Assessing the odds of FLOKI gaining by 60% in the short term

- FLOKI has a short-term bullish outlook after climbing above June’s local resistance zone

- On-chain metrics showed the long-term outlook is bullish, with a chance of short-term holders realizing profits

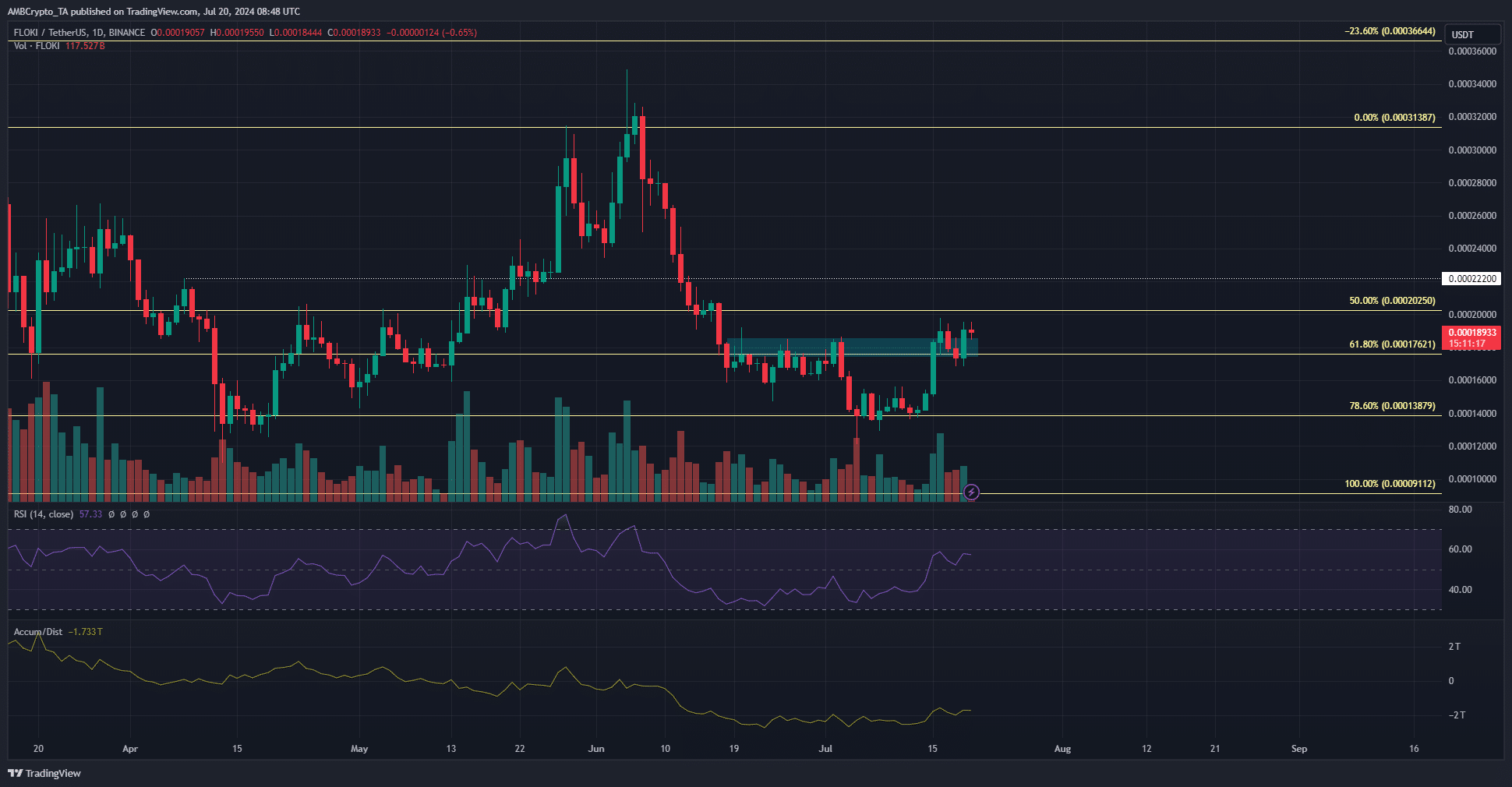

FLOKI, at press time, was trading above the resistance zone it encountered in the latter half of June. In fact, it had formed a bullish pattern and can be projected to gain by 60% in value in the coming weeks.

The on-chain metrics relayed good news for the bulls a week ago and a 41% price bounce from the Fibonacci retracement level was soon seen. Also, technical analysis revealed that the upward momentum might likely continue, at least in the short term.

Another northbound move anticipated

The memecoin tested the 78.6% retracement level for the second time in four months. These Fibonacci retracement levels were plotted based on FLOKI’s rally in March, but are still pertinent.

With the $0.000176 level flipped to support, the bulls would be targeting $0.000222 as the next resistance. The daily RSI showed that momentum has turned bullish after moving above neutral 50. However, the A/D indicator did not bounce as quickly.

It halted the previous downtrend, but its northbound move was sluggish – A sign that buying pressure was weak. While this did not suggest a divergence, it could be a warning sign for the market’s buyers.

Network-wide accumulation has resumed

Source: Santiment

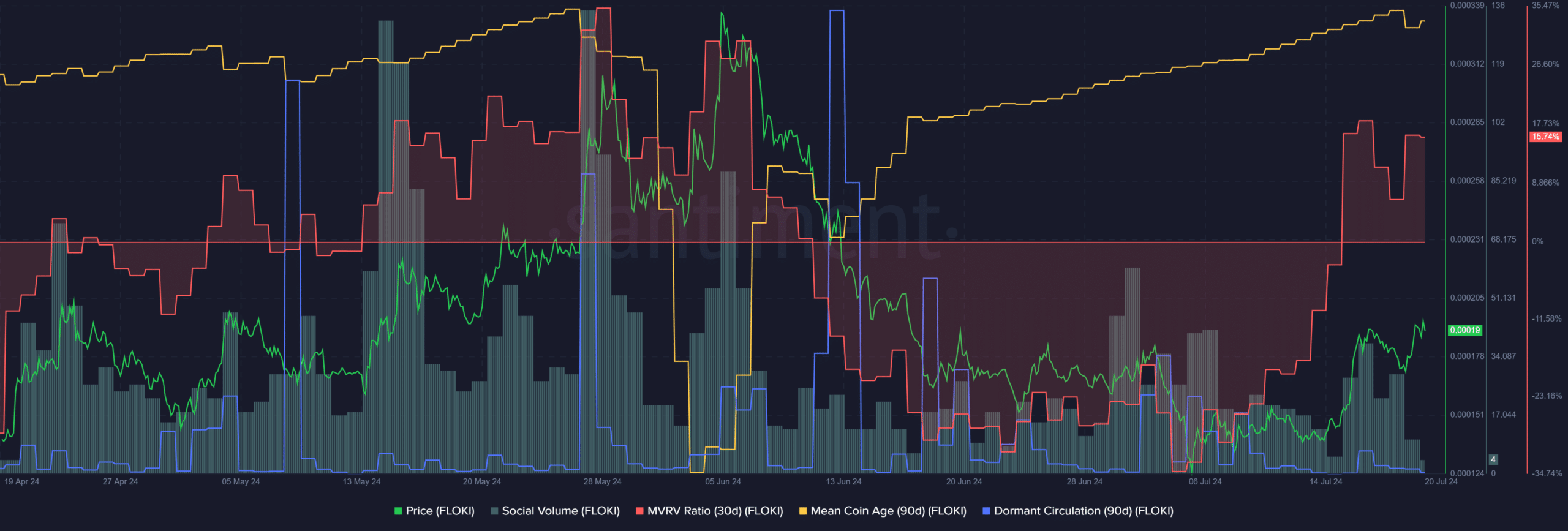

The mean coin age has trended higher after a steep fall in early June. This can be interpreted to be a sign of accumulation. The 30-day MVRV climbed into the positive territory, which could lead to sell-pressure from short-term profit taking activity.

Is your portfolio green? Check the Floki Profit Calculator

Finally, the social volume has been diminished compared to the heights of late May. A sustained bullish trend could see more engagement and spur demand in the coming weeks.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.