AURA Coin and its short-term gains – Why its 26% spike isn’t a big deal

- Aura Finance seemed to have a strongly bearish bias on the higher timeframes, despite recent gains

- Spike in dormant activity was concerning for long-term holders

Aura Finance [AURA] registered gains worth 26% in the last two days. Buying volume picked up in the short-term and momentum also shifted bullishly on the daily timeframe. This, alongside a strong upward move for Bitcoin [BTC] on the price charts.

And yet, the technical analysis revealed that the longer-term trend was not bullish. The on-chain metrics also sparked concerns about the sustainability of this rally. Ergo, the question – Can AURA bulls maintain the trajectory of the past two days?

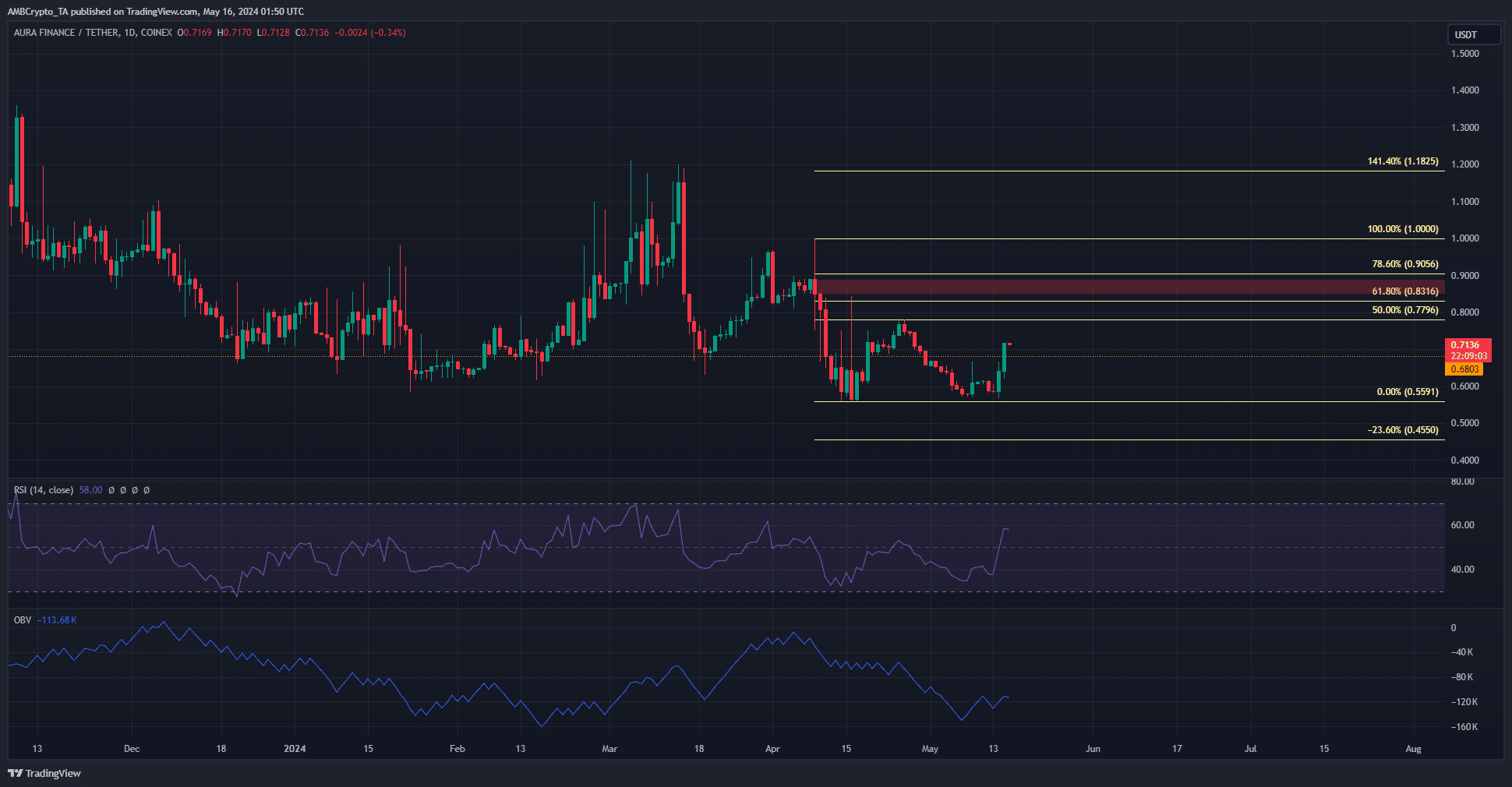

Market structure was unbeaten

On the daily timeframe, AURA has formed a series of lower highs since mid-March. The drop below $0.68 in the second week of March flipped the structure bearishly once more.

The altcoin is within this one-day timeframe bearish structure. Even though the RSI leaped above neutral 50 to indicate bullish momentum, it would likely continue to trend downward. The Fibonacci retracement levels (pale yellow) at $0.83 and $0.9 are expected to serve as resistances and rebuff the bulls.

The $0.85-$0.88 region (highlighted in red) has also acted as a technical resistance zone. The OBV climbed higher over the past week, but did not reach its April highs – A sign that buying pressure was present, but might not be enough.

A wave of selling around the corner?

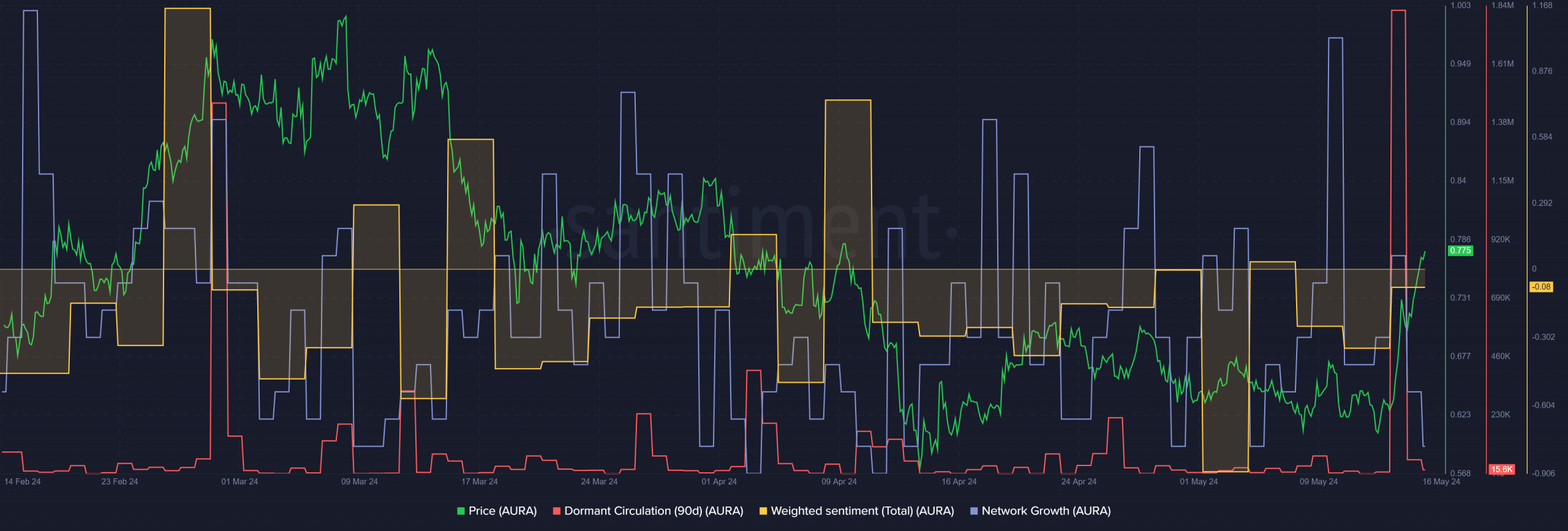

Source: Santiment

On-chain metrics did not show bullishness for Aura Finance either. Network growth has been consistent over the past two months, but the values since February have been under 20.

This means less than 20 unique addresses have been created on the network each day since late February, which could be a depressing finding for long-term investors.

Realistic or not, here’s AURA’s market cap in BTC’s terms

During the near 30% rally over the past two days, the dormant circulation noted a massive spike, the biggest of the past three months. As expected, a flurry of token movement was spotted – A likely sign of selling pressure into the short-term bounce.

Finally, the weighted sentiment has also been negative for the past month, underlining how little power the bulls likely have.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.