Assessing the rise and fall of Cardano

- Cardano was briefly displaced by Base in terms of TVL on 22 August.

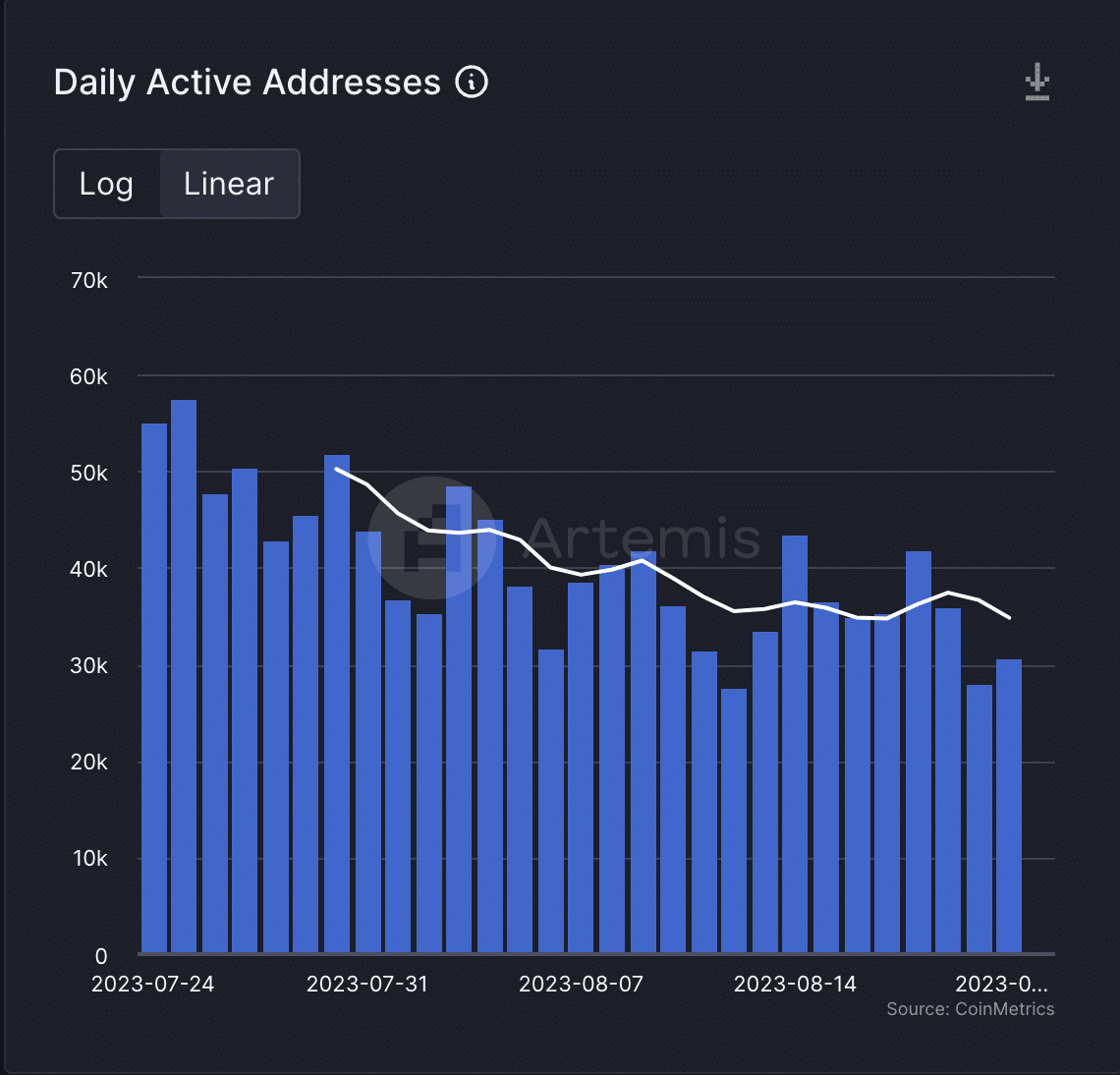

- A look at user activity on Cardano revealed a decline in the last month.

During the intraday trading session on 22 August, the total value locked (TVL) in Cardano’s [ADA] decentralized finance (DeFi) ecosystem was briefly overtaken by that of Coinbase’s Layer-2 (L2) platform Base.

Read Cardano’s [ADA] Price Prediction 2023-24

As on-chain analytics platform Nansen noted in a tweet, Cardano’s TVL was behind Base’s by about $1 million for a short period before it regained dominance.

It didn't take long for Base to overtake Cardano's TVL

Maybe they should pivot into becoming an ETH L2… pic.twitter.com/8Ma2vhqQaT

— Nansen ? (@nansen_ai) August 22, 2023

At $190.7 million at press time, the value of assets on Cardano ranked ahead of Base, which had a TVL of $186.31 million, according to data from DefiLlama.

The year has been good for Cardano’s DeFi ecosystem, but…

While it started the year with a low TVL of $64.85 million, the past few months have been marked by a surge in the protocol’s assets. According to DefiLlama, these have grown by 197% in the last eight months.

As earlier reported, the growth in the network’s TVL, particularly in the second quarter, has been due to the enlargement of its stablecoin market.

Between April and June, the total stablecoin market capitalization on the network grew by 34.9% from $10.0 million to $13.5 million. So far this year, Cardano’s stablecoin market capitalization has risen from 54th to 37th place among other networks.

However, on a broader assessment, Cardano’s TVL has plummeted significantly in the last year. Peaking at $434 million on 28 March 2022, Cardano’s DeFi vertical has since shed over 50% of its value. This drop is attributable to the severe bearish conditions that marked the 2022 trading year.

User activity in the last month

Cardano has experienced a general network decline in the last month. While its TVL has fallen by 16% during that period, user activity on the chain has also trended downwards.

Data from Artemis revealed a steady drop in the daily count of unique wallet addresses that have completed on-chain transactions on Cardano in the last 30 days. Between 23 July and 21 August, this declined by 44%.

How much are 1,10,100 ADAs worth today?

With fewer active addresses on the Layer 1 (L1) network in the last month, the number of transactions completed has also slowed. Per Artemis, the total number of transactions registered on-chain in a rolling 24-hour period between 23 July and 21 August fell by 32%.

Regarding its DeFi vertical, trading activity on the decentralized exchanges (DEXes) housed on Cardano peaked on 7 August. But it has since begun to trend downward. With $2.72 million recorded in DEX volume on 22 August, a 79% decrease was recorded in the last 15 days.