Avalanche eases to a bullish zone, but…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Price action eased to a bullish confluence area.

- More long positions liquidated as sellers locked in more gains.

Avalanche [AVAX] price performance was massively boosted after Ripple Labs’ win around mid-July. However, the euphoria dissipated after the win, prompting altcoins to reverse the gains. So far, AVAX has dropped from $16 and hit a crucial confluence area and bullish zone near $13.

Is your portfolio green? Check out the AVAX Profit Calculator

Meanwhile, Bitcoin [BTC] struggled to close above $30k ahead of the Fed decision on 25/26 July.

If BTC records more losses after the Fed decision, AVAX’s bullish zone could be invalidated. However, bulls could see a reprieve if BTC defends the $29.5k after the Fed announcement.

Will the confluence area hold?

The price rejection at $16 saw short-sellers gain market entry, exposing AVAX to depreciate toward $13. Notably, the overall price action during the recovery from mid-June chalked an ascending channel pattern.

The recent pullback has hit the range-low of the channel at $13.3. Interestingly, the range-low is in a confluence area with a bullish order block (OB) of $12.9 – $13.4 (cyan).

So, the confluence area could be a strong bullish zone only if BTC doesn’t register sharp losses in the next few days. The immediate targets will be the mid-range near $14.5 or the range-high of $15.5.

But a drop below the confluence zone ($13) will expose AVAX to a likely retest of $12, especially if BTC drops lower after the Fed decision.

Meanwhile, the RSI (Relative Strength Index) retreated and rested at the neutral level while the OBV (On Balance Volume) moved sideways. It denotes a stagnated buying pressure and demand ahead of the Fed decision.

More long positions liquidated

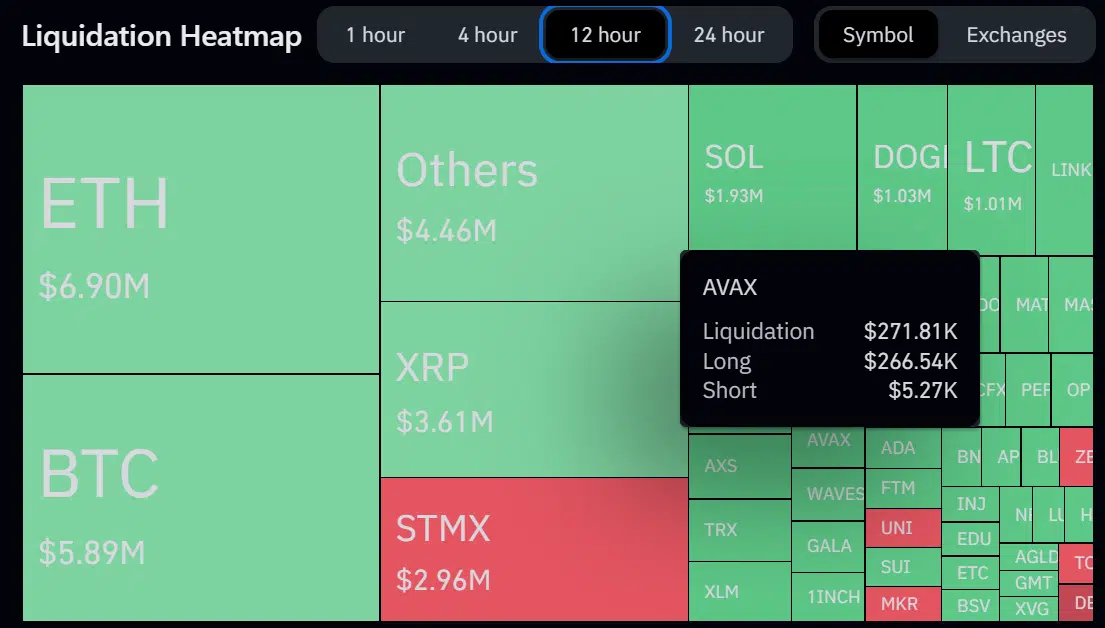

According to Coinglass liquidation data, the futures market was under a bearish grip in the last few hours. The dominant lush green color means more long positions were wrecked across the futures market.

How much are 1,10,100 AVAXs worth today?

Out of >$270k total AVAX liquidations, over $260k accounted for wrecked long positions. It emphasizes the bearish grip and sentiment over the weekend.

The above bearish inclination calls for close tracking of BTC price action after the Fed decision before attempting to go long from the confluence and bullish zone described above.