Assessing the odds of Monero [XMR] retracing on the charts

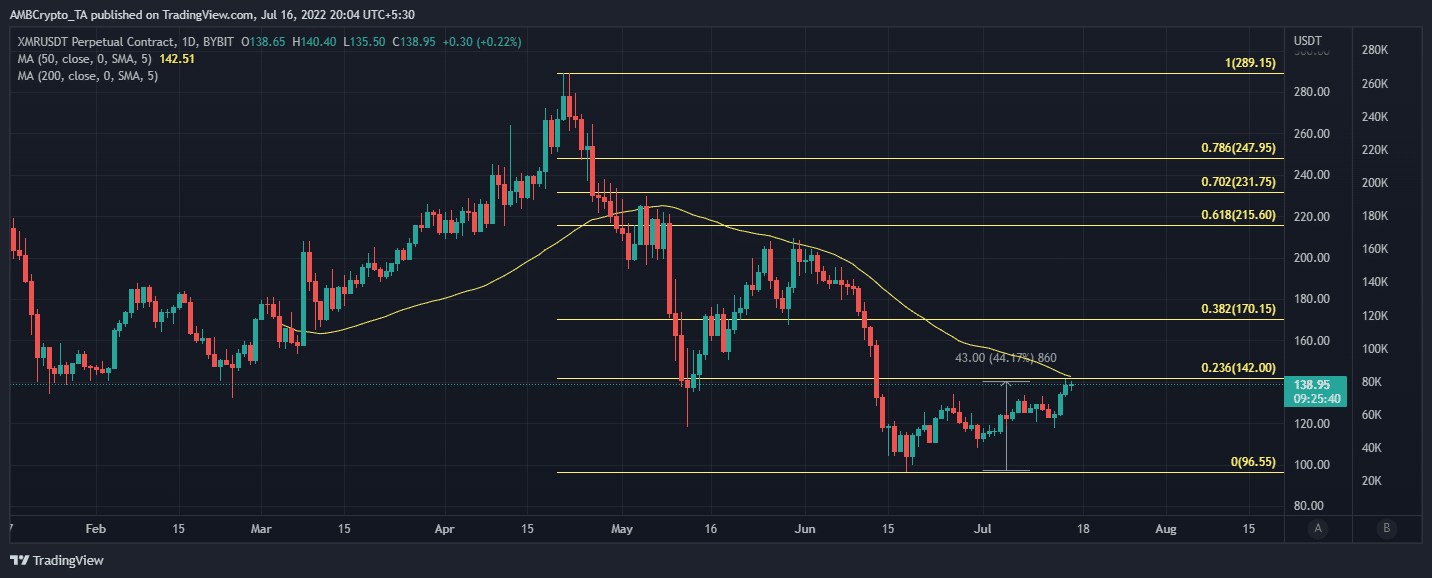

Monero [XMR] is among the few cryptos that have seen healthy recovery from its 2022 lows. In fact, it is up by more than 44% from its $96.50 June low. Even so, its press time position seemed to suggest that a bearish retracement is imminent.

XMR peaked at $141.45 during Friday’s trading session. This represented a healthy upside of more than 44% from its lowest level in June. This move placed it within January 2022’s support level.

More notably, the latest peak placed it within the 0.236 Fibonacci retracement level. This price level will likely act as a new resistance level as many investors who enjoyed XMR’s latest upside cashed out some of their gains.

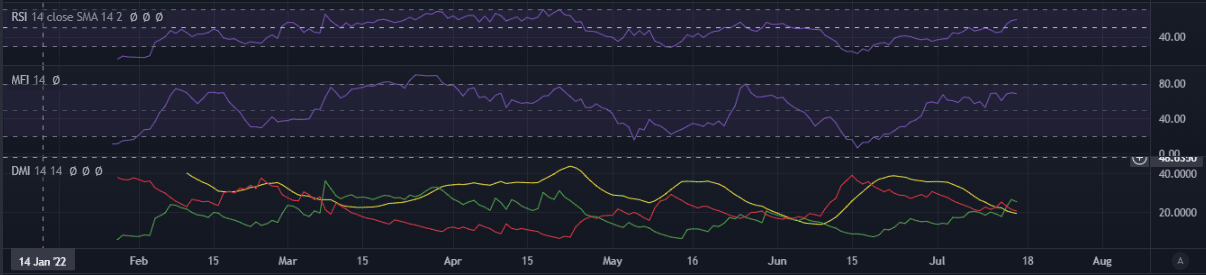

In fact, XMR’s bulls were already showing signs of weakness at the said price level at press time. Its price action managed to push past the 50% RSI level, but its MFI soon flattened, suggesting that accumulation or buying pressure may be tapering off.

The aforementioned was also picked up by the Directional Movement Index, with its +DI pivoting in the last 24 hours.

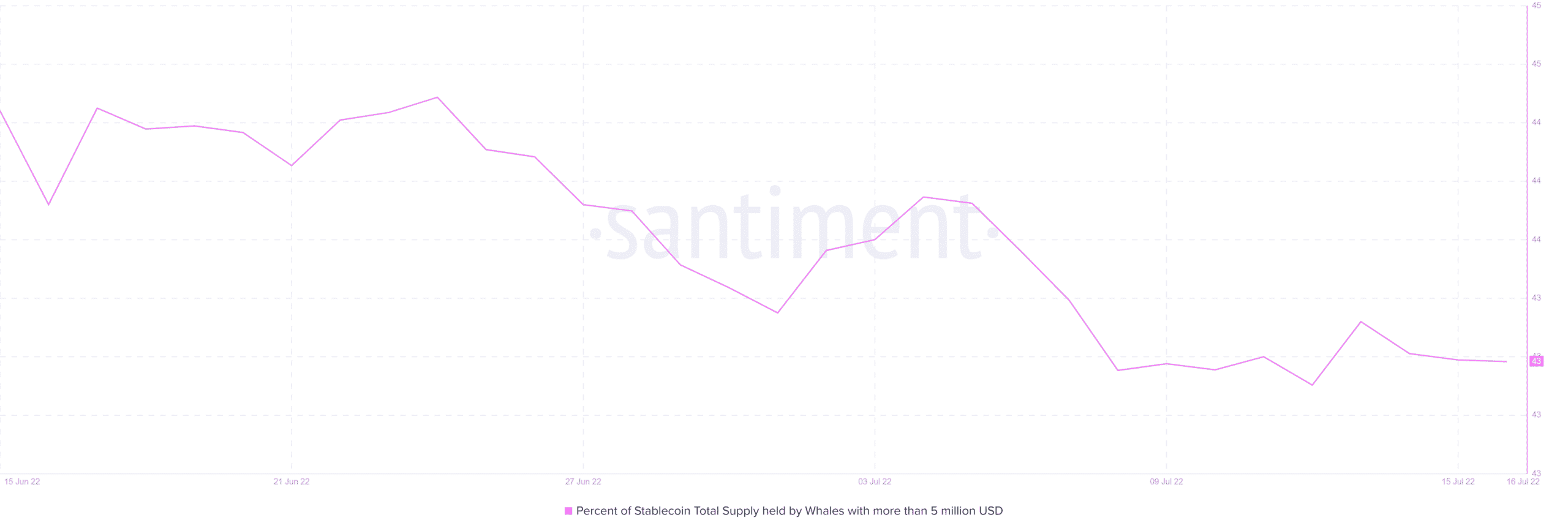

On-chain metrics also supported the greater probability of XMR’s bearish reversal. The supply held by whales metric dropped by 0.20% in the last three days. This is confirmation that some profit-taking has already started taking place.

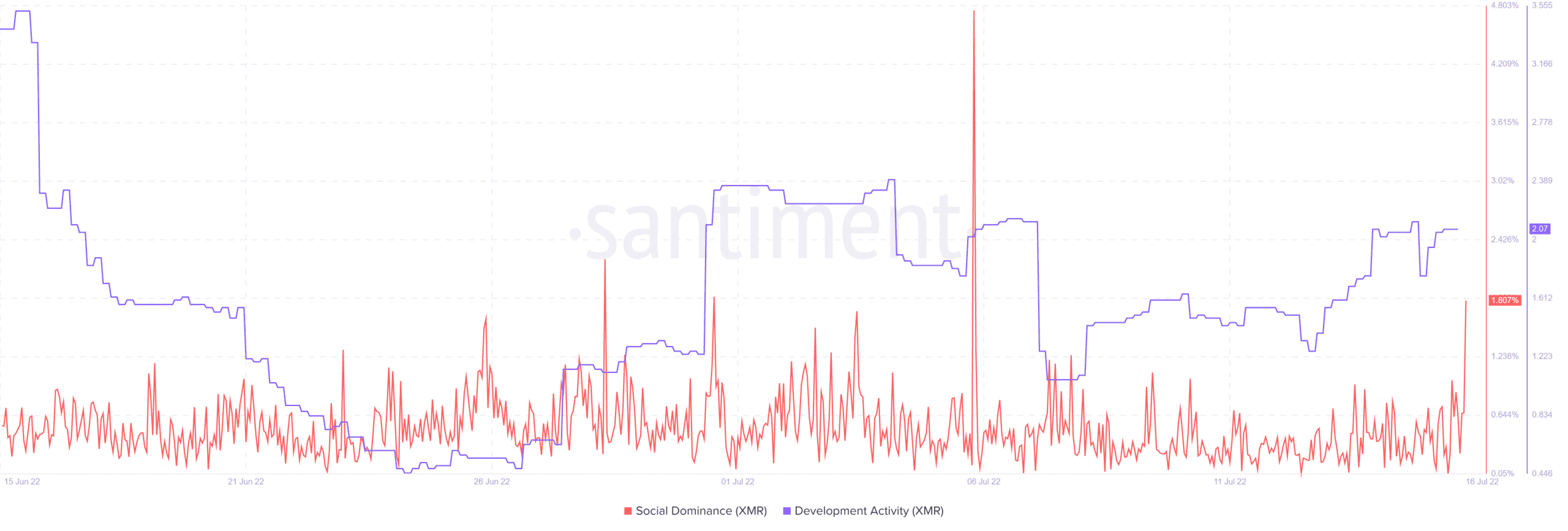

Despite the drop in the supply held by whales, Monero’s social dominance has increased significantly over the last three days. XMR has also maintained healthy development activity in the last seven days, and this may help keep investors interested.

How much of a pullback is to be expected?

It is hard to say how much of a bearish retracement to expect due to the multiple variables involved. For example, many of the investors who bought at lower price levels may opt to hodl. Such an outcome will reduce the maximum potential downside. Alternatively, greater bullish sentiments in the next few days may soften the fall and perhaps, push XMR higher.

On the other hand, if many holders panic sell, XMR’s retracement might be significant. In such an instance, the price might find support near the $120-level. This is the closest previously-tested support level.

However, it’s worth noting that all this is subject to prevailing market conditions.