Assessing the state of LUNC after UST’s re-peg passes first stage

- The Terra Classic community moved a step ahead towards bringing back UST

- LUNC surged, but it was overbought and could soon reverse.

The notion that the Terra Classic [LUNC] community was over the painful collapse of LUNA may be wrong. Of course, the community had repeatedly said that they were focused on rebuilding. But there has been a Signal proposal to reawaken the fizzled stablecoin of the Terra [UST] ecosystem.

The Signal proposal to re-peg with UST proposed by the LUNC community has passed. Signal proposals do not represent immediate technical consequences. The proposer said that after the voting is completed, he will discuss with the L1 team how to proceed. https://t.co/We9ATUVcpi

— Wu Blockchain (@WuBlockchain) February 3, 2023

Read Terra Classic’s [LUNC] Price Prediction 2023-2024

LUNC in the face of a possible UST comeback

As of 3 February, the proposal had passed the first reading to re-peg UST to the dollar. However, there was no certainty that the objective would eventually be approved, as it would need to pass through several stages.

The development may sound bewildering considering the stablecoin played in Terra Luna [LUNA] and broader crypto market crash in 2022. Recall that investors were enthusiastic about LUNA, and most even agreed with the label “the future of money.”

But the dishonesty of the project’s founder and multiple half-truths have made a large part of the crypto community steer away from LUNC.

Nevertheless, the token did not seem to be doing too badly. In the last 30 days, it picked up a 29% price increase, although this was minute compared to many other cryptocurrencies.

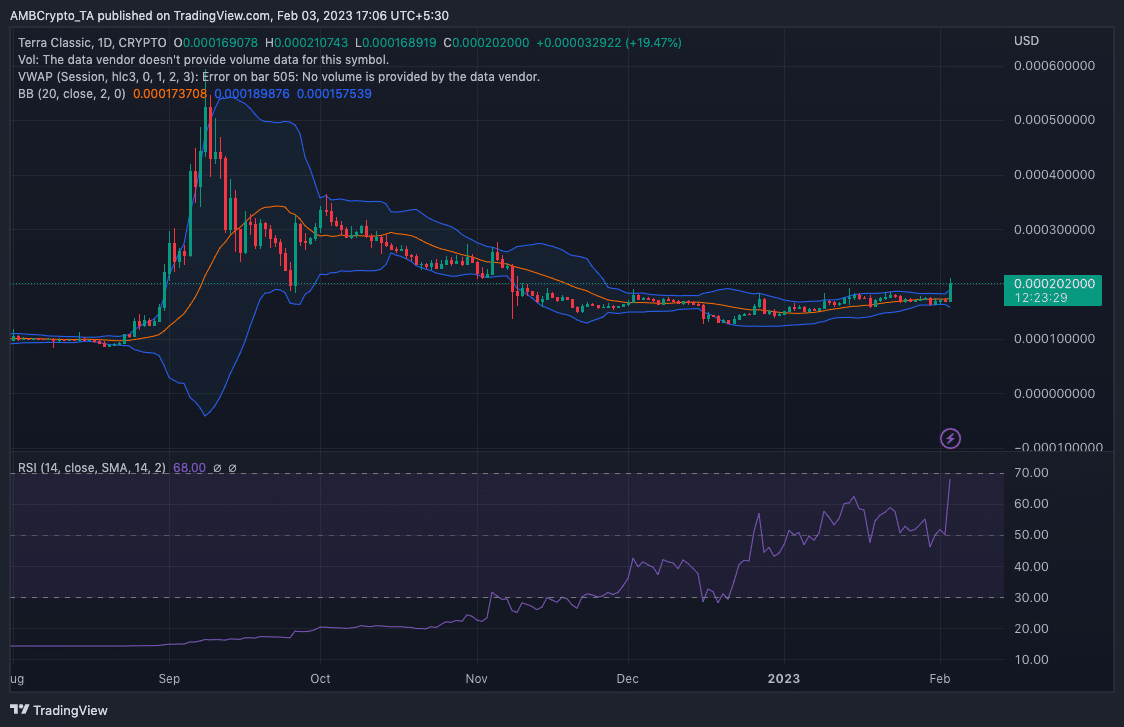

On the daily chart, LUNC had approached the overbought region, as displayed by the Relative Strength Index (RSI) below. Due to the stance, a price reversal could be imminent.

In a twist of expectations, LUNC, which was known to show extreme volatility, showed high contraction as indicated by the Bollinger Bands (BB). However, the price, time and time again, hit the upper band. This state points to LUNC being in an overbought zone.

LUNC: Swinging on-chain

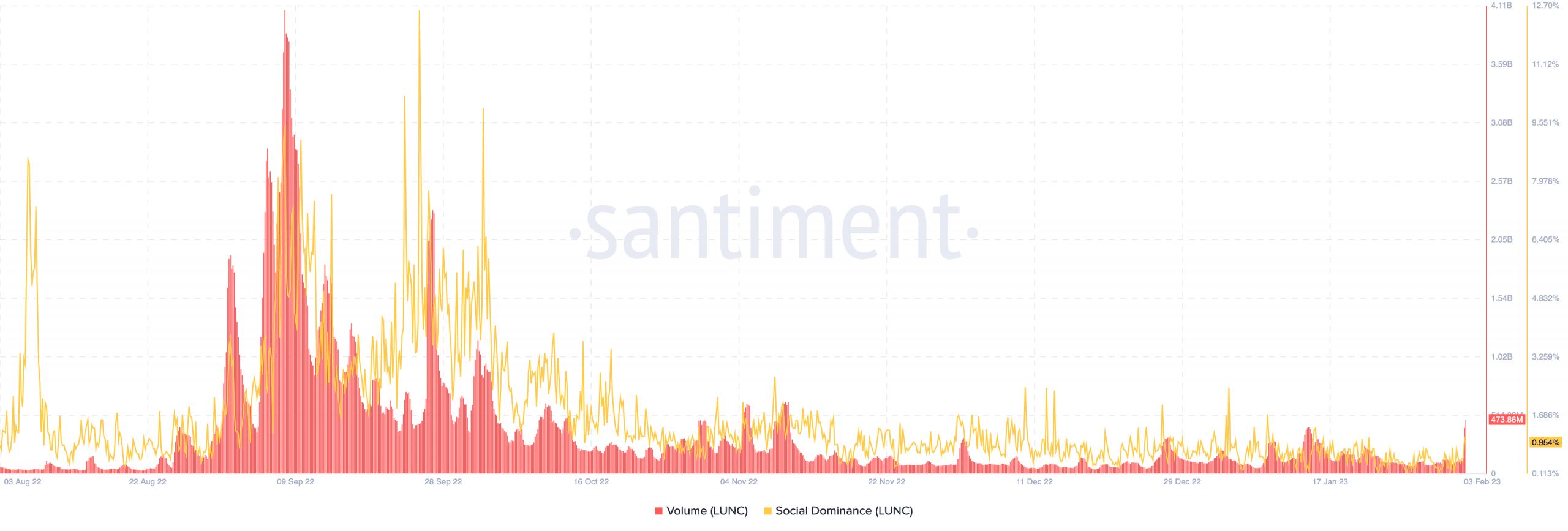

Regarding its volume, Santiment showed that there was a significant spike on 2 February. This drove the metric 473.04 million. The volume gauges the number of time assets are traded within a particular time frame.

With the LUNC price surging alongside the volume in 24 hours, it meant that a lot of buying and selling of LUNC tokens was going on.

Realistic or not, here’s LUNC’s market cap in BTC’s terms

The social dominance, which measures an asset’s share of discussion in the industry, also followed the same trend. At the time of writing, it was 0.954%, meaning LUNC had joined some of the top conversations around cryptocurrencies lately.

Meanwhile, comments from the LUNC community showed decreased euphoria about the UST development. Either way, the forthcoming months would confirm whether would be a comeback.