Avalanche [AVAX] fixated on its pre-FTX level – Is it even achievable?

![Avalanche [AVAX] fixated on its pre-FTX level – Is it even achievable?](https://ambcrypto.com/wp-content/uploads/2023/01/johannes-waibel-WdBQHcIiSIw-unsplash-1-e1674885437811.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- AVAX could reclaim its pre-FTX level in the next few days.

- The Funding Rate for AVAX remained positive in the derivatives market.

Avalanche [AVAX] is an inch away from hitting a crucial multi-month peak. AVAX’s value surged from $10 to a high of $18.97 – over 75% gains. At press time, AVAX’s value was $17.97, flickered red as Bitcoin [BTC] struggled to reclaim the $23K zone.

If next week’s FOMC announcement offers a positive market trigger, BTC could enter an upward momentum and prop up the altcoin market. Such a move could see AVAX reclaim this pre-FTX level.

Read Avalanche [AVAX] Price Prediction 2023-24

The pre-FTX level of $20: Next bulls’ target?

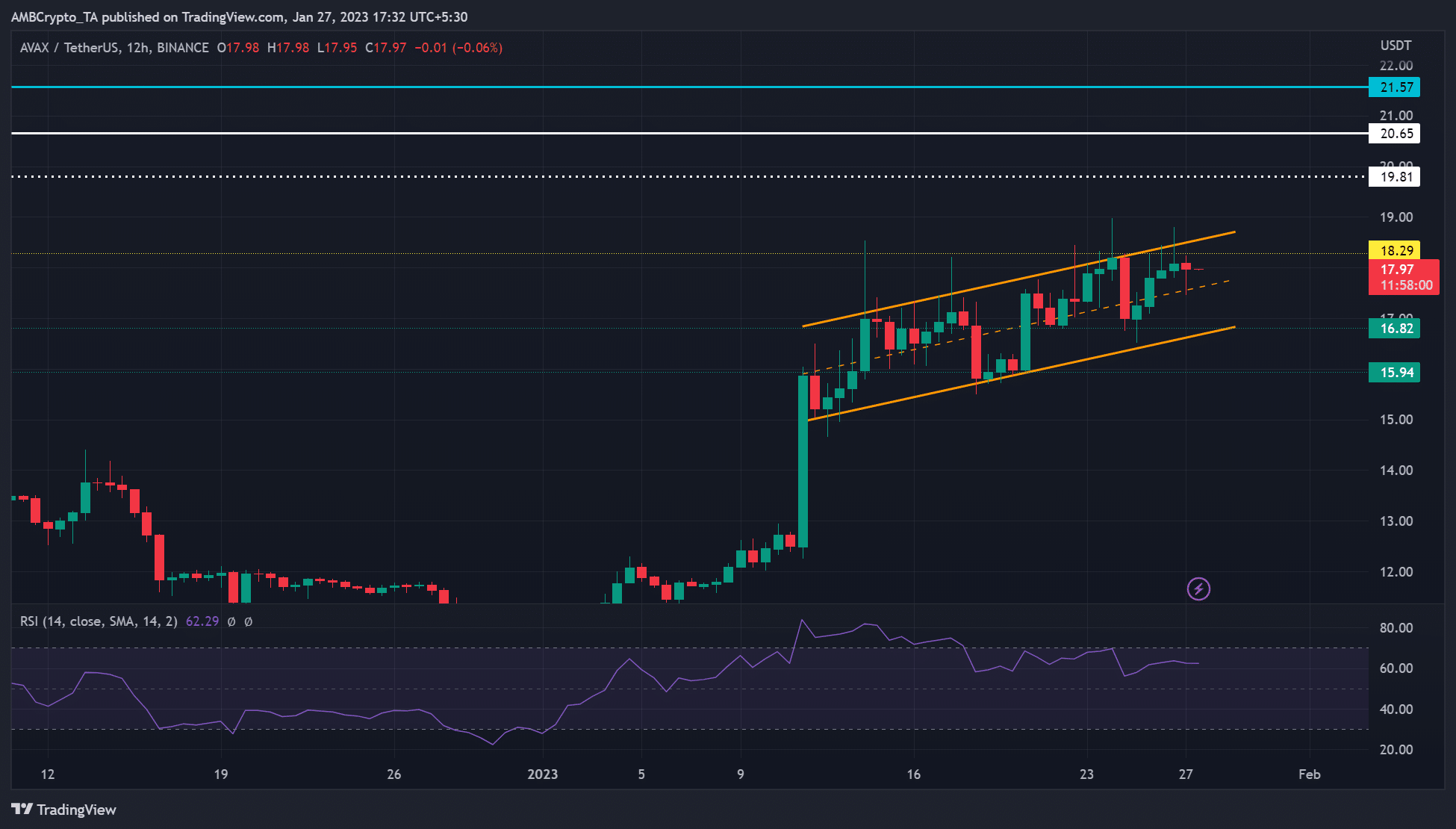

After a massive rally on 11 January, AVAX’s subsequent price action chalked out a rising channel. Since last Saturday (21 January), the price action has pre-dominantly oscillated within the channel’s upper range.

At the time of publication, AVAX’s Relative Strength Index (RSI) on the 12-hour chart was 62. The value shows a bullish AVAX; hence, bulls could attempt to break above the rising channel and overcome the $18.29.

If FOMC triggers the market positively, a bullish BTC could push AVAX to overcome the hurdles at $18.29 and $19.81. Such an upswing will allow AVAX bulls to reclaim the pre-FTX level of $20.65. The $20 zone was also a key peak level in July 2022.

How much is 1,10,100 AVAXs worth today?

However, a bearish BTC, especially if the FOMC announcement is hawkish, could see AVAX drop below the rising channel’s mid-level. The downtrend could either retest the channel’s lower range boundary or break below it, invalidating the forecast described above. The downtrend could settle at $16.82 or $15.94.

AVAX recorded a positive Funding Rate but a fluctuating open interest

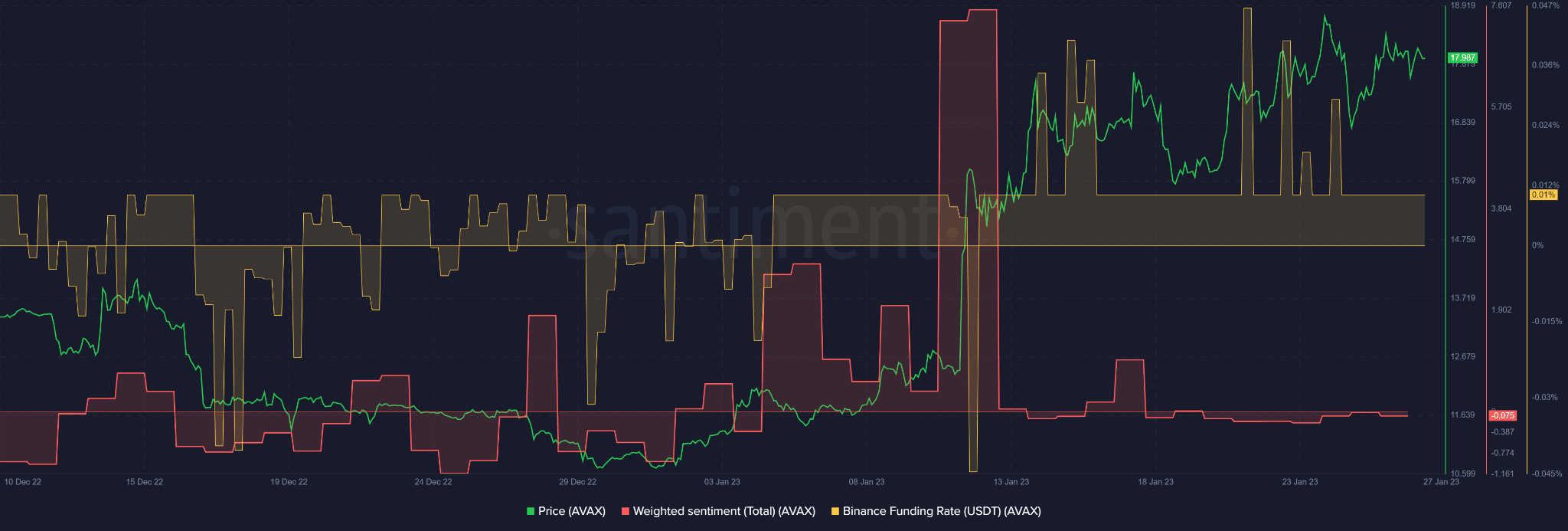

As per Santiment data, AVAX’s Funding Rate remained relatively positive throughout January, indicating that there was considerable demand for the asset in the derivatives market. However, AVAX’s weighted sentiment fluctuated flipping between negative and positive in the same period.

At press time, the sentiment was negative but close to the neutral line. Any extra demand for AVAX (uptick in Funding Rate) could boost its value and uptrend momentum, improving sentiment along the way.

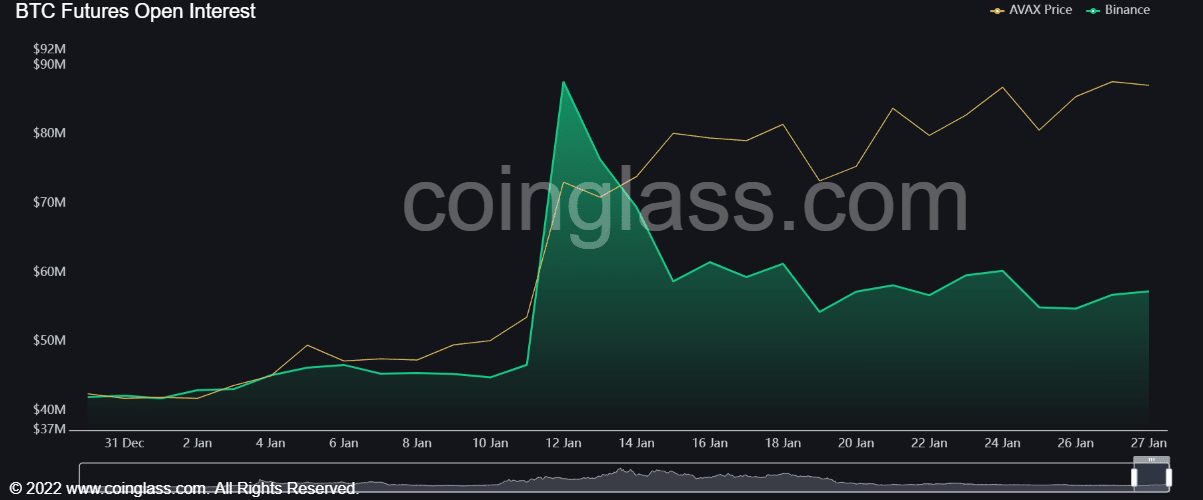

But AVAX’s open interest has been fluctuating since mid-January which could undermine a definitive price action and direction. Therefore, investors should track BTC performance to gauge the AVAX’s capacity break above or below its rising channel.