AVAX dropped to key demand zone – Can bulls prevail?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

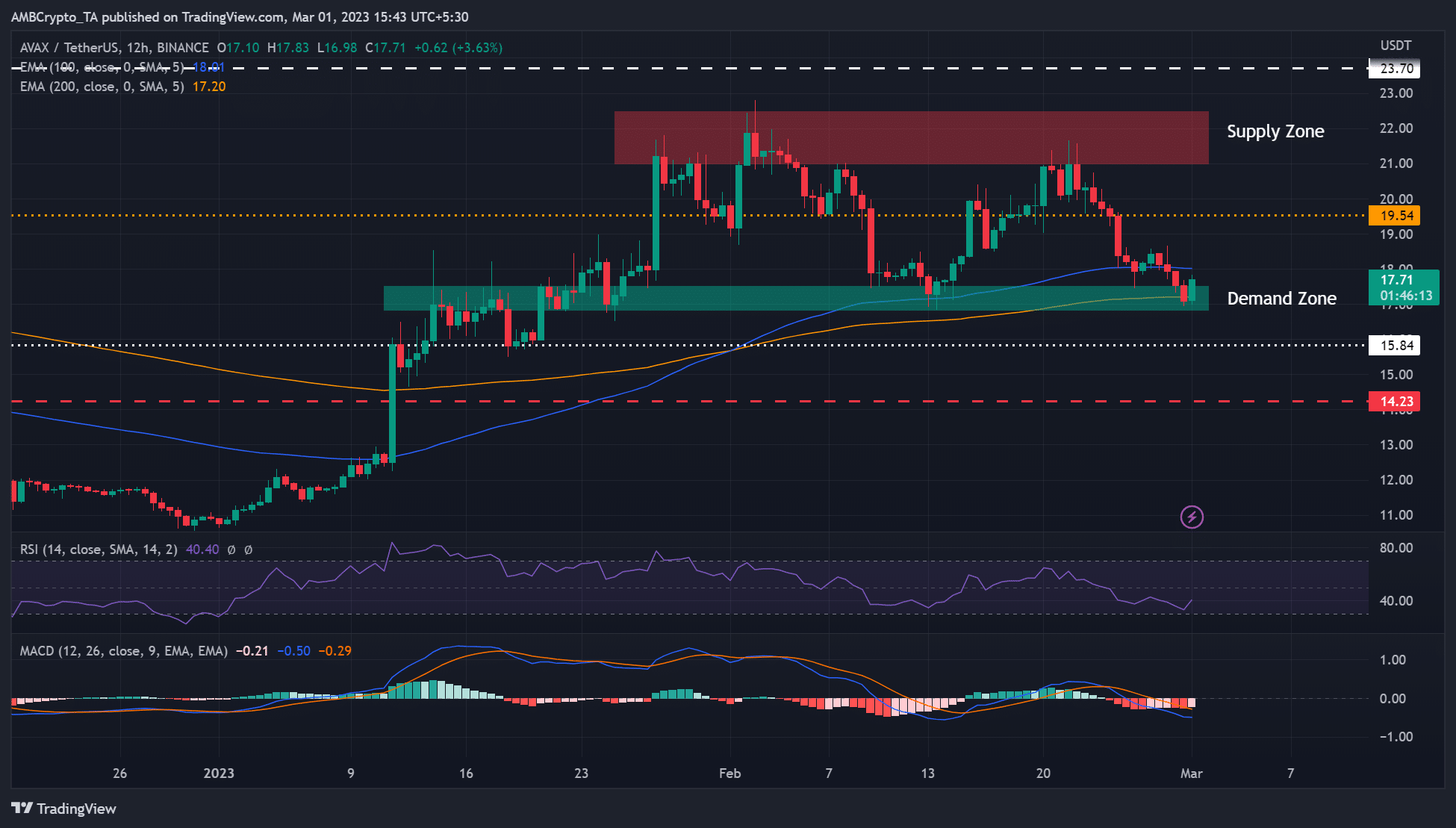

- AVAX hit a crucial demand zone of $16.8 – $17.51.

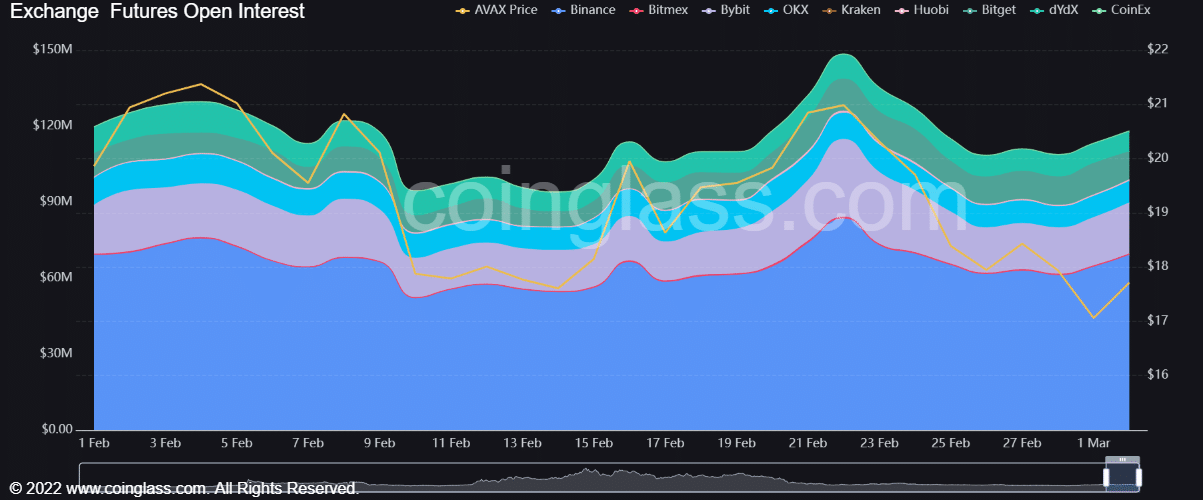

- An increasing open interest could boost the recovery.

Avalanche [AVAX] could offer bulls hope if the $16.8 – $17.5 support zone prevents further plunge. So far, the support range has become a key demand zone thrice, offering bulls reprieve from an extended price drop. The fourth retest, at press time, offered discounted prices that could attract new buying opportunities.

Read Avalanche [AVAX] Price Prediction 2023-24

Can the demand zone hold the plunge?

In the past few weeks, AVAX traded between key demand and supply zones ($17 – $22). On the 12-hour chart, the Relative Strength Index (RSI) rebounded near the oversold territory, showing that buying pressure picked momentum.

Moreover, there could be a MACD (moving average convergence divergence) bullish crossover in the next few hours/days, which could confirm the uptrend. Such an occurrence could offer bulls a signal of a strong recovery.

Risk-averse bulls could wait for a retest of a pullback on the demand zone before entering long positions. The supply zone of $21.0 – 22.5 will be the target – offering a potential 20% hike in the next few days/weeks.

However, key obstacles at $18 and $20 are worth watching. Bulls will also face another key resistance level at $23.7 if they overcome the selling pressure at the supply zone.

A break below the demand zone ($16.8 – $17.5) will invalidate the bullish thesis. The drop could slow towards $15.84 or $14.23, offering shorting opportunities at these levels.

AVAX’s open interest increased

According to Coinglass, AVAX’s open interest (OI) rate increased significantly by press time after steadily declining in the past week. The OI surge at the time of writing suggested a significant demand for AVAX in the futures market – a bullish signal.

How much are 1,10,100 AVAXs worth today?

If the OI increases after AVAX cross above $18, it will denote an increasing bullish momentum which could push the asset toward the supply zone of $22. However, the recovery could be undermined if Bitcoin [BTC] drops below $23k.

Therefore, bulls could track a bullish MACD crossover (golden cross), OI, and BTC price action before making moves.