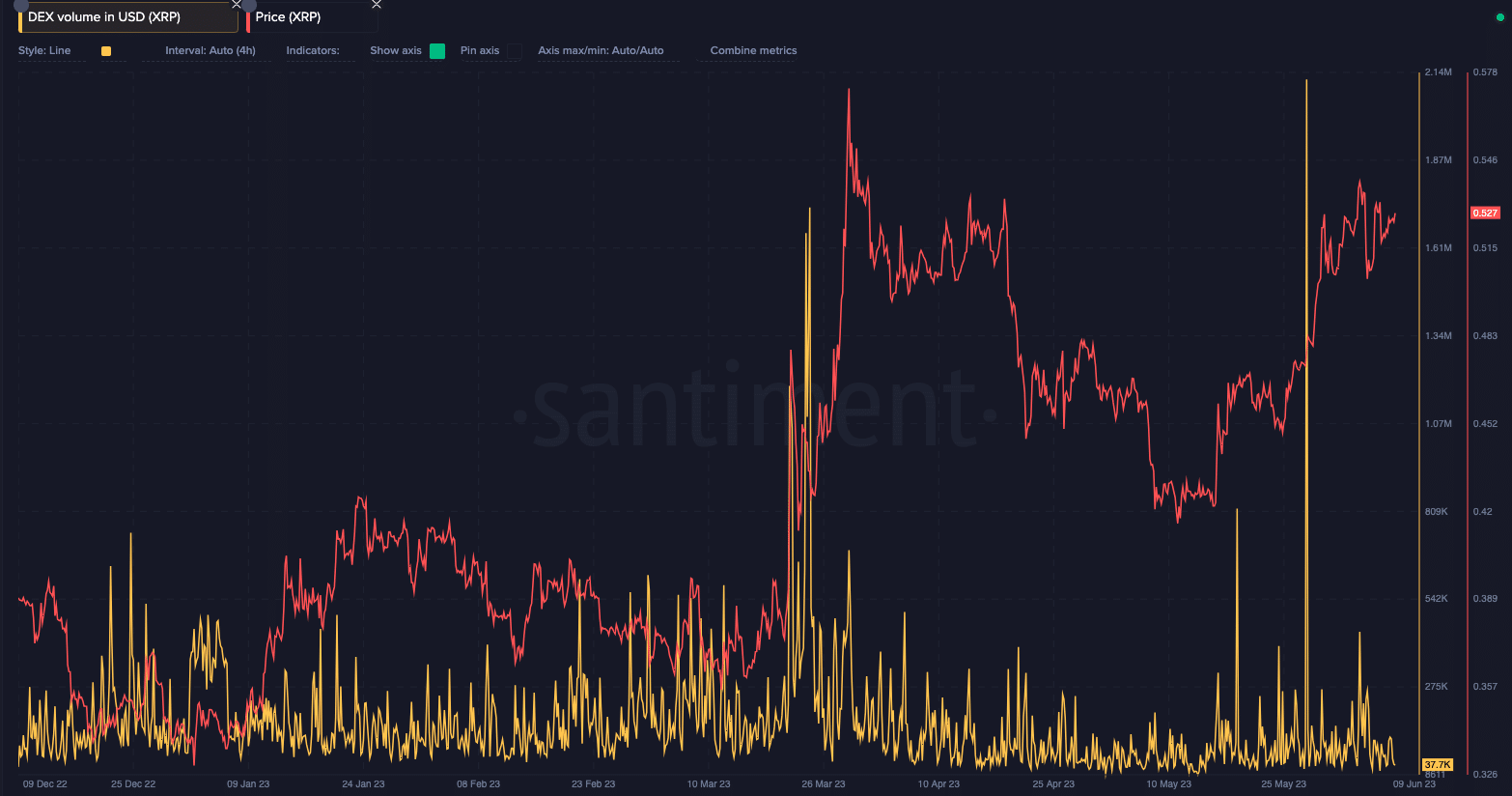

Ripple’s [XRP] volume on Decentralized Exchanges (DEXes) experienced a drop to $33,300 after it rose significantly on 4 June. On the aforementioned date, the metric increased to $440,000. This represents its highest since the $2 million milestone in May.

Realistic or not, here’s XRP’s market cap in BTC terms

Nothing lasts forever

The increase implied that liquidity connected to XRP on platforms where the token was traded was dissipating. Nonetheless, XRP has enjoyed a long period of upticks, decoupling from Bitcoin’s [BTC] trend since its community expressed confidence in winning its case with the SEC.

While the ongoing lawsuit between Ripple and the SEC has created a level of uncertainty around the classification of XRP as a security, it was surprising that the token did not come up when the regulator sued Binance and Coinbase. And as a consequence, the token continued exchanging hands above $0.5.

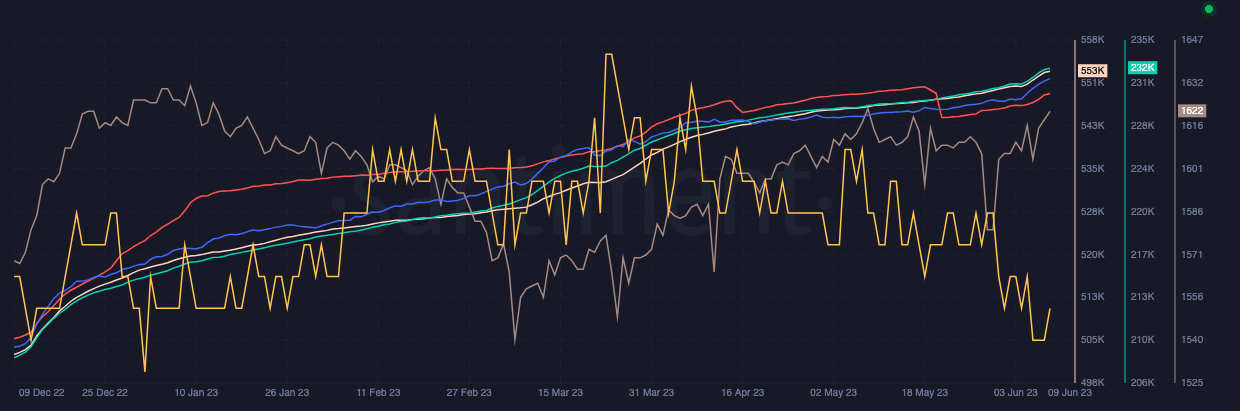

As a result of the positive outlook, the token was gaining increased adoption. At press time, the number of addresses holding 100 to 10,000 tokens increased. It was the same case with the number of holders with 10,0000 to 1,000,000 tokens.

This suggests that demand for the token has increased. However, it was not the same situation with the largest whale cohort. According to Santiment, this group failed to increase their number since the end of May.

When it comes to the balance on existing addresses, on-chain data showed that both retail and whales towed a similar path.

Brewing confidence for the judgement

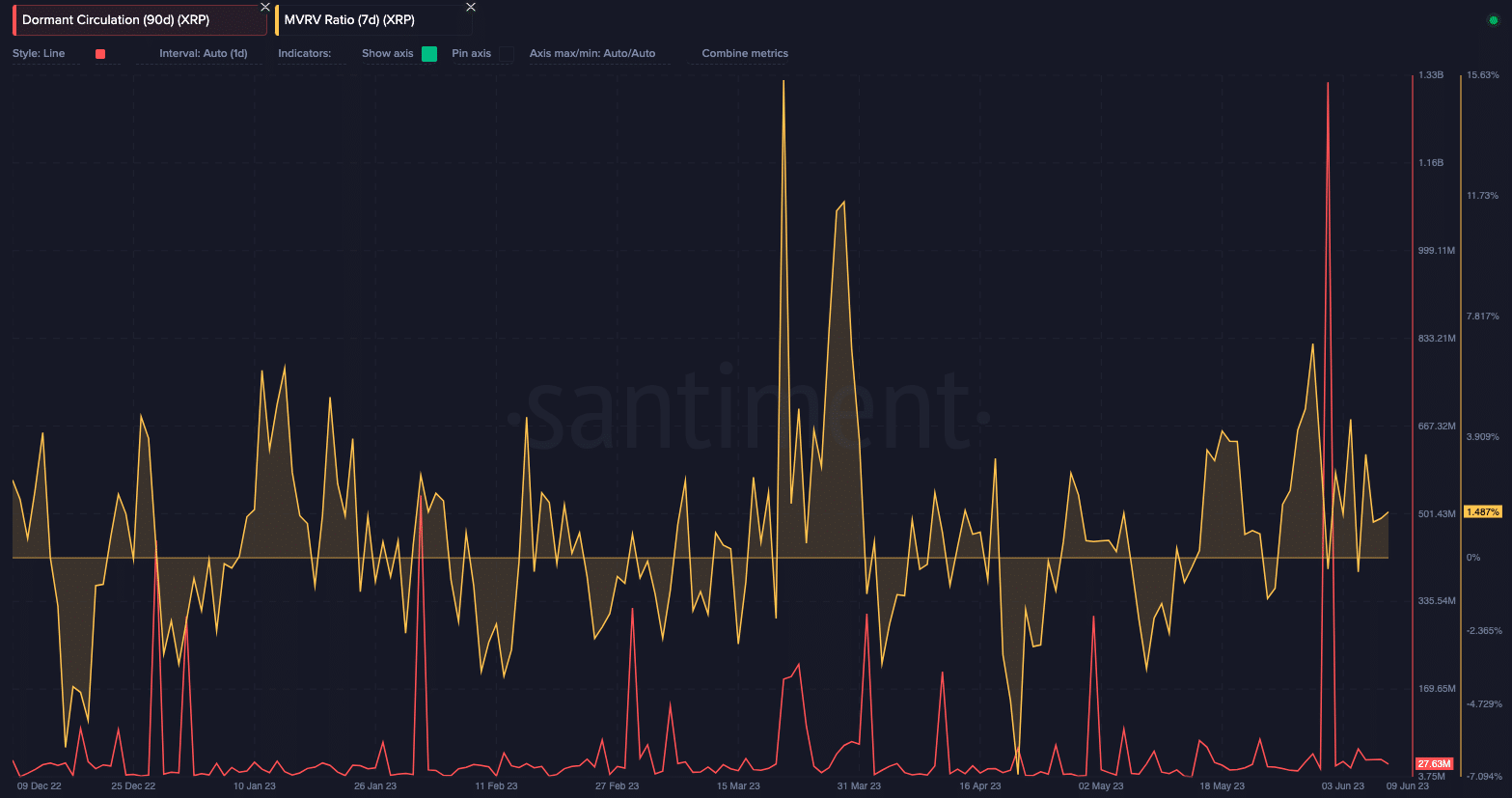

Furthermore, Santiment revealed that the 90-day dormant circulation reached its highest point on 1 June. Although the metric has now decreased, the 1.31 billion hikes on the said date meant that many long-term holders participated in transactions.

While it was unsure why the assets moved, speculation went around how it could be a case of moving assets for protection. In other circumstances, the owners of the wallets involved could have the motive to take profits.

Is your portfolio green? Check the Ripple Profit Calculator

As per the Market Value to Realized Value (MVRV) ratio, press time data showed that it was 1.487%. The metric is responsible for showing the average profit/loss of all tokens in circulation. Therefore, the positive value implies that a sizable number of circulating XRP were in gains.

Meanwhile, the resolution of the lawsuit and clarity on the regulatory status of XRP could pave the way for a resurgence in DEX volume and overall market activity for XRP. But in the meantime, there was no guarantee yet.