Avalanche daily active addresses soar as the network rolls out more subnets

- Avalanche subnet’s increase fueled growth in daily active addresses.

- AVAX gave up some recent gains after the crypto market got spoofed with FUD.

April has turned out to be the best month for the Avalanche’s [AVAX] network so far this year. The network has achieved robust growth in multiple facets including daily active addresses which increased aggressively since the start of April.

Is your portfolio green? Check out the Avalanche Profit Calculator

Avalanche’s daily active addresses remained below the 45,000 range between January and March. However, the network saw explosive growth, especially in the last three weeks, during which daily active addresses soared above 80,000.

But what is the reason for this aggressive growth? A look at Avalanche’s recent reports reveals that the explosive address growth might be related to aggressive subnet deployment.

This has in turn brought more utility into the network, thus more user activity. Avalanche subnets have particularly been attracting interest from gaming-related projects.

The network announced on 18 April that gaming DAO MeritCircle.io is currently developing a subnet for its Beam network. The latter is presently developing WEB3 games.

This development puts Avalanche in a position to leverage growth opportunities within the fast-paced WEB3 gaming segment. The latter is one of the most promising segments.

Another Subnet has entered the game ?

Popular gaming DAO @MeritCircle_IO is launching @BuildOnBeam, an Avalanche Subnet designed specifically for Web3 gaming.

What will Beam offer? ?? pic.twitter.com/AmFcjwyLVl

— Avalanche ? (@Avax) April 18, 2023

The growing demand for Avalanche subnets underscores the network’s improving prospects. As a result, development activity in the network has been on an upward trajectory. Avalanche’s development activity, at press time, was at its highest point in the last four weeks.

AVAX falls off a cliff after a strong bullish performance earlier

The growth in daily active addresses in the last three weeks contributed to an influx of liquidity into AVAX. As a result, its price pulled off a 28% rally on a month-to-date basis, peaking at $21.57.

However, it registered a large selloff in the last 24 hours which pushed it to a $19.51 press time price.

How many are 1,10,100 AVAXs worth today

AVAX’s sell pressure is not surprising considering its previously strong rally which pushed it into the overbought zone.

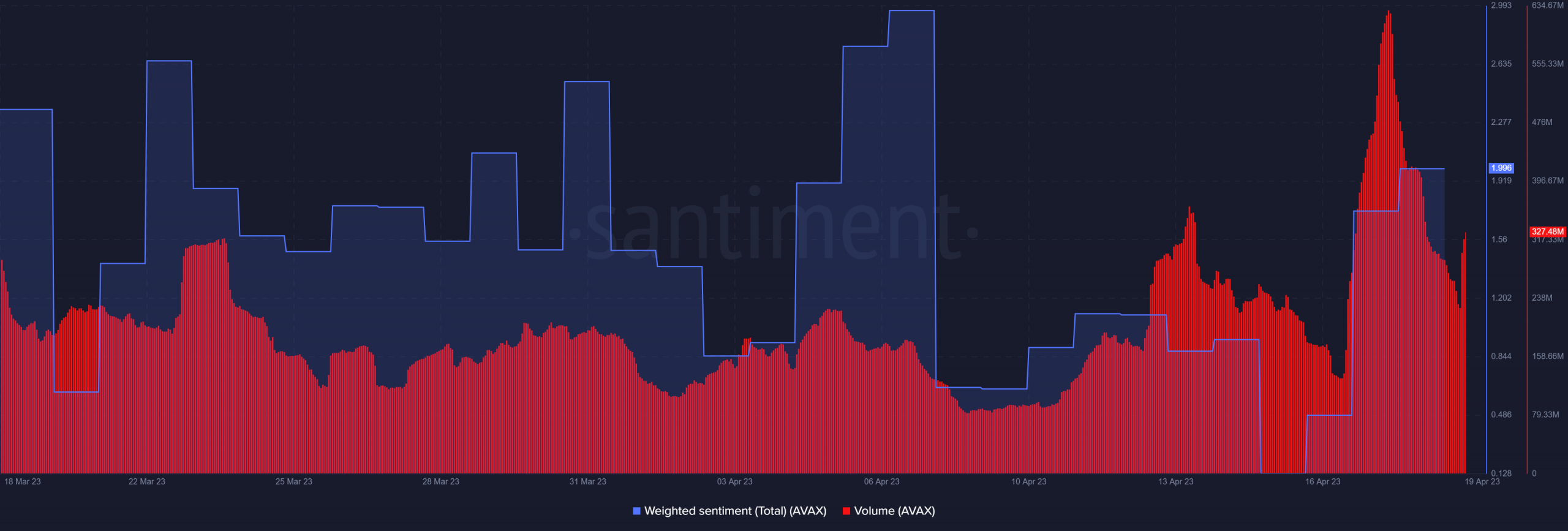

The price dip occurred after a sharp volume drop in the last 24 hours.

This may suggest that there was buyer exhaustion, paving the way for the bears to take over, fueled by strong profit-taking.

AVAX’s weighted sentiment remained high despite the bearish outcome. This suggests that AVAX investors are still optimistic about its prospects. This is because the growing subnets and network demand lays the foundation for more long-term potential.