ATOM: Should the declining demand worry bulls?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ATOM dropped to a new 2023 low of $6.158.

- There were no signs of a reversal signal from the Futures market data.

Cosmos [ATOM] hasn’t contained the extra selling pressure in Q4 2024. The altcoin was down 14% in October based on the press time value of $6.2, with no immediate signs of price reversal.

Is your portfolio green? Check out the ATOM Profit Calculator

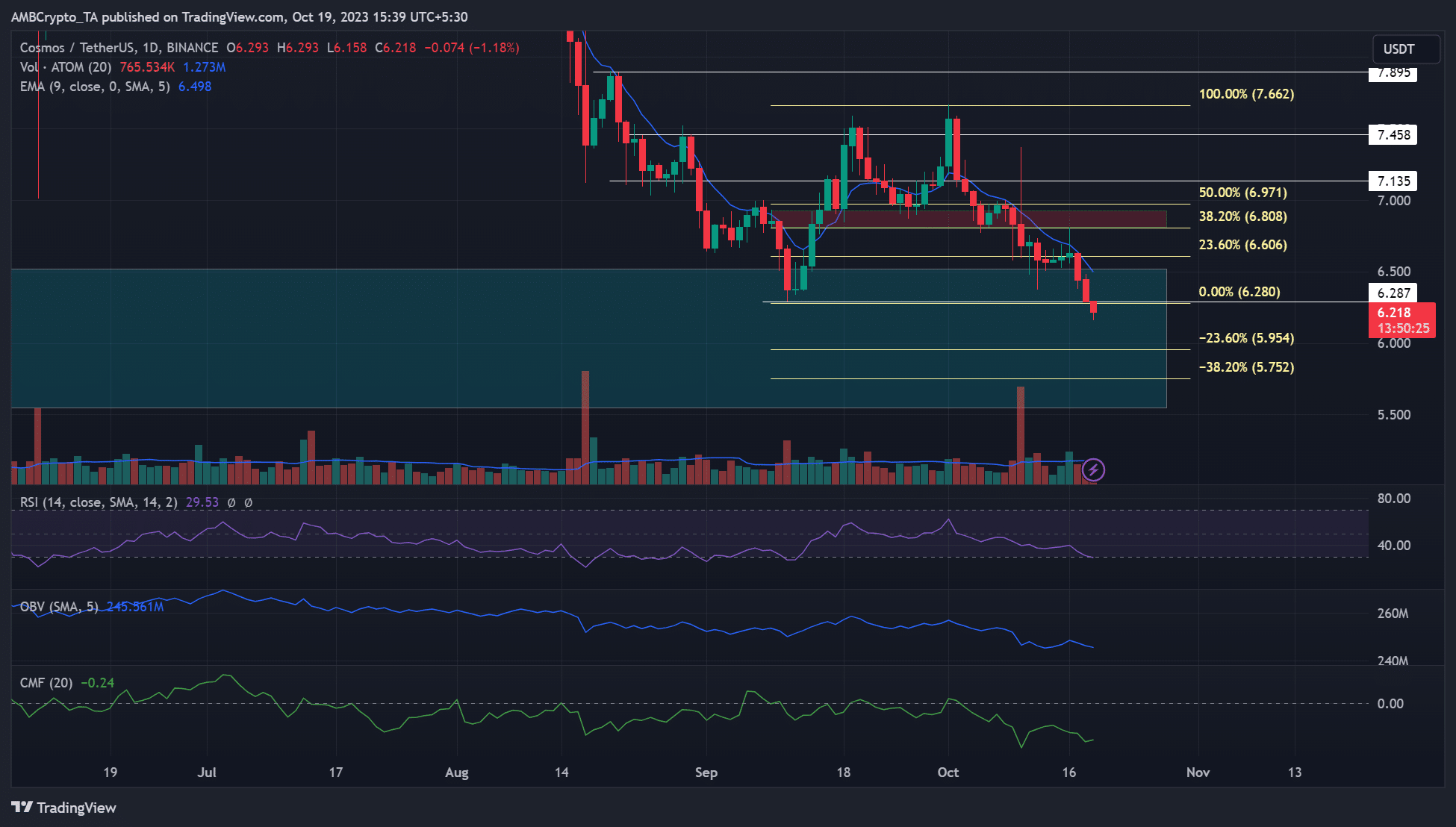

A previous technical analysis of ATOM captured the recent extra price drop. A move below the previous low of $6.287 formed on 11 September meant that ATOM could plunge further.

When will the plunge stop?

The previous low of $6.287 occurred in a daily bullish order block of $5.550 – $6.520 (cyan) formed on 18 June 2022. Although the above bullish OB stopped the previous pullback, the recent extended drop meant sellers had more market leverage.

A Fib tool was plotted between the recent high and previous low. Based on the tool, $5.95 and $5.75 were the immediate bearish targets for aggressive sellers.

Conversely, a price reversal at the bullish OB, which was unlikely at the time of writing, could set ATOM to target $6.8 or $6.6.

Key price indicators were negative and cemented the bearish inclination. In particular, the RSI retreated to the oversold zone and signaled a spike in selling pressure. Sellers’ edge was further boosted by low Spot market demand, as shown by downsloping OBV.

Capital inflows also declined, as shown by the CMF’s southward movement.

No reversal signal in the Futures market

How much are 1,10,100 ATOMs worth today?

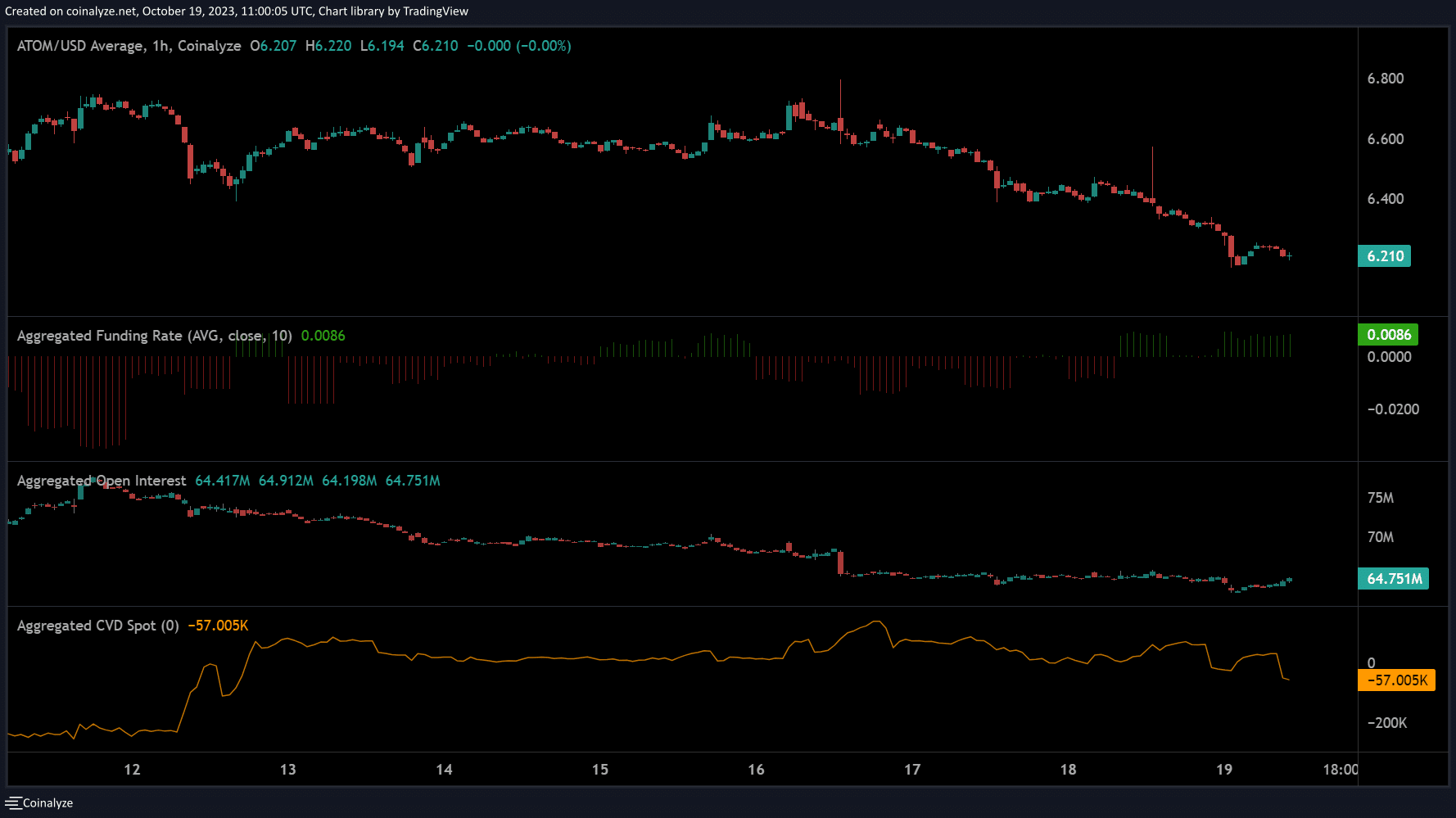

In the Futures market, the Open Interest rates dropped from >$75 million to below $65 million. The above trend underscored muted demand in the derivatives segment.

Besides, the fluctuating funding rates indicated that a solid reversal for ATOM could be difficult. At the time of writing, sellers were firmly in control, as shown by the declining CVD (Cumulative Volume Delta). So, bullish efforts could be constrained for a while.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)