Avalanche’s [AVAX] key metrics can decline further- Here’s why

![Avalanche's [AVAX] key metrics can decline further- Here's why](https://ambcrypto.com/wp-content/uploads/2023/03/AVAX.jpg)

- Avalanche’s TVL and market capitalization declined over the last week.

- A few metrics were positive but market indicators supported the bears.

AVAX Daily, a popular Twitter handle that posts updates related to the Avalanche [AVAX] blockchain, recently published the network’s weekly report.

The tweet stated that AVAX’s market capitalization registered a double-digit decline of 13% in the last seven days. Along with the market cap, AVAX’s total value locked (TVL) also went down by more than 3%.

?Avalanche Ecosystem Weekly Highlights?

Price gainers$SWAP @TrustSwap$CQT @Covalent_HQ$FRM @FerrumNetwork$PENDLE @pendle_fi

TVL gainers$WOW @KineProtocol$EMDX @emdx_io$SUSHI @SushiSwap$SIS @symbiosis_fi#AVAX #Avalanche #DEFI $AVAX pic.twitter.com/CEiZS3pIT3

— AVAX Daily ? (@AVAXDaily) March 4, 2023

Read Avalanche’s [AVAX] Price Prediction 2023-24

Is a revival possible?

While the market cap and TVL declined, the number of active addresses, on the other hand, increased. This was a positive development, reflecting increased usage of the Avalanche network.

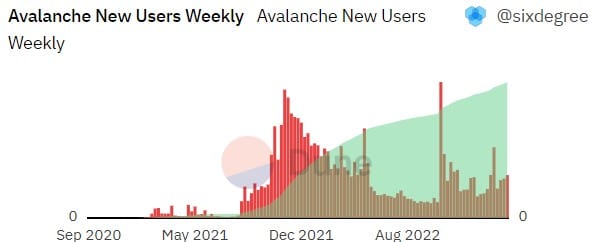

Moreover, Dune’s data revealed that Avalanche’s new weekly addresses had gained upward momentum since the beginning of this year.

Besides, growth was also noted in terms of fees. As per Token Terminal, after a steady decline, fees and revenue from Avalanche spiked on 3 March 2023.

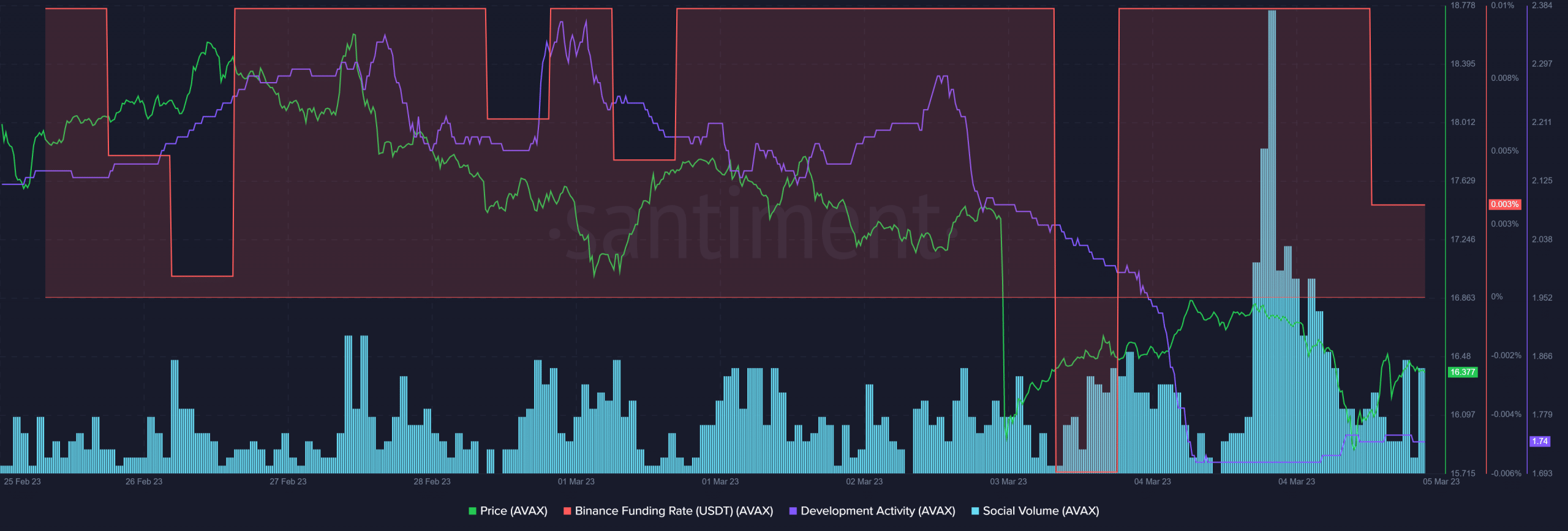

Quite a few other on-chain metrics also supported Avalanche. For instance, AVAX’s demand in the futures market remained pretty decent, which was evident from its Binance funding rate.

LunarCrush’s data revealed that bearish sentiments around Avalanche went down by over 50% last week, indicating the crypto community’s confidence in the token.

Furthermore, AVAX’s popularity increased considerably as its social volume registered a major uptick in recent days. In addition to that, AVAX ranked second on the list of the top DeFi projects by the Twitter audience, further establishing its popularity.

Top #DeFi Projects by Unique Monthly #Twitter Audience

The Unique Monthly Audience is the total number of unique Twitter accounts that have interacted with the project's Twitter in the last 30 days.$CAKE $AVAX $JOE $KAVA $MBOX $LUNC $ROSE $LINK $OGN $BRG $COTI $MCB $AUTO $DYDX pic.twitter.com/gvYvh2hcoa

— ?? CryptoDiffer – StandWithUkraine ?? (@CryptoDiffer) March 3, 2023

However, the coin’s development activity metric moved southward over the last week, which can bring trouble as it indicated that fewer efforts were being put by the developers to improve the network.

How much are 1,10,100 AVAXs worth today

Bears to lead the market for some time

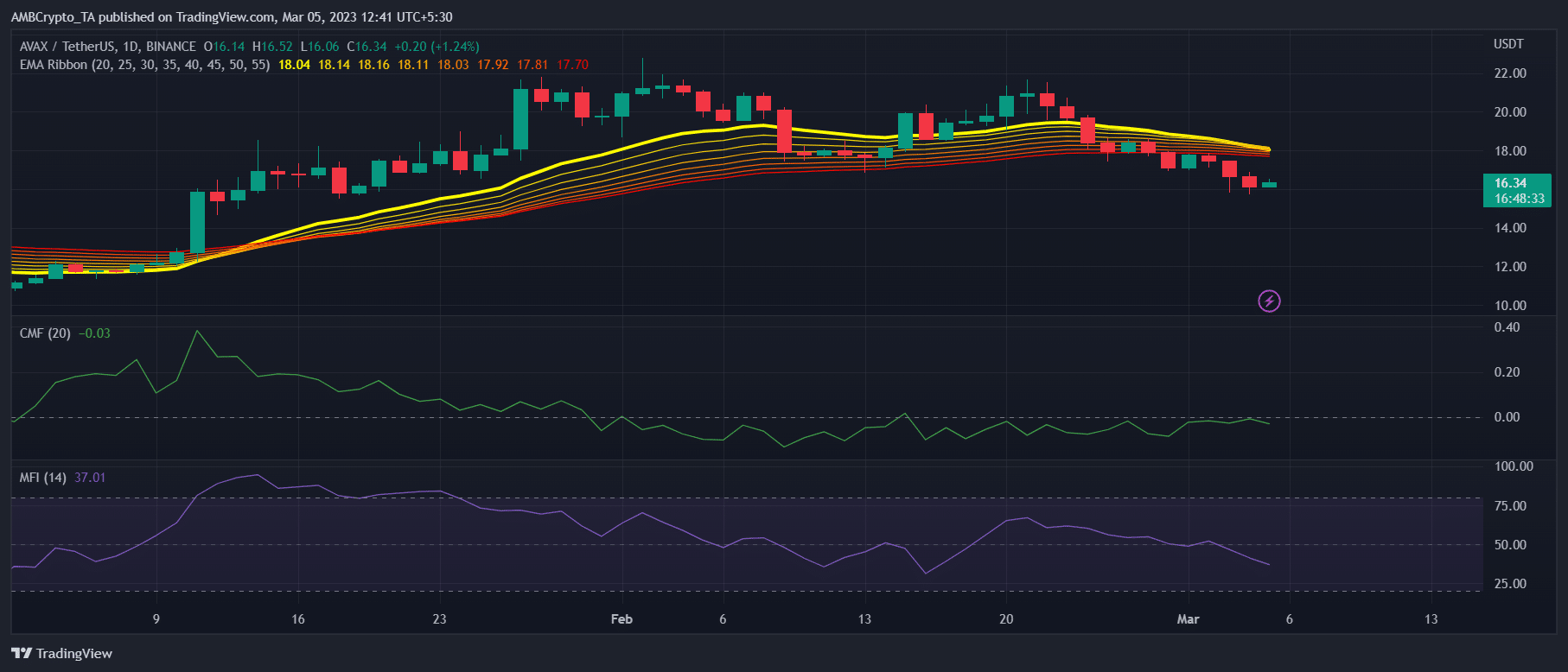

Meanwhile, a look at AVAX’s daily chart gave more reasons to worry. Consider this- the Exponential Moving Average (EMA) Ribbon displayed the possibility of a bearish takeover as the 55-day EMA was about to flip the 20-day EMA.

AVAX’s Money Flow Index (MFI) went down considerably from the neutral zone, which was a bearish signal.

The Chaikin Money Flow (CMF) was also below the neutral zone, further increasing the chances of a price decline. At press time, AVAX was down by nearly 2% in the last 24 hours and was trading at $16.35.