Avalanche [AVAX] tries to snowball past range highs, but is it a false breakout

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Momentum remained neutral despite proximity to the range highs.

- Avalanche sellers appeared to have the upper hand.

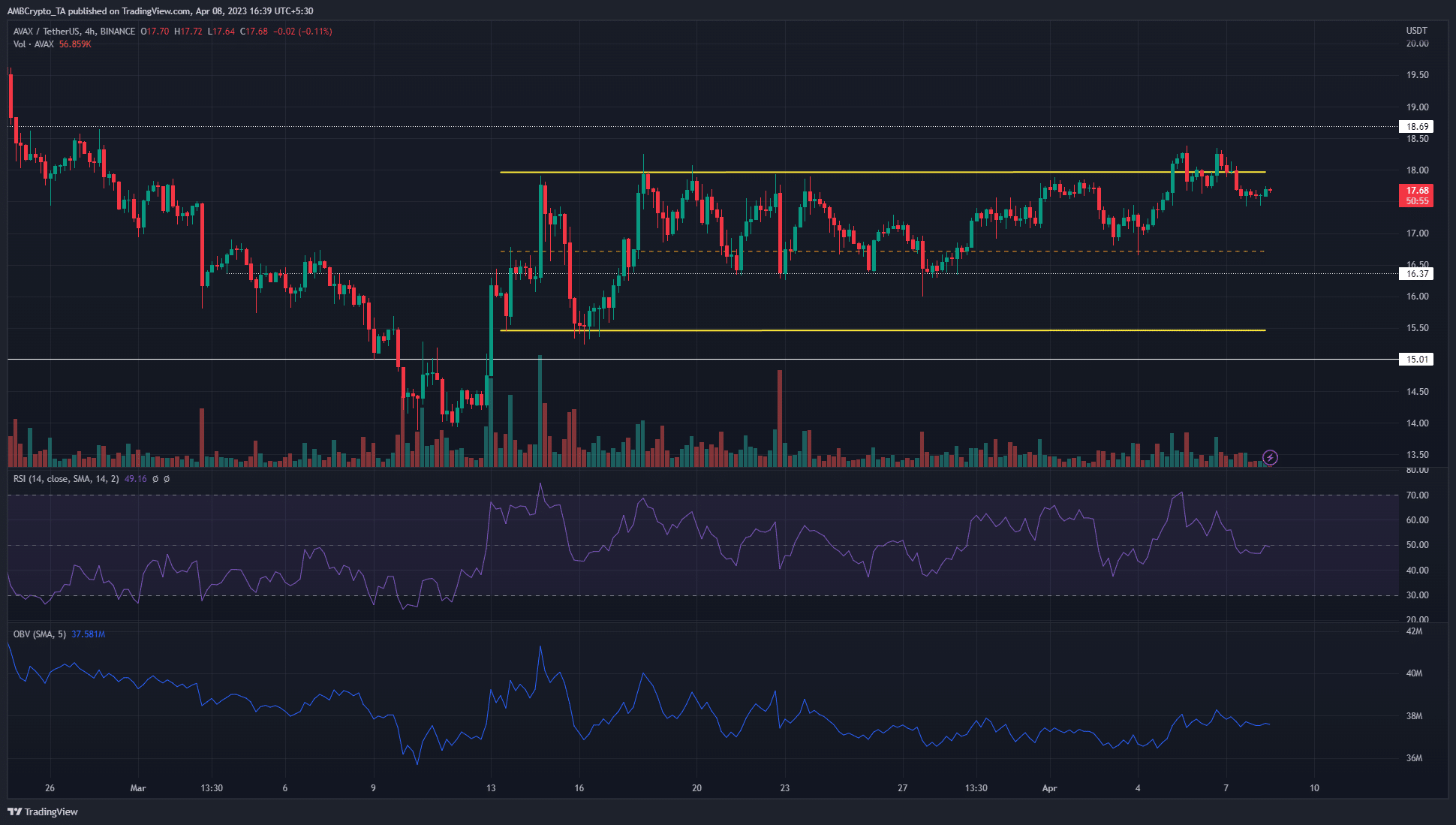

Avalanche [AVAX] appeared to break out past the $18 resistance on the price charts on 5 April, but the sellers were able to stall for a time. The same maneuver was repeated on 6 April, with the same result.

How much are 1, 10, or 100 AVAXs worth today?

Technical analysis showed that although the market structure was bullish, neither buyers nor sellers had an upper hand at the time of writing. This could change after 10 April’s high and low are established.

Low trading volume could see AVAX trade sideways over the weekend

Since 16 March, Avalanche has traded within a range (yellow) that extended from $15.45 to $18. The support level at $16.37 was defended multiple times toward the end of March, and AVAX has formed a series of higher lows over the past ten days.

However, this was not reflected particularly well on the indicators. The RSI slumped from 70 to 49 over the past two days as Avalanche fell from $18.25 to $17.65. Moreover, on even lower timeframes, such as one-hour, AVAX formed a lower low. This could see a slow descent toward $16.5, especially if Bitcoin [BTC] bulls get exhausted.

Realistic or not, here’s AVAX’s market cap in BTC’s terms

The OBV saw some gains in April, but remained relatively flat over the past month. Once again, this highlighted a lack of demand. Until this changes, a breakout would likely elude AVAX bulls.

The sentiment favored the bears in the futures markets

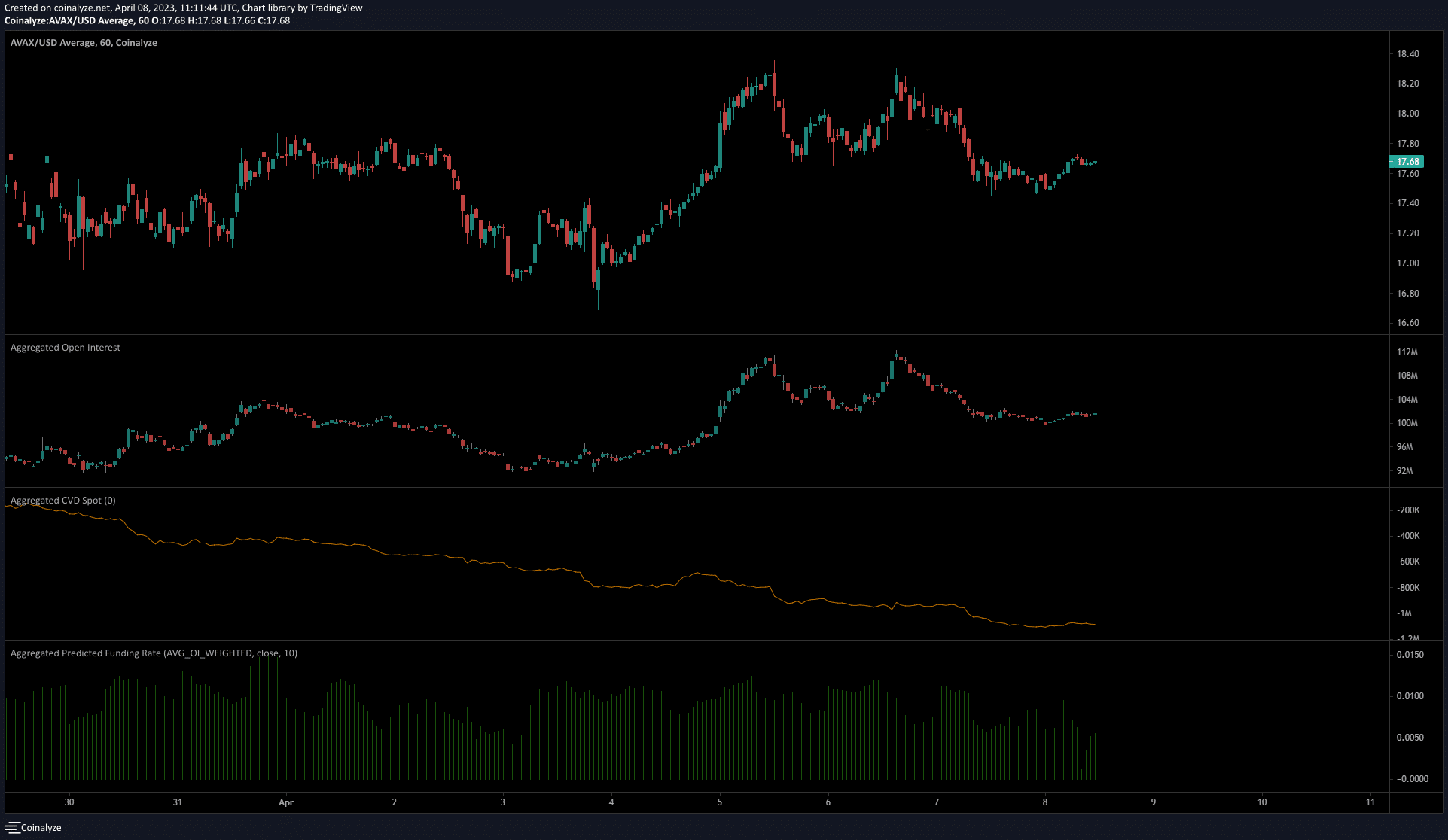

Source: Coinalyze

On the bright side, the funding rate remained positive. This meant long positions were the majority, which was a bullish indication. However, over the past two days, the Open Interest has declined by close to $8 million.

Meanwhile, AVAX also slipped by close to 4% on the charts. Taken together, this highlighted bearish sentiment, and overshadowed the inference from the funding rate. Coinalyze’s data also showed spot CVD was in steady decline, which reinforced the idea that sellers were stronger as things stand. Hence, Avalanche was likely to trade within this range over the next week or two.

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Erastus-2025-06-29T145427.668-1-400x240.png)