AVAX approaches $11 but should traders bet on a bearish reversal?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Avalanche indicators point toward further gains for the token

- The liquidation levels and the range formation meant that late bulls could be caught offside in the near future

Avalanche [AVAX] saw a strong bullish run over the past six days. The token noted gains close to 25% as it rallied from $8.65 to $10.8. During this time, Bitcoin [BTC] also climbed close to 24%.

Is your portfolio green? Check the Avalanche Profit Calculator

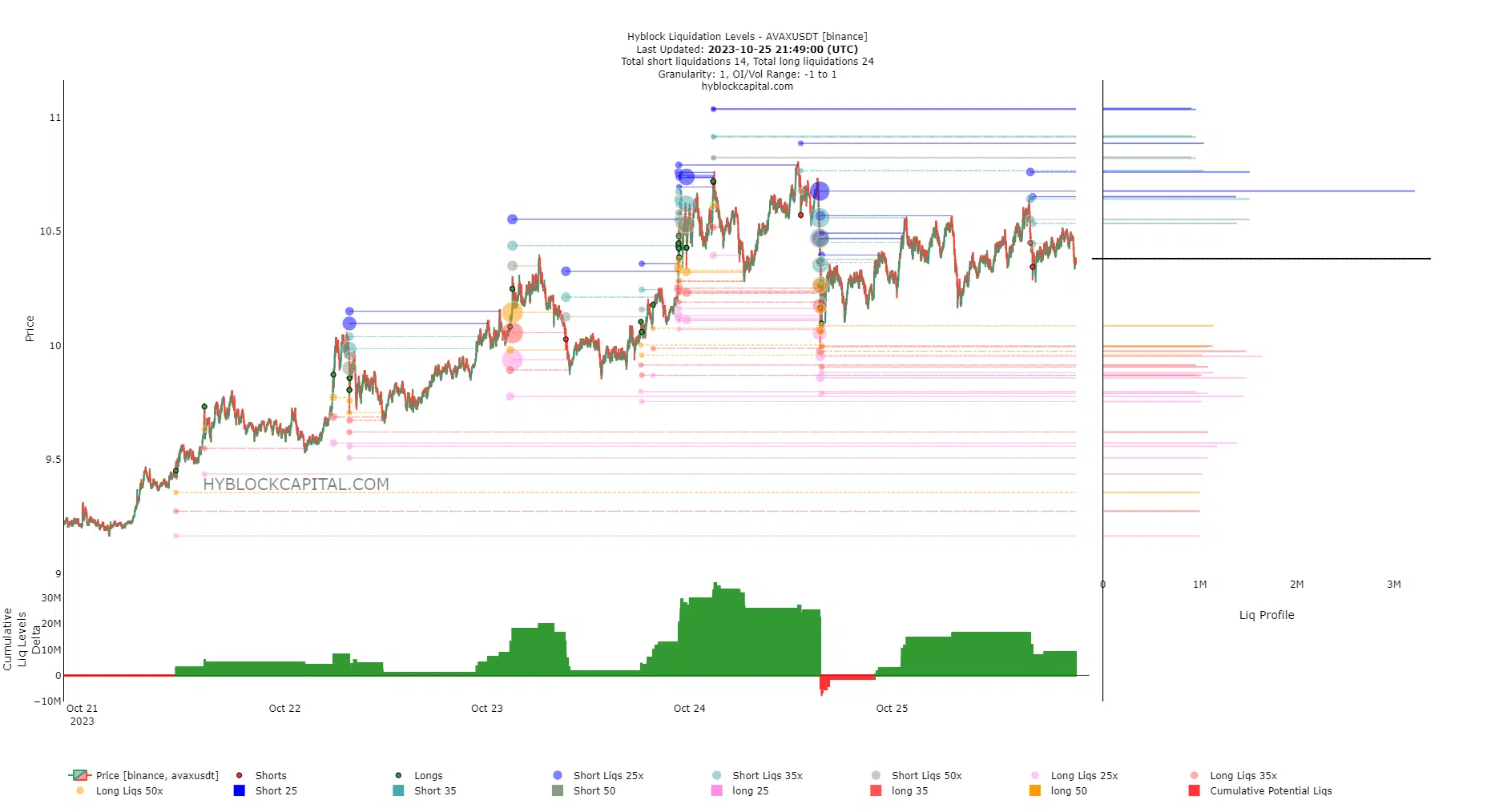

A technical analysis report by AMBCrypto from last week highlighted the $9.2 level had a significant chunk of liquidations based on Hyblock data. The $8.8-$9 zone was also underlined as a region where a bullish reversal toward $10 could commence. This analysis has since been vindicated.

Should AVAX traders wait for a bullish breakout past the two-month range high?

On 29 August, AVAX saw a short-term bounce to the $11.21 level before a downtrend took hold in September. The price action of the latter half of August reflected the significance of the $11-$11.2 region for the bears.

In the past two months, this level has been tested thrice, including the late August one. The bears have won each time, although the early October one was an explosive move to $11.88 that quickly receded.

The market structure on the four-hour chart was bullish and the Relative Strength Index (RSI) was as well. The On-Balance Volume (OBV) reached higher over the past week to outline buying volume. However, a breakout and retest of the $11.2 resistance zone would be needed before the next leg upward.

Therefore, traders could consider shorting AVAX near the $10.8 region, with invalidation just above $11.2

Has the bullish sentiment shifted in the past 36 hours?

Source: Coinalyze

On 24 October AVAX reached $10.8 and then witnessed a minor drop to $10.18. This was accompanied by a fall on the Open Interest (OI) chart as well. The dropping prices and OI signaled short-term bearish sentiment in the market, a feature that continued at the time of writing.

Source: Hyblock

Hyblock data showed $3.2 million worth of short liquidations could be triggered upon a move to the $10.67 level. An additional $1.5 million would be found at the $10.76 level. These findings help justify the idea of shorting a token on a firm uptrend.

Realistic or not, here’s AVAX’s market cap in BTC’s terms

These short liquidations could cause some short-term volatility and a possible extended move toward $11 before a bearish reversal. If such a scenario were to play out, short-sellers could stand to profit.