Avalanche’s [AVAX] fundamentals stay weak despite big-ticket tie ups

![Avalanche's [AVAX] fundamentals stay weak despite big-ticket tie ups](https://ambcrypto.com/wp-content/uploads/2023/03/luka-senica-16r1fPq_56g-unsplash-e1677914025639.jpg)

- Most of the top games on Avalanche registered a drop in their unique active users.

- AVAX tanked 24% over the previous month until press time.

Avalanche [AVAX] registered a significant drop in its weekly trading activity throughout the month of February. According to Token Terminal, the weekly average daily active users for the chain fell nearly 28% since January.

With the drop in users, the weekly transaction fees paid on the platform halved during the same time period.

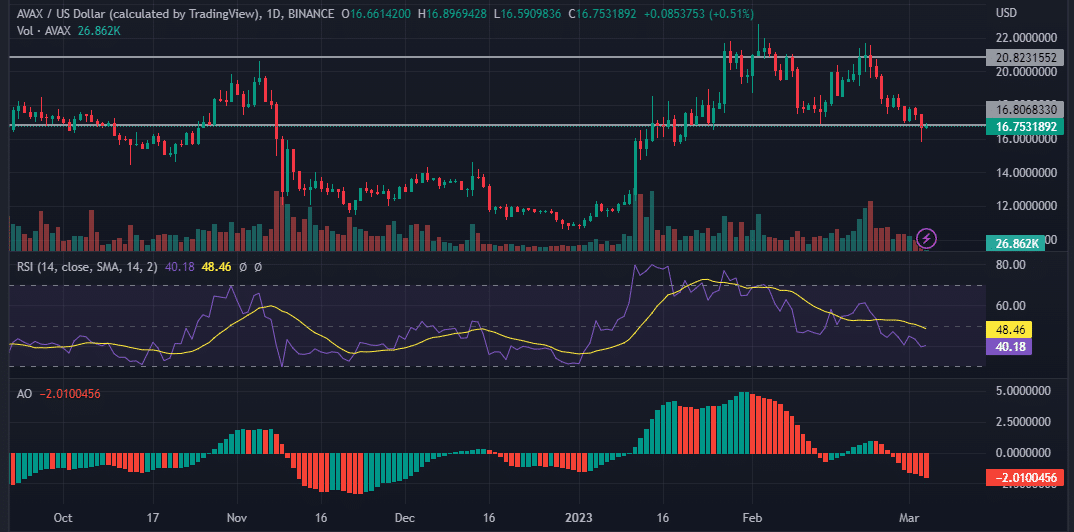

The drop in trading activity was reflected in the price of AVAX as well. The coin tanked 24% over the previous month while the weekly drop was to the tune of 8%, as per CoinMarketCap.

Read Avalanche’s [AVAX] Price Prediction 2023-24

Big partnerships fail to make an impact

GameFi has become one of the fastest-growing sectors in the Avalanche ecosystem. The platform has entered into high-profile partnerships of late to boost its appeal in the play-to-earn landscape.

Recently, it announced a collaboration with Japanese gaming pioneer GREE, who opted for Avalanche for their plunge into the Web3 world.

Japanese gaming giant GREE, with 30M monthly users across some of the biggest titles in gaming, #ChoseAvalanche for their big move into Web3.

The latest Builder's Spotlight features an interview with @TakasuguMurata, Head of BD for Web3 at @GREE_pr_jp /?https://t.co/IJkX39K7KM

— Avalanche ? (@avalancheavax) March 3, 2023

In the last month, Avalanche locked a deal with Indian game streaming platform Loco, to launch an NFT marketplace.

However, a look at metrics presented a different picture for the chain. Most of the top games on the ecosystem registered a drop in their unique active wallets in the last 30 days, data from DappRadar showed.

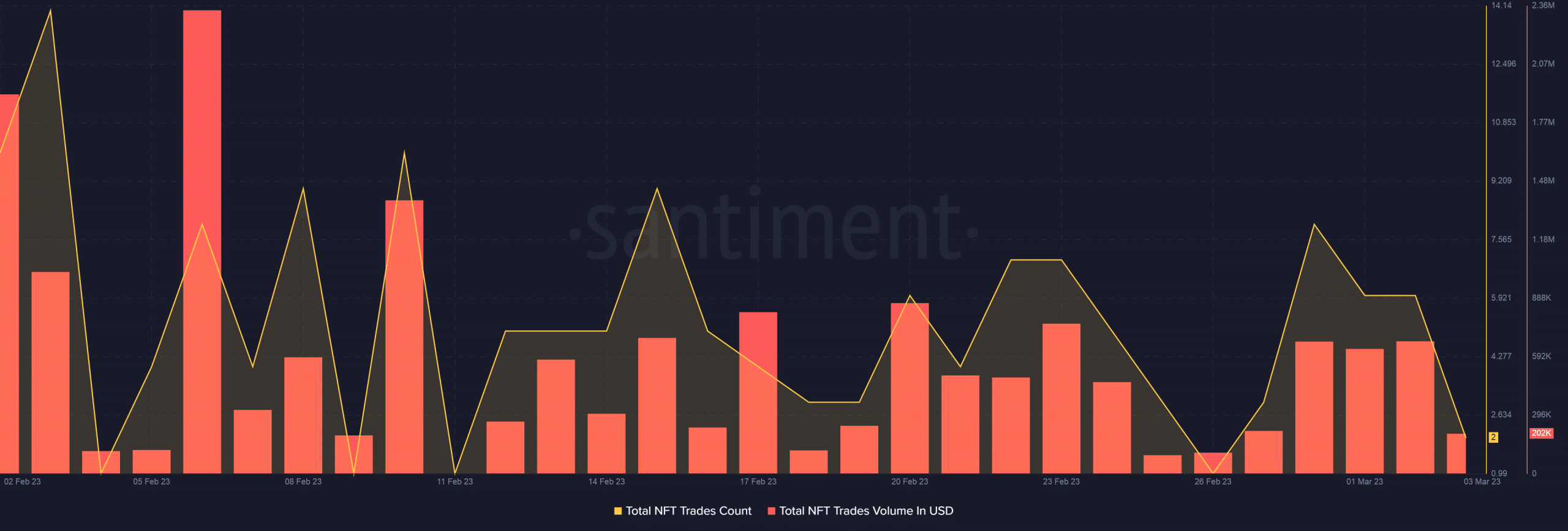

Furthermore, the big-ticket partnerships failed to give a major push to Avalanche’s NFT activity during February. At the time of writing, the total NFT trade volume plummeted 80% over the previous month, as per Santiment.

Realistic or not, here’s AVAX’s market cap in BTC terms

AVAX in grip of the bears?

The result of the deal with GREE was met with cheers. At the time of writing, AVAX was up 2% in the 24-hour period, as per CoinMarketCap.

The technical indicators, though, sided with a bearish idea for the short term.

The Relative Strength Index (RSI) fell throughout February and sat well below neutral 50 at press time. This indicated that selling pressure was intense. The Awesome Oscillator’s (AO) growing red bars also implied that bears were gaining strength.

AVAX moved in a range as indicated and faced repeated rejections at the $20 mark. A breakout below the range lows will validate the bearish idea for the coin.