Altcoin

Avalanche daily transactions surge to new high following…

The launch of Star Arena has resulted in an influx of new users to Avalanche, and this has driven up its daily transaction count and the value of its native token AVAX.

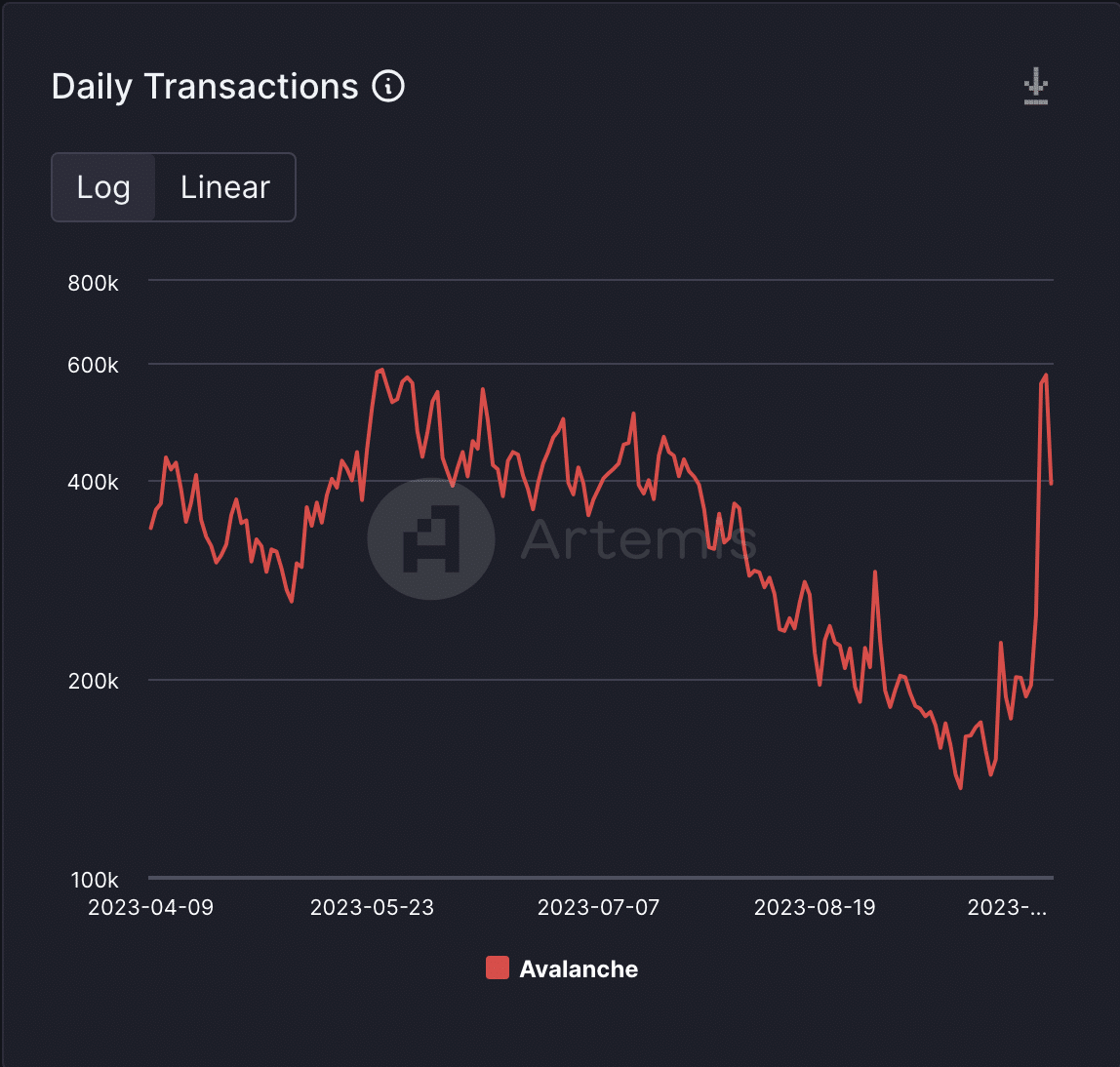

- Following the launch of Stars Arena, Daily Transactions count on Avalanche has climbed to its highest since August.

- AVAX has seen an influx of new demand due to this.

Daily Transactions count on leading open-source proof of stake (PoS) blockchain Avalanche [AVAX] rallied to a high of 577,000 on 4 October, representing its highest level since May, on-chain data sourced from Artemis revealed.

Read AVAX’s Price Prediction 2023-24

The surge in transaction count came after the launch of blockchain-based social application Stars Arena, which rivals Friend.tech on Avalanche’s C-chain network.

Due to the influx of new users into the protocol, within two weeks of its launch, the total value of assets locked on Stars Arena has exceeded $1 million. Data from DefiLlama put it at $1.45 million at press time.

According to data from DappRadar, in the last week, the social application has seen a cumulative count of 6,000 unique active wallets interacting with its smart contracts, making it the protocol on Avalanche with the most active users in the past seven days.

AVAX is the winner

As a result of increased activity on Stars Arena, AVAX has seen an uptick in social activity. As on-chain data provider Santiment noted in a recent post on X,

“Traders have become bullish on Avalanche following the injection of new $AVAX address activity thanks to StarsArena and the ability to buy shares and tip helpful posts.”

The current hype around AVAX has pushed its price up by almost 5% in the past 24 hours, making it the third-leading asset in terms of gains during that period, data from CoinMarketCap showed.

AVAX price movements assessed on a 12-hour chart showed that spot traders have taken advantage of the current hype to accumulate the altcoin. At press time, key momentum indicators were spotted above their respective neutral lines and in uptrends.

For example, AVAX’s Chaikin Money Flow (CMF) was 0.27. A positive CMF value above zero is a sign of strength in the market as it signals the entry of liquidity necessary to drive up the value of a coin.

Likewise, the coin’s Relative Strength Index (RSI) and Money Flow Index (MFI) rested at 71.87 and 68.90, respectively, indicating that AVAX’s accumulation significantly outpaced its distribution amongst daily traders.

How much are 1, 10, and 100 AVAXs worth today?

Moreover, a look at the Awesome Oscillator indicator confirmed the bullish nature of the current AVAX market. As of this writing, the indicator returned only green histogram bars sitting above the zero line.

When an asset’s Awesome Oscillator is positioned in this manner, it means that the short-term moving average is consistently higher than the long-term moving average. It also suggests that the asset is in a strong uptrend and that bullish momentum is increasing.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)