Avalanche contract deployment spikes – did AVAX feel the ripple effect

- Avalanche witnessed a spike in smart contract deployment.

- The DeFi sector saw little growth as NFT trades on the network declined.

Avalanche [AVAX] has observed growth on multiple fronts over the last few months. Noticeably, one area where it has grown the largest would be in terms of smart contracts deployment.

Read Avalanche’s [AVAX] Price Prediction 2023-2024

The contract deployment of $AVAX has recently hit its highest levels in over six months.

After analyzing the on-chain activity, we found that contract deployment hasn't seen such growth since May 2022. pic.twitter.com/ehkVk7ZrrK

— Artemis ? (@Artemis__xyz) April 28, 2023

A spike in contract deployment on the Avalanche network can indicate increased usage and adoption of the protocol. More contracts being deployed on the network means more developers are building on Avalanche and creating decentralized applications (dApps) that can run on the network.

This can lead to a wider range of use cases for the network and potentially attract more users and projects, which in turn can increase the demand for the native token, AVAX.

Avalanche’s challenges in the DeFi sector

Even though Avalanche witnessed a surge in terms of smart contract deployment, it wasn’t able to do well in the DeFi sector.

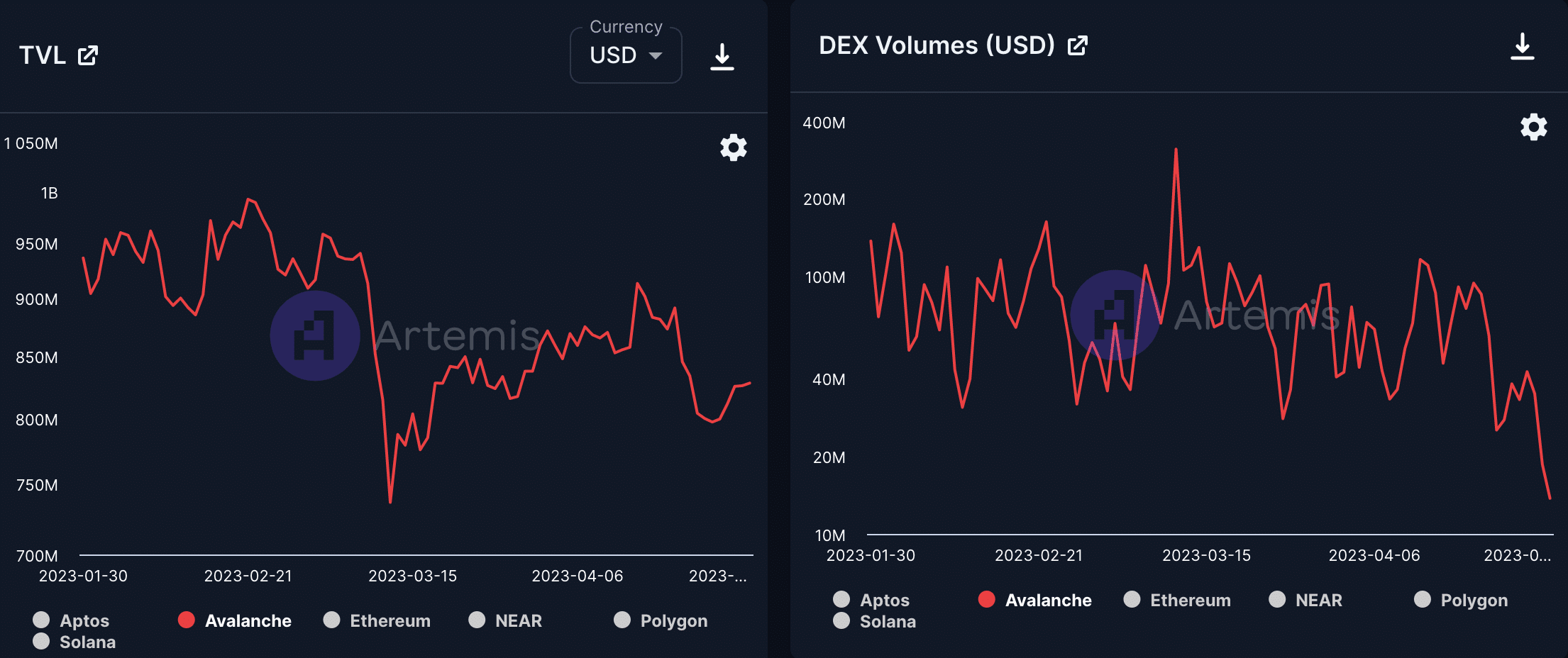

Its DEX volume decreased materially, falling from 311 million to 13.74 million (at press time) in the span of a few months. This ended up affecting Avalanche’s TVL, which also declined.

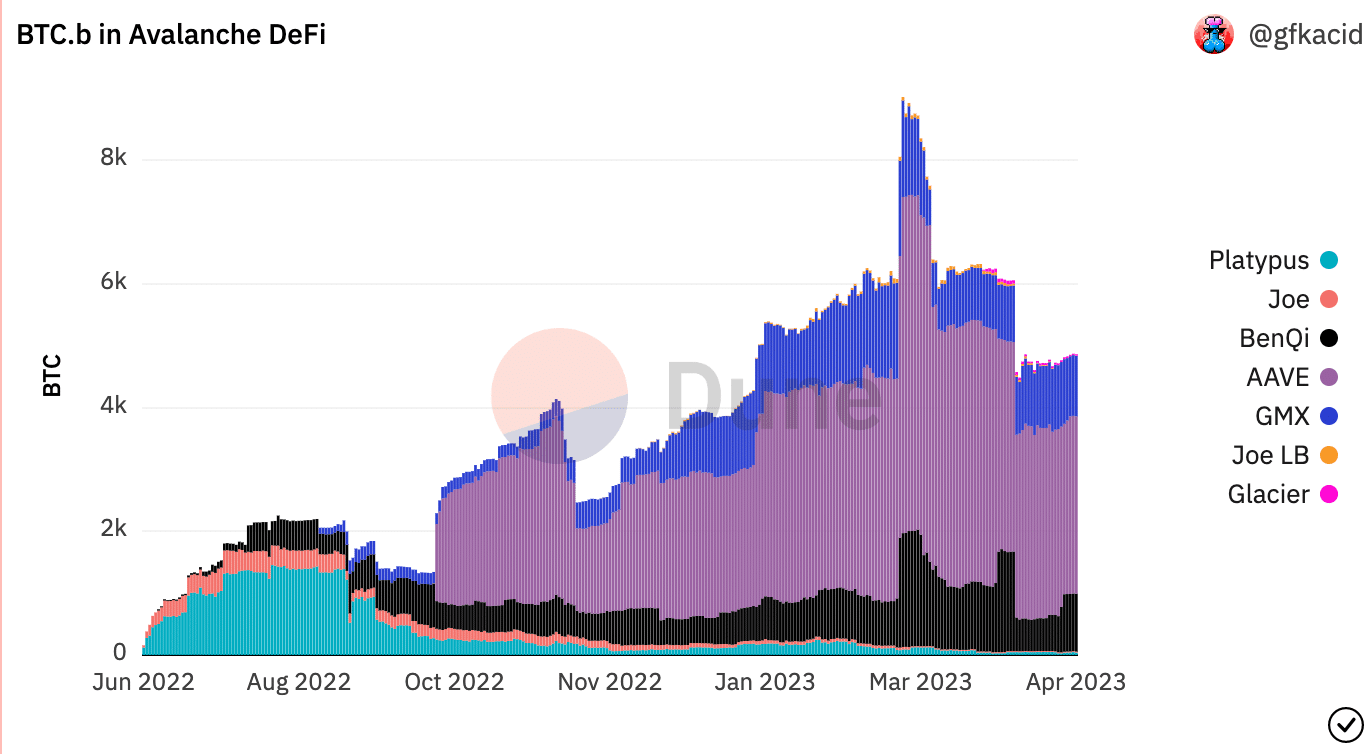

Additionally, interest in BTC.b also diminished. For context, BTC.b is a wrapped Bitcoin token on Avalanche used for DeFi purposes, with the ‘b’ standing for ‘wrapped Bitcoin’. The Bitcoin is held in custody and corresponding wrapped tokens are issued on Avalanche for use in DeFi applications such as trading, yield farming, and borrowing.

According to Dune Analytics’ data, all Avalanche network DEXes witnessed a fall in BTC.b usage.

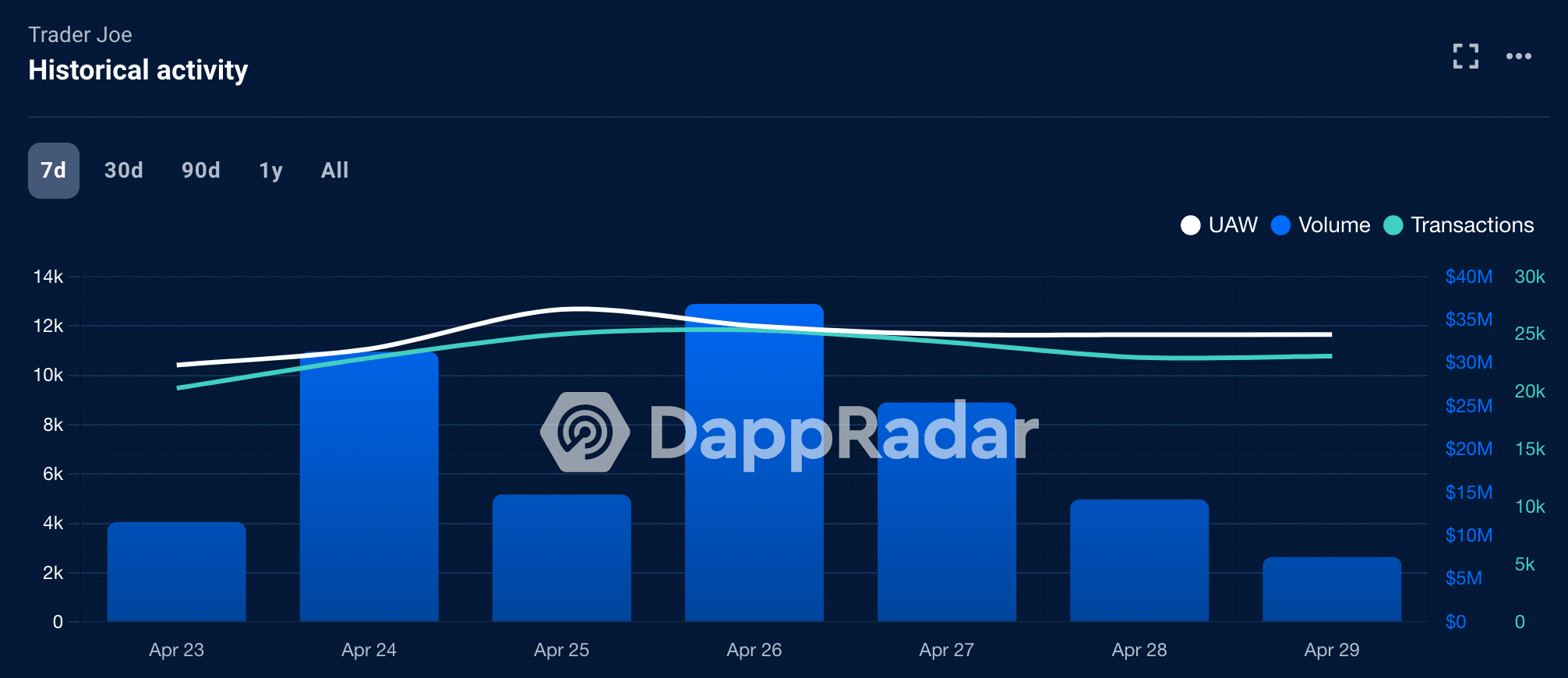

Trader Joe, one of the most popular DEXes on the protocol, suffered the most. According to Dapp Radar’s data, its overall volume fell by 40.2% in the last 24 hours At press time, the cumulative volume on the network was $7.2 million.

Realistic or not, here’s AVAX market cap in BTC’s terms

As a result of this falling volume, the number of transactions on the protocol also fell by 1.06% in the last 24 hours.

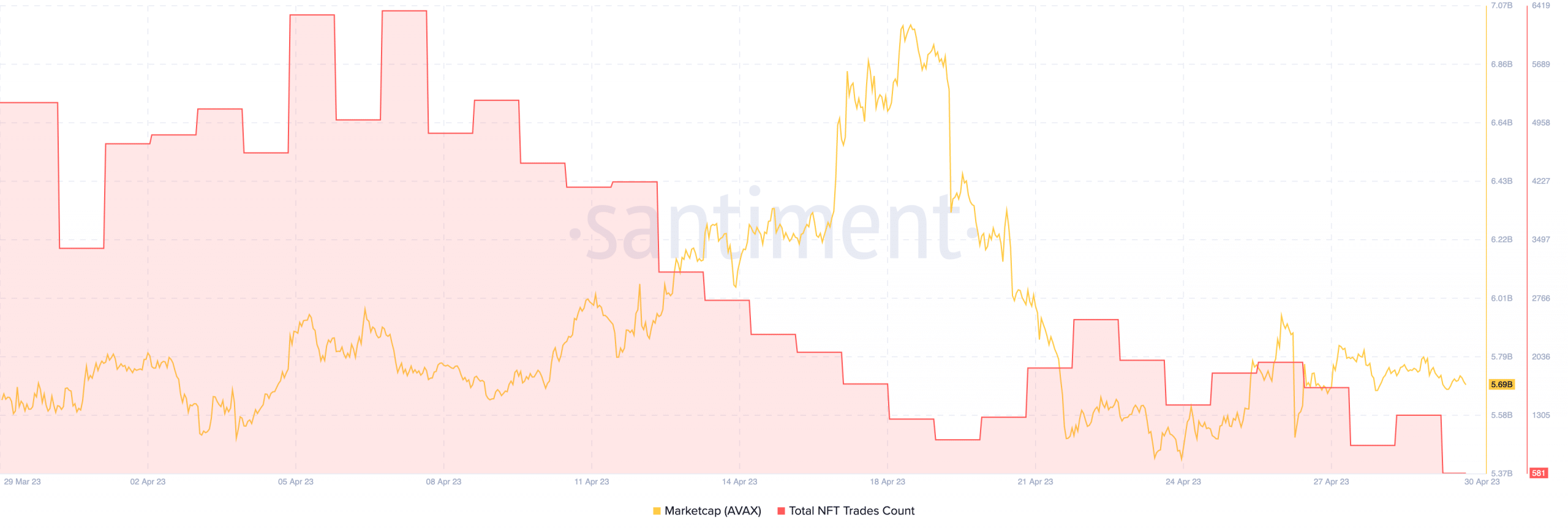

The protocol’s impact was also felt in the NFT sector. According to Santiment’s data, the overall number of NFT trades being made on Avalanche fell significantly, sitting at 581 at press time.