Avalanche: Revenue spikes, but AVAX investors must be cautious as…

- Avalanche network’s revenue and fees spiked on 11 March.

- Metrics were bullish, but market indicators supported the sellers.

Avalanche [AVAX] witnessed a major decline in key metrics last week, which was concerning for the network’s overall health.

AVAX Daily, a popular Twitter account that posts updates related to the Avalanche ecosystem, pointed out in its latest weekly report that AVAX’s daily active addresses declined by over 22%.

Not only did active addresses decline, but AVAX’s market capitalization also followed the same trend, thanks to the dominant bearish market sentiment of the last week.

?Avalanche Ecosystem Weekly Highlights?

Price gainers$BETS @BetSwirl$GENI @Genicrypto$SURE @InsureToken$PENDLE @pendle_fi

TVL gainers@emdx_io$RADIO @RadioShack$IBEX @ImpermaxFinance$SIS @symbiosis_fi#AVAX #Avalanche #DEFI $AVAX pic.twitter.com/DSUeRzPQck

— AVAX Daily ? (@AVAXDaily) March 12, 2023

Read Avalanche’s [AVAX] Price Prediction 2023-24

A surprising episode

While AVAX’s active addresses went down, reflecting less usage of the network, Token Terminal’s data revealed an interesting development. The network’s revenue and fees spiked on 11 March, suggesting a change in trend.

AVAX to regain control

The growth in revenue and fees signified that network usage had indeed increased, opening the door to the possibility of AVAX regaining users’ confidence in the blockchain.

The same possibility was further established by AVAX’s recent price action, which was in investors’ favor.

As per CoinMarketCap, Avalanche’s price increased by more than 10% in the last 24 hours. At the time of writing, AVAX was trading at $16.14 with a market capitalization of over $5.2 billion.

Metrics in favor?

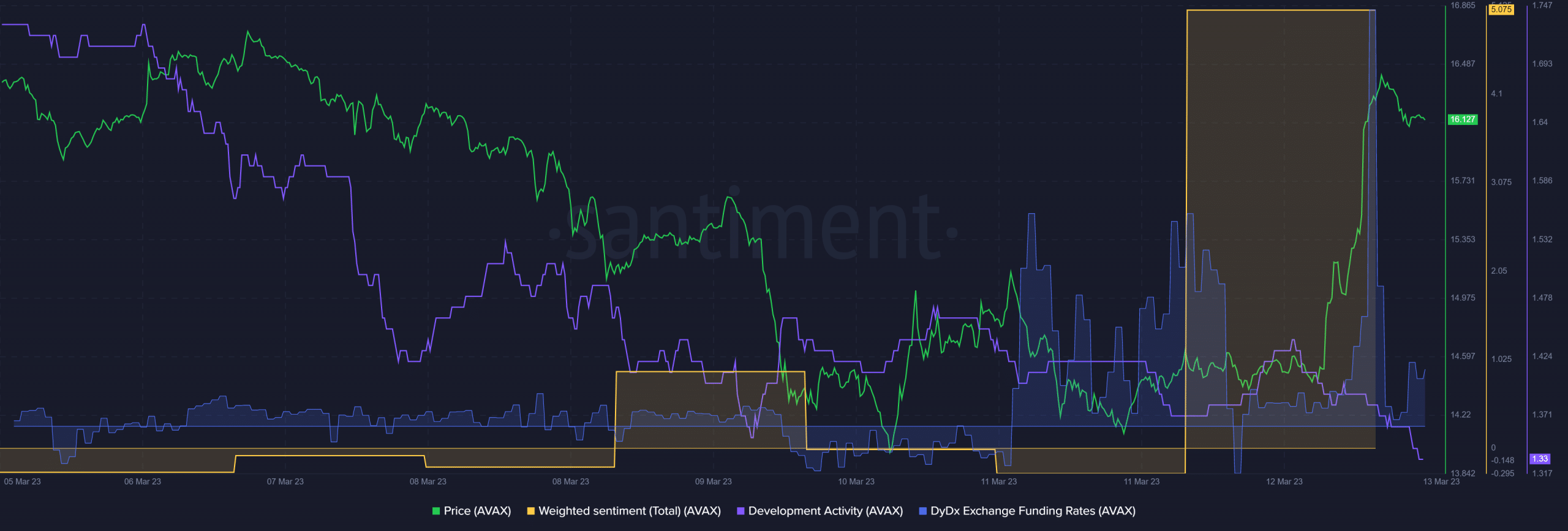

Santiment’s chart revealed that the market’s confidence in AVAX seemed to have improved drastically as its weighted sentiment shot up.

The token’s demand in the derivatives market also increased of late, which was evident from the rise in AVAX’s DyDx funding rate.

However, the possibility of the sentiments turning against AVAX can’t be ruled out yet as Avalanche’s development activity declined sharply last week.

How much are 1,10,100 AVAXs worth today?

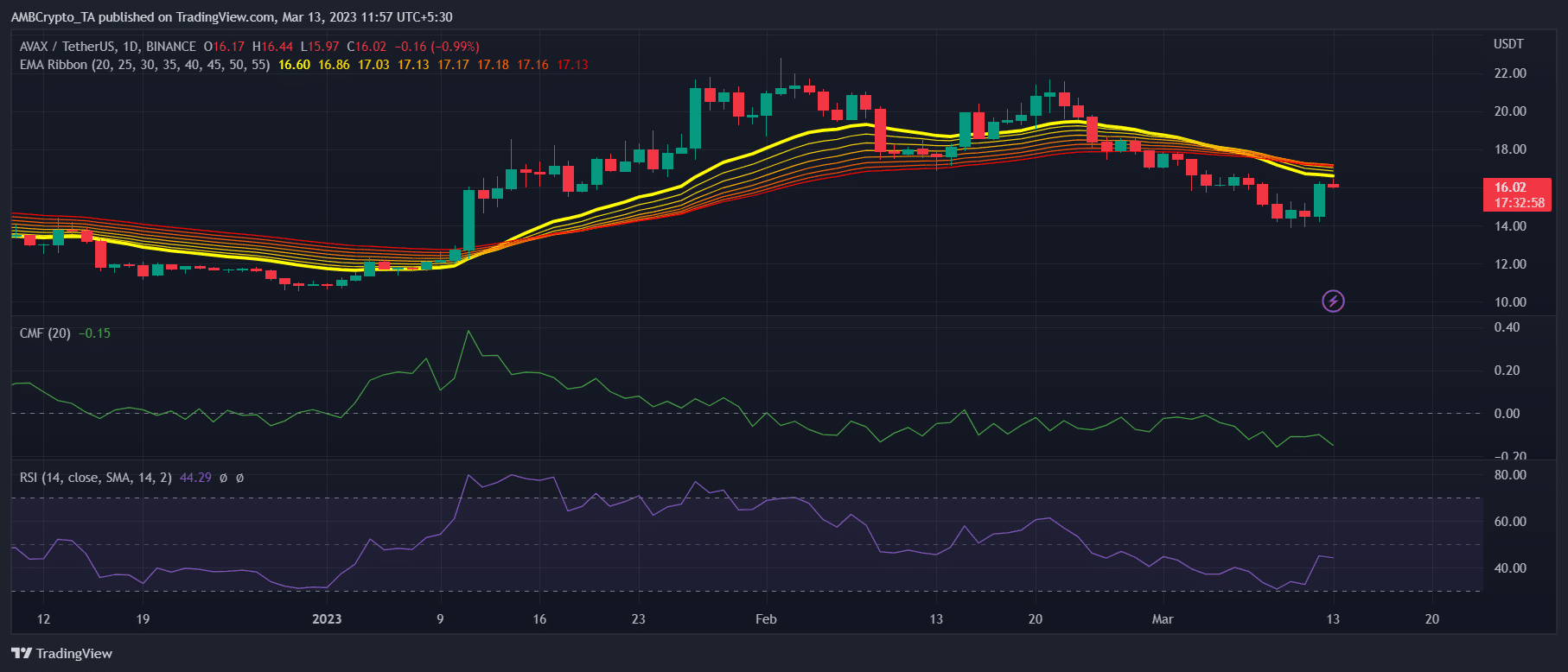

Meanwhile, a look at AVAX’s daily chart gave quite a few reasons for concern, as it indicated that the good days might be short-lived.

Most of the market indicators including the Relative Strength Index (RSI), supported the bears as they registered a slight downtick.

Despite the recent price pump, AVAX’s Chaikin Money Flow (CMF) failed to move up, which was also a bearish signal. The Exponential Moving Average (EMA) Ribbon displayed a bearish crossover, further increasing the chances of a trend reversal soon.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)