Back to March lows for AVAX as U.S Debt talks continue

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The U.S. debt talks are expected to continue into the weekend.

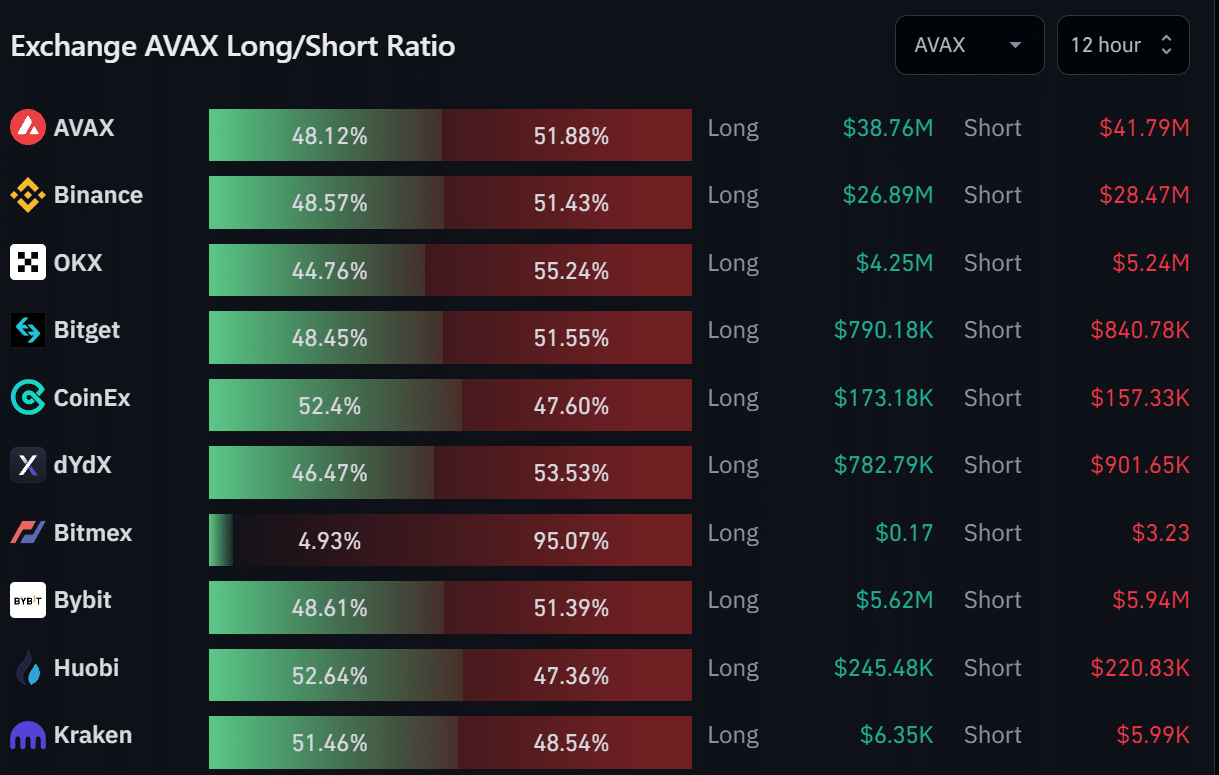

- Exchanges long/short ratio was neutral despite AVAX retesting March lows.

The U.S. debt talks have overshadowed the markets for a while, giving bears an edge. Sellers further consolidated their hold following the FOMC minutes on 24 May. Interestingly, Avalanche [AVAX] bears managed to retest March swing low of $13.88.

Is your portfolio green? Check out the AVAX Profit Calculator

In the meantime, Bitcoin [BTC] breached below the $26.6k area as selling pressure intensified. With speculation that the U.S. debt talks could extend into Memorial Day weekend, there is likely volatility in the next few hours/days.

Will sellers push lower, or will bulls gain ground?

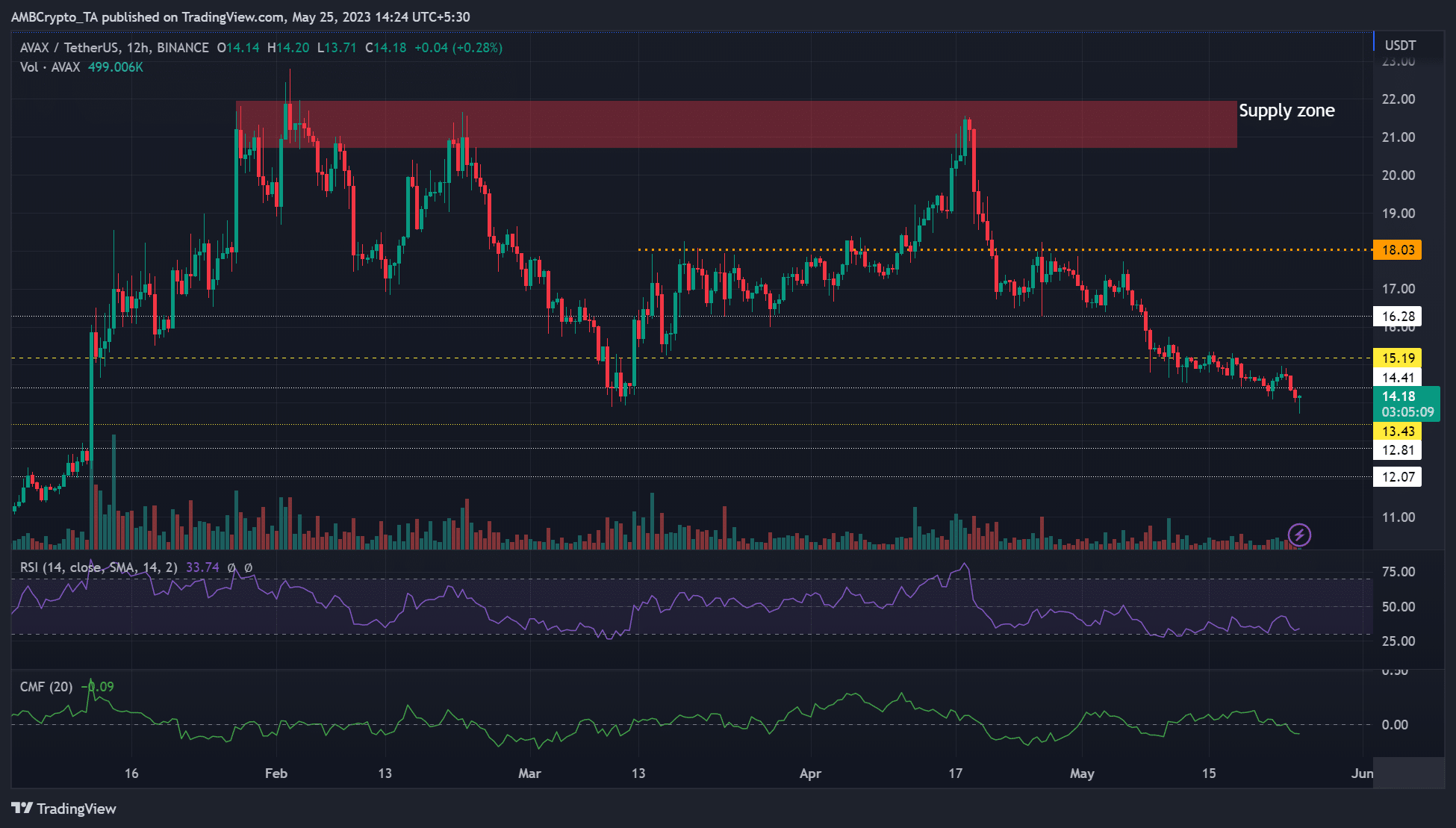

The 12-hour chart’s RSI has been dominantly below the neutral level of 50 since the second half of April, highlighting heightened selling pressure in the same period. For CMF, there have been fluctuations between negative and positive zones, showing capital inflows wavered.

The overwhelming selling pressure saw AVAX drop sharply from the supply zone (red), near $21 – $22, to March swing lows of $13.88 as of press time. The underlying bearish pressure and weak BTC could tip the scale further in favor of bears.

As such, sellers could extend gains beyond March swing lows. The next support levels are at $13.43, $12.81 and $12.07. These could act as short-selling targets.

However, if BTC reclaims the $26.6k level, AVAX bulls could gain little leverage. They could attempt to clear the $14.41 hurdle and rally to $51.19. A move above this level could tip AVAX to retest the $16.3 level.

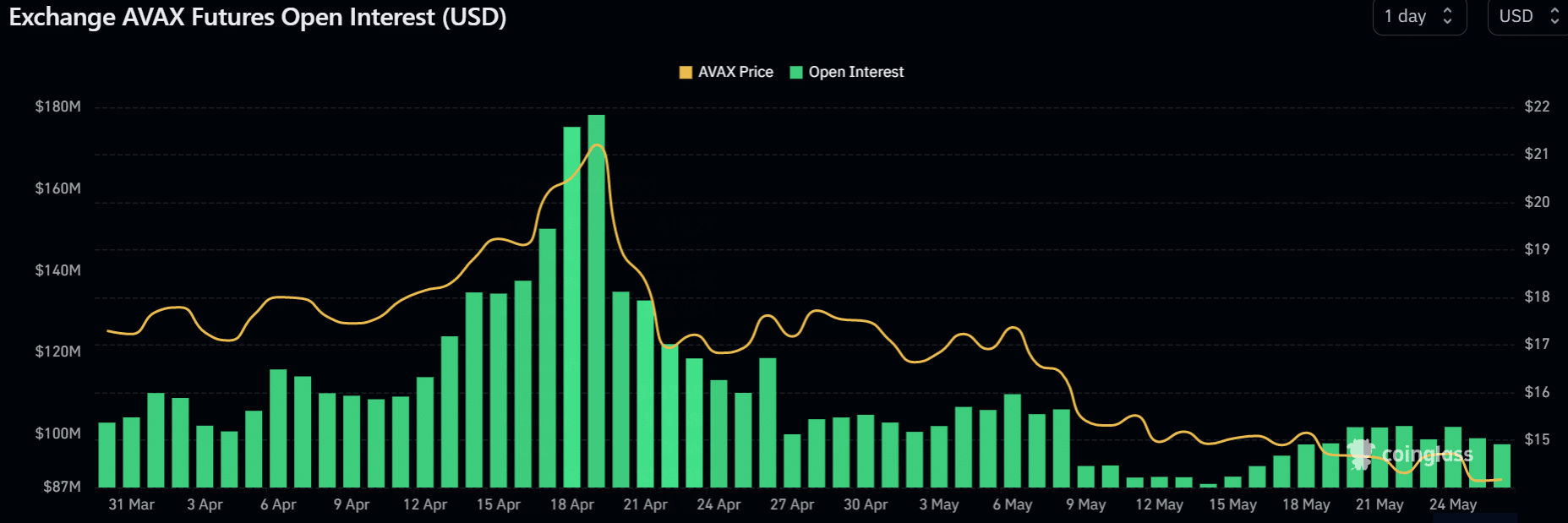

OI is yet to recover to mid-April levels

Read Avalanche’s [AVAX] Price Prediction 2023-24

In mid-April, AVAX’s open interest (OI) rates rose above $160 million, pushing the price to $20. However, OI fluctuated in May, tanking significantly around halfway into the month before attempting recovery.

But the OI is yet to recover mid-April’s level, further confirming the bearish pressure.

Regardless, AVAX’s exchange long/short ratio showed very little spread between long and short positions in the 12-hour timeframe. As such, the price could go in either direction and tracking BTC’s movement could offer more clarity.