Avalanche: What a new update will mean for AVAX

- Avalanche extends its service to the European market with new stablecoins.

- AVAX fails to sustain recent upside as demand falls short of expectations.

A few weeks ago, Avalanche revealed that it would support the EuroCoin [EUROC], a stablecoin pegged to the Euro currency. Well, that launch is finally here as it has been confirmed that it is now live on Avalanche.

EUROC’s launch on Avalanche marks an important milestone for the parties involved. Especially for Avalanche which expects to benefit in terms of network utility as one of the layer 1 networks supporting the stablecoin.

Is your portfolio green? Check out the Avalanche Profit Calculator

This is because EUROC also operates on the Ethereum network but its new launch on Avalanche may offer some benefits. These include faster and cheaper transactions.

?Breaking New?#EuroCoin is now multi-chain and live on @avax

?Euro Coin, or $EUROC, launched on Ethereum in 2022 to provide businesses and developers with a fully reserved, euro-backed stablecoin they can trust.#Avalanche #AVAX $AVAXhttps://t.co/QitrqQOeUW pic.twitter.com/ufB8UtMznr

— AVAX Daily ? (@AVAXDaily) May 29, 2023

The launch represents an interesting dynamic shift following the recent anti-crypto sentiments in the U.S. Europe has been a bit friendlier and offers more clarity as far as crypto regulations are concerned. As such, crypto companies are now eying Europe as a favorable market for crypto.

The new development came just a few days after Avalanche added support for EUROe. This is the first stablecoin, to secure MiCA-compliant stablecoin. MiCA is the EU regulation that oversees the issuance of stablecoins and crypto assets in the EU.

Membrane Finance is proud to bring the first MiCA-compliant stablecoin onto Avalanche!@avax is a future-proof blockchain built to scale – now the ecosystem participants can also access future-proof money on Avalanche.https://t.co/Bx94SBtY7X

— EUROe (@EUROemoney) May 26, 2023

Will this shift in dynamics be favorable for AVAX?

The newly launched European stablecloins underscore healthy growth for the Avalanche ecosystem. It could be good for AVAX depending on the level of demand the new European stablecoins can generate in the short and long term.

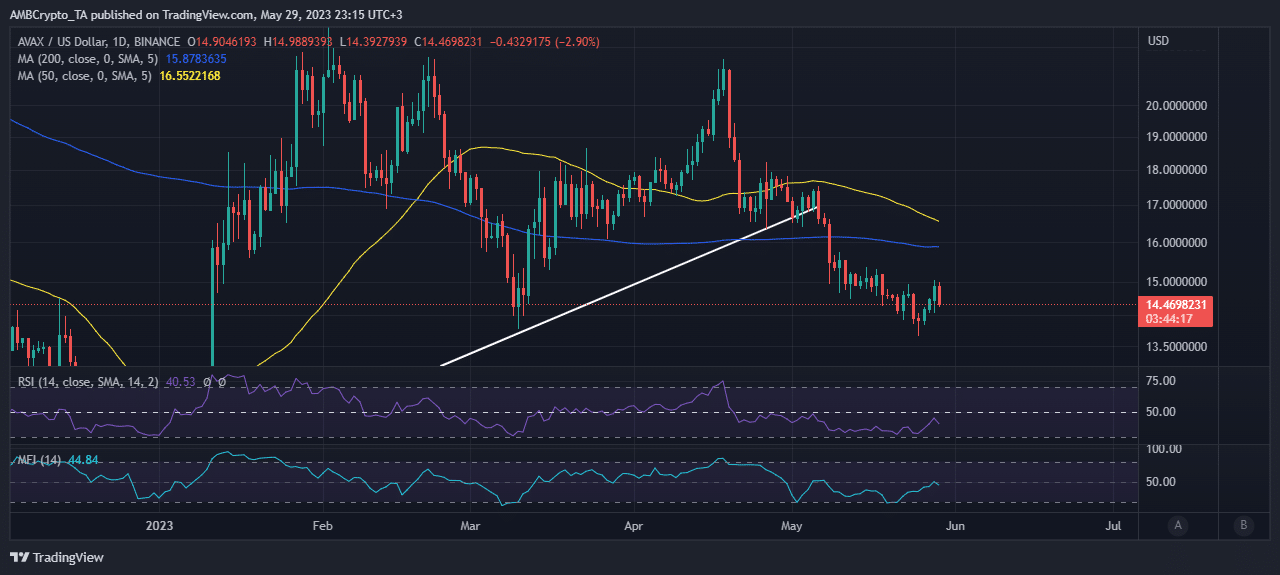

AVAX extended its break below ascending support by almost 15% since the first week of May. Despite the bearish performance, it managed to avoid dipping into oversold territory and the bulls managed to regain control in the last few days, albeit briefly. AVAX exchanged hands at $14.46 at press time after shedding some of the gains achieved during the weekend.

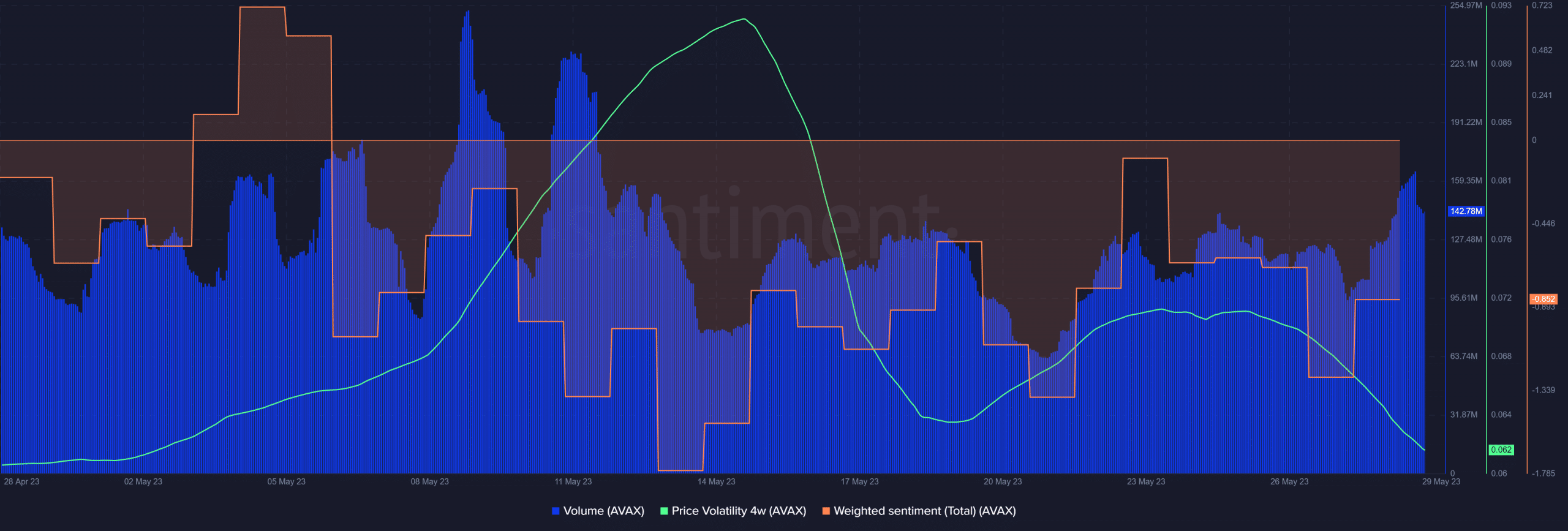

AVAX registered noteworthy growth in the last 10 days, hence the shift in demand in favor of the bulls. This was a sign that there had been some accumulation confirmed by the MFI uptick during the same period. However, demand wasn’t quite there yet since there was still low volatility, which reflected the weak demand.

As far as the investor sentiment was concerned, the weighted sentiment has been up and down for the last few days. Not really favoring a particular side. It suggested that traders were still unsure of the market’s next move.

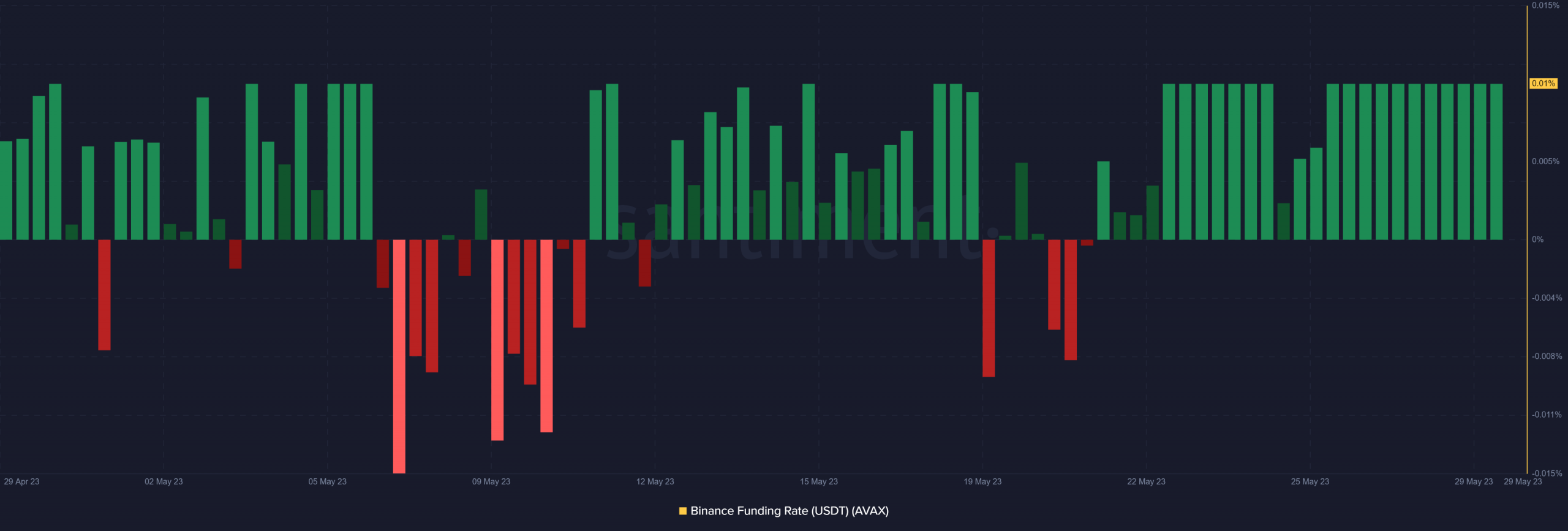

Despite the uncertainty, AVAX’s demand in the derivatives market has been growing. Furthermore, the demand specifically on Binance was positive, hence leaning on the bullish side.