AVAX breaks this bearish pattern – What’s next for price?

- AVAX has broken above the upper boundary of a descending triangle pattern.

- The Heikin Ashi candlesticks are also showing signs of a possible bullish reversal.

Avalanche [AVAX] traded at $25.95 at press time after an around 1% drop in 24 hours. Trading volumes had also declined by more than 40%, according to CoinMarketCap.

AVAX experienced a spike in volatility in the last seven days as geopolitical tensions caused panic across the broader market. However, the medium-term momentum shows signs of a shift as bulls fight for control.

AVAX price outlook

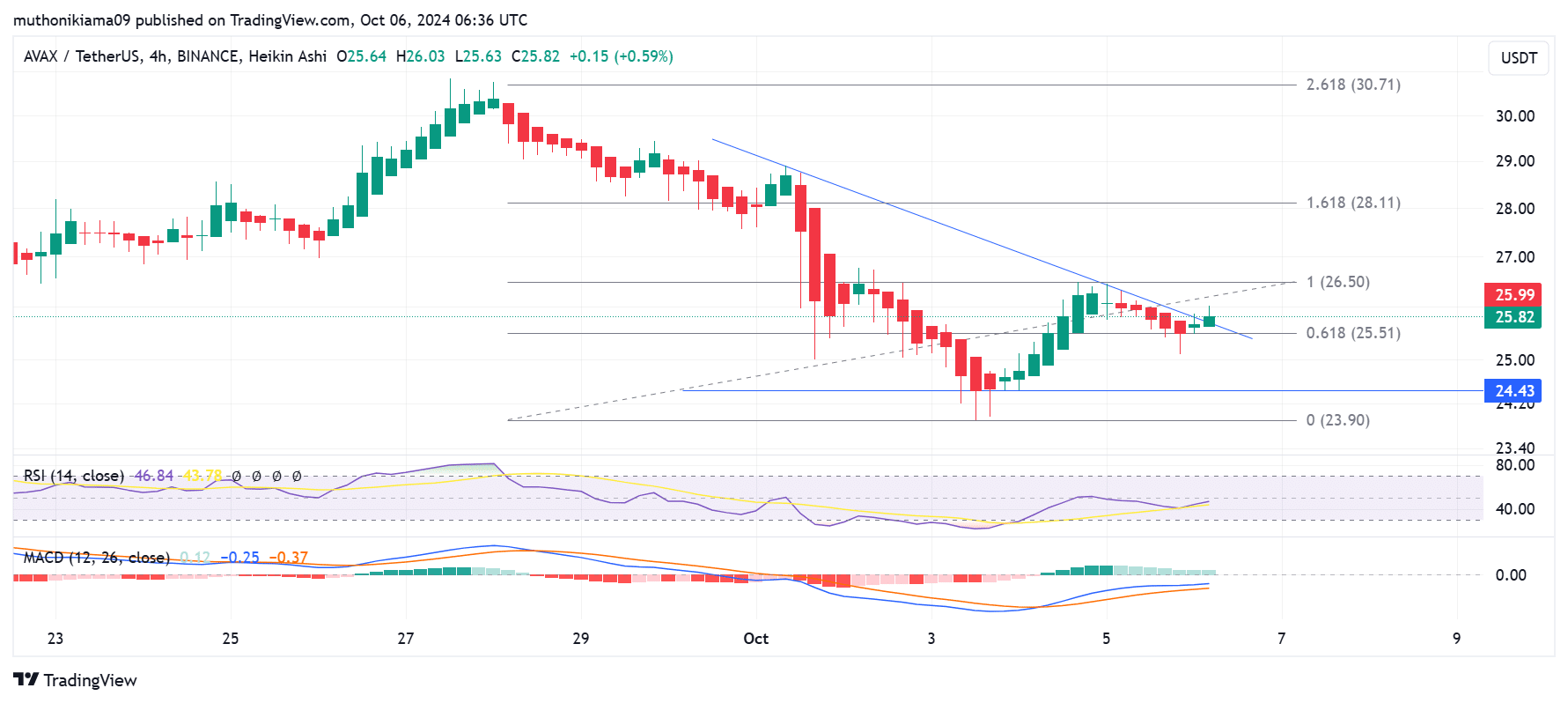

AVAX has formed a descending triangle pattern on the four-hour chart. This is usually a bearish pattern that shows sellers are active and driving the price down to create lower highs.

However, AVAX is breaking above this channel, suggesting that a bullish reversal is likely. A break above the upper boundary indicates that the upward momentum is picking up as bulls attempt to make a higher high.

A look at the Heikin Ashi candles that have flipped green shows that bulls are taking charge of the price action.

This could support an extended rally towards the next key resistance level at $26.50, also the 100% Fibonacci level.

Nevertheless, breaking this resistance will depend on buying activity. The Relative Strength Index (RSI) at 46 shows weak buying activity.

However, buyers could be entering the market after the RSI line moved above the signal line, indicating bullish momentum.

If AVAX breaks the $26 resistance level, the next target for price will be the 2.618 Fib level ($30). However, this breakout will depend on whether the uptrend is strong.

The Moving Average Convergence Divergence (MACD) line is above the signal line but still negative. Bulls will have complete control of AVAX’s price action if the MACD flips positive and remains above the signal line.

Conversely, if AVAX fails to hold support at $25, the bearish sentiment could strengthen, pushing prices lower.

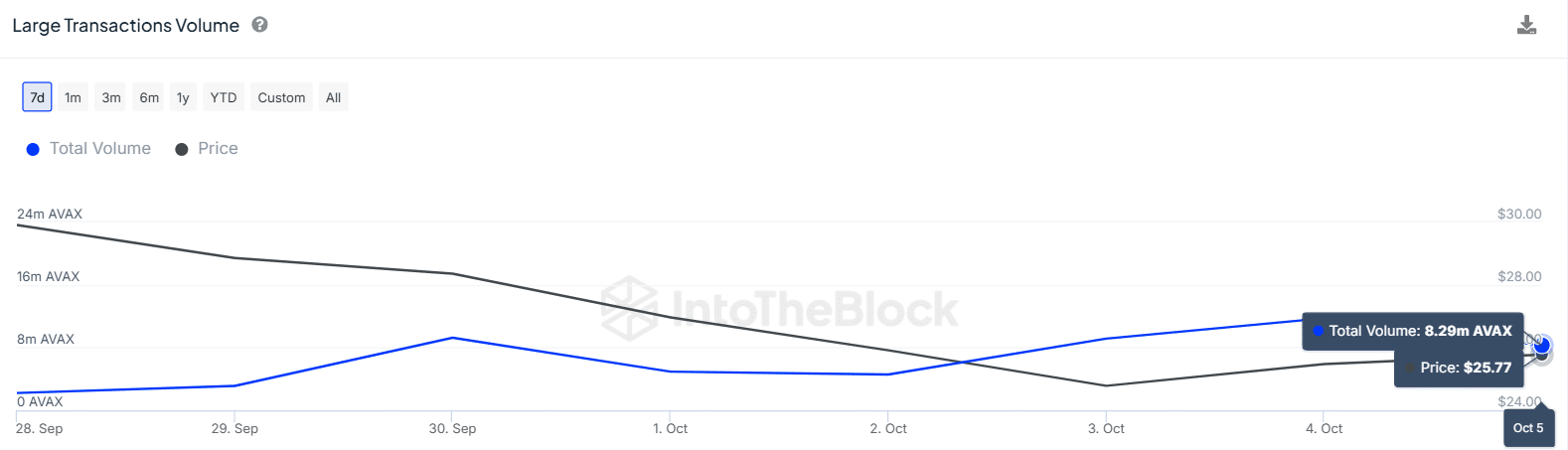

As AMBCrypto reported, AVAX is seeing increased whale interest. At press time, large transactions stood at 8.29 million, a notable jump from 4.9 million at the start of the month.

If these large addresses continue to buy, it could support an extended rally for the token.

Analyzing DeFi & dApp activity

Data from DeFiLlama shows that Avalanche, which is the eighth-largest blockchain by Total Value Locked (TVL) has seen an uptick in activity.

Avalanche’s TVL has pushed back above $1 billion after increasing by more than $100M in the last month.

Additionally, the 7-day average volumes for decentralized applications (dApps) created on the network have increased by over 20% according to DappRadar.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

A rise in network activity could deliver more gains for AVAX by increasing the token’s utility.

Despite signs of bullish activity, the market sentiment remains negative. Per Market Prophit data, AVAX’s crowd sentiment has dropped to a monthly low, suggesting traders are not confident in the price action.