Avalanche [AVAX]: Despite price surge, these concerns emerge

![Avalanche [AVAX]: Despite price surge, these concerns emerge - more inside](https://ambcrypto.com/wp-content/uploads/2023/04/AMBCrypto_The_image_depicts_a_stylized_representation_of_the_Av_a10a04de-310c-4d08-a7a5-a4a9b64edc81-e1680933605173.png)

- Avalanche witnessed a major spike in activity on its protocol across all fronts.

- Interest in its NFT markets declined, however, the price of AVAX continued to surge.

In recent weeks, there has been some instability within the Avalanche [AVAX] ecosystem as its C-Chain experienced some downtime. Despite this setback, the overall activity on the network remained strong.

Read Avalanche’s [AVAX] Price Prediction 2023-2024

The C-Chain, or Contract Chain, is responsible for executing smart contracts and running decentralized applications (dApps) on the Avalanche network.

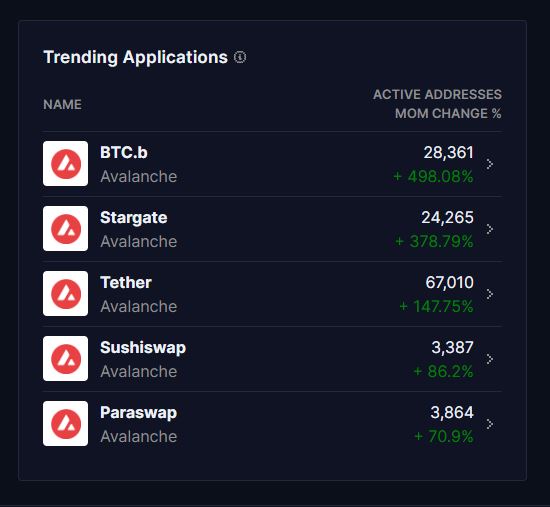

However, despite the inconvenience caused by the downtime, the other chains and functionalities within the Avalanche ecosystem continued to operate as usual. This caused a surge in activity, which was driven by the usage of BTC.b, Stargate, and Tether [USDT].

Some bearish signs

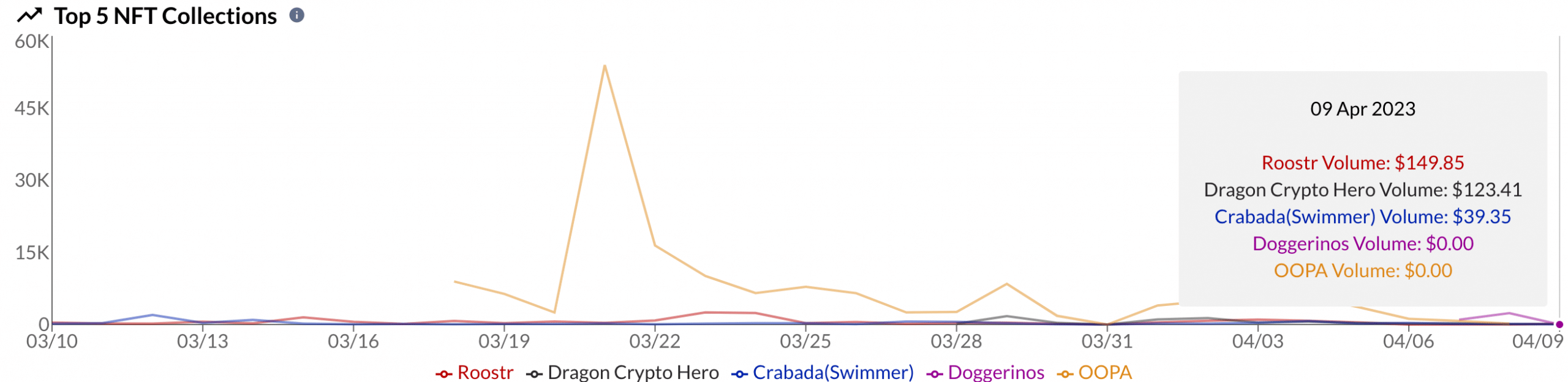

Even though there was high activity observed on Avalanche due to its dApps, its NFT market did not see any interest.

Recent data from AVAXNFTSTATS showed a notable decline in the trading volume of several high-profile NFT collections on the Avalanche network. Over the past month, popular collections such as Roostr, Doggerinos, and Crabada have experienced a decrease in the number of trades being made for each of their collections.

This decline in trading activity may be attributed to several factors, such as market saturation or a decrease in interest among potential buyers.

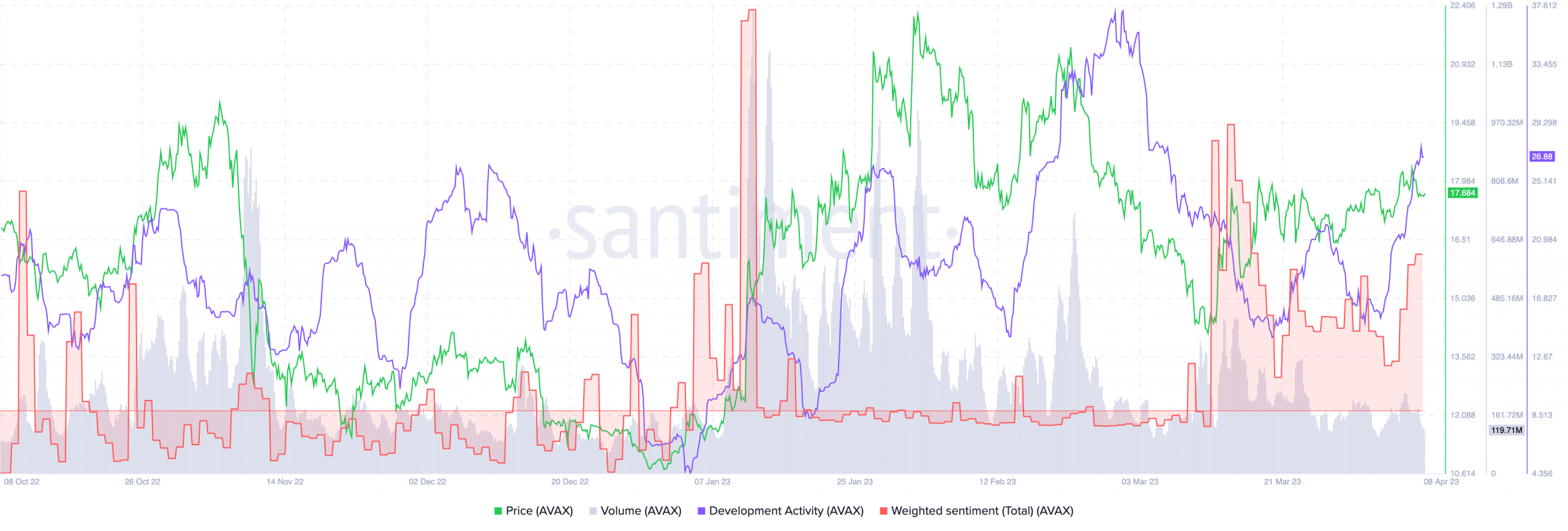

However, despite the recent decrease in interest towards Avalanche NFTs, the overall outlook towards the protocol remains positive. This positivity was reflected in the weighted sentiment indicator, which indicated that the crypto community has a favorable view of Avalanche.

Realistic or not, here’s AVAX’s market cap in BTC’s terms

The positive sentiment towards Avalanche coincided with a surge in the prices of AVAX over the past few weeks. However, it’s worth noting that while AVAX prices continued to rise, the volume of AVAX decreased. This may suggest that a bearish outcome for AVAX could be possible in the short term.

On the other hand, Avalanche Protocol’s development has been on the rise during this period. This could impact the level of interest in the platform going forward. With the addition of new features and improvements, Avalanche may attract more users and investors. This could, in turn, lead to increased demand for AVAX.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)