AVAX consolidates near $16 psychological level – what are some key levels

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- AVAX was bearish on the four-hour chart at press time.

- However, sentiment and funding rates improved.

Avalanche [AVAX] incurred a loss of about 20% after dropping from $21 to nearly $16. But the pullback may be easing as price consolidation crept in. At the time of writing, AVAX’s value was $16.98, oscillating between $16.5 and $17.4 since 22 April.

Read Avalanche’s [AVAX] Price Prediction 2023-24

Meanwhile, Bitcoin [BTC] consolidated near the $27k price range as bulls tried to block bears from sinking it lower. If BTC bulls defend the price range, AVAX could continue to hover above the $16 psychological level.

A price dump, rally or consolidation – What’s next?

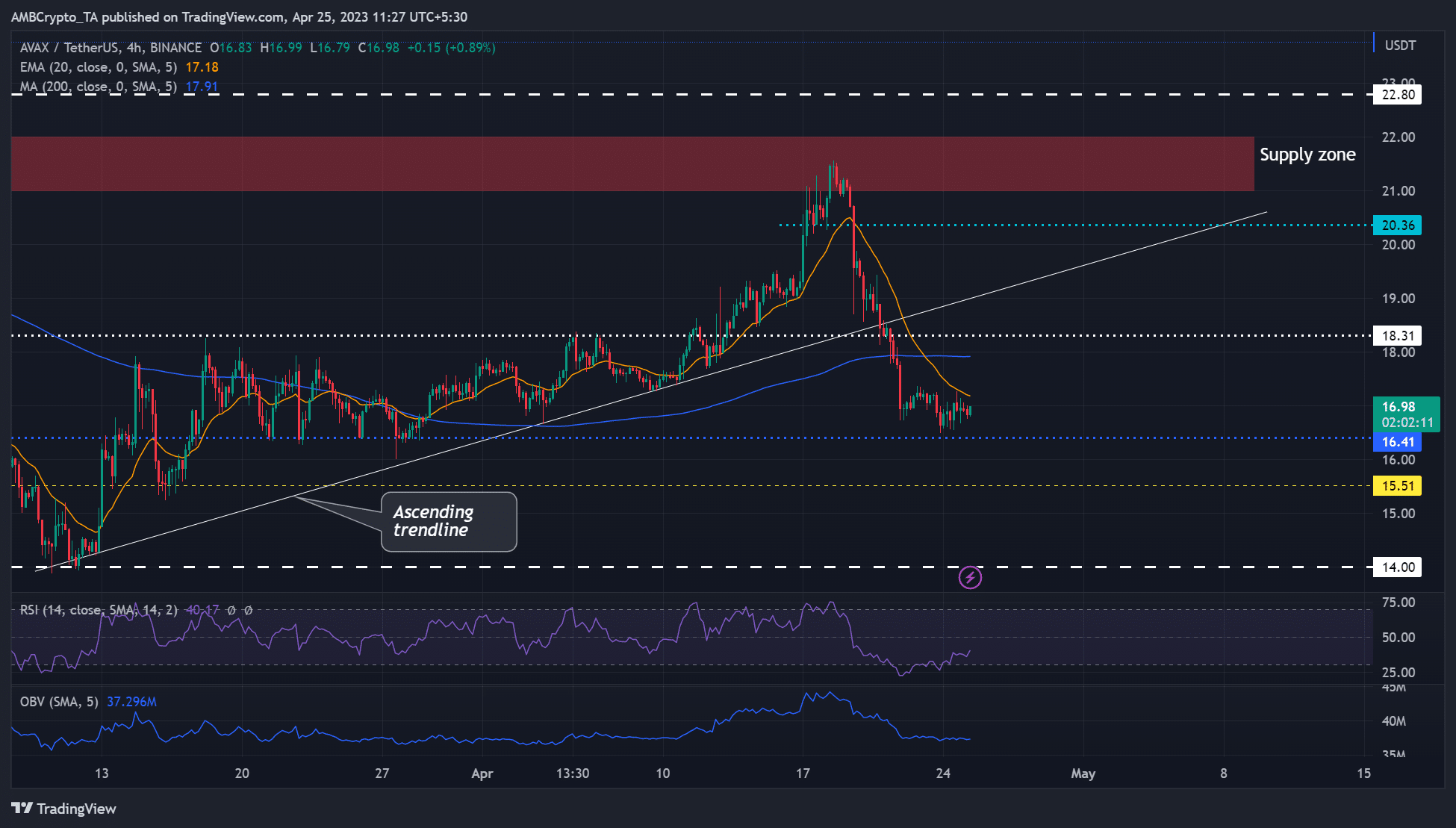

The price action was below its short- and long-term trends at press time. Notably, the 200-MA (Moving Average) was flat, indicating a likely extended consolidation. But the 20-EMA had a downtick, suggesting a likely price dump in the short term.

As such, the AVAX/USDT pair could oscillate between $16.41 and the 20-EMA or drop to $15.51 in the next few hours/days. Any extended downtrend beyond $15.5 could ease near March’s swing low of $14.

A close above the 200-MA and $18.31 could tip the pair to rally to the $21 – $22 range before facing strong resistance. Nevertheless, the near-term bulls must clear obstacles at the ascending trendline and $20.36.

At press time, the RSI retreated from the oversold zone, indicating bulls were attempting to keep sellers at bay. But the OBV (On Balance Volume) was flat – demand stagnated in the past few days, which could undermine a strong recovery.

Sentiment and funding rates improved

How much are 1, 10, 100 AVAXs worth today?

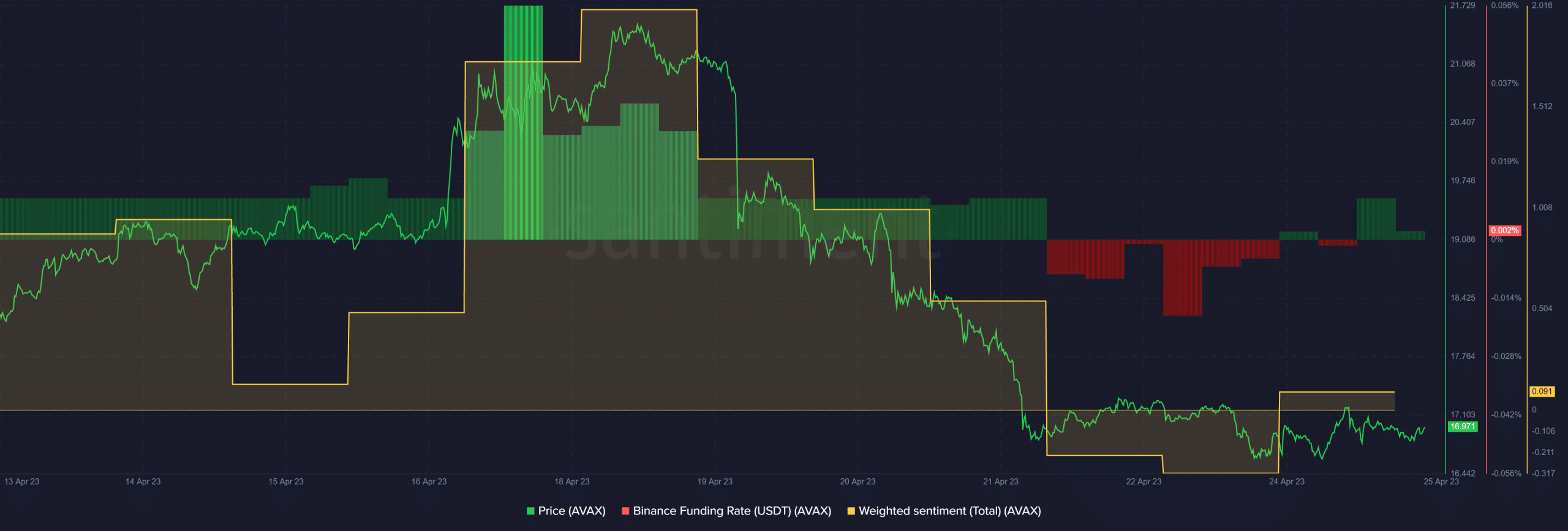

Weighted sentiment dipped to its recent lowest on 22-24 April. However, there was considerable improvement at press time as sentiment edged above the neutral level – reinforcing a mild bullish sentiment.

The improved and positive funding rates further corroborate the mild bullish sentiment above. If the trend persists, the pair could secure the $16 support and attempt to clear the 20-EMA hurdle. However, the support could be breached if BTC drops below $27k. Hence, tracking BTC’s movement is key.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)