AVAX hikes by +6% after Foundation announces token buyback from LFG

- Avalanche Foundation plans to repurchase AVAX tokens from a defunct crypto project

- AVAX held by LFG worth over $56 million

Avalanche (AVAX) recorded a significant uptick in its value over the last 24 hours. Not just due to broader market conditions, but also owing to a key development within its ecosystem.

The Avalanche Foundation is in the news today after it announced a major plan to repurchase AVAX tokens from a defunct crypto project – Marking a pivotal moment for the platform.

Avalanche Foundation to repurchase AVAX

In a recent announcement, the Avalanche Foundation revealed that it had agreed to repurchase all AVAX tokens previously sold to the Luna Foundation Guard (LFG).

This agreement, currently awaiting approval from the bankruptcy court, will see the return of 1.97 million AVAX tokens to the Foundation.

The Luna Foundation Guard (LFG) is the entity behind the Terra ecosystem, which collapsed in May 2022. To defend the peg of the algorithmic stablecoin TerraUSD (UST), LFG spent $2.8 billion in crypto assets, but these efforts were ultimately unsuccessful.

According to the LFG’s reserve data, AVAX made up over 40% of its reserves, valued at over $137 million. Other major assets held by LFG include Bitcoin [BTC] and Binance Coin [BNB].

Positive market reaction to AVAX’s token repurchase

Following the Avalanche Foundation’s announcement on 11 October via its X (formerly Twitter) page, AVAX saw an immediate reaction on the charts.

On the daily charts, for instance, AVAX gained by 6.15%, moving from around $25 to $27 in just 24 hours. At press time, it was trading well above $28, having hiked by another 3%.

And yet, AVAX still faces some resistance, with its 200-day moving average sitting near the $30-price mark. If AVAX can maintain its ongoing bullish trend, as highlighted by its Relative Strength Index (RSI), this resistance level could potentially turn into support.

AVAX gains popularity and market momentum

In addition to the price hike, Avalanche also gained traction as one of the top trending assets in the market.

For example – Data from Santiment revealed that AVAX ranked as the fourth-most trending asset, with a 68% positive sentiment.

Moreover, CoinMarketCap listed AVAX as one of the top 15 assets by market capitalization. It recorded the highest gains among the top assets in the last 24 hours, with a 9% hike.

– Is your portfolio green? Check out the Avalanche Profit Calculator

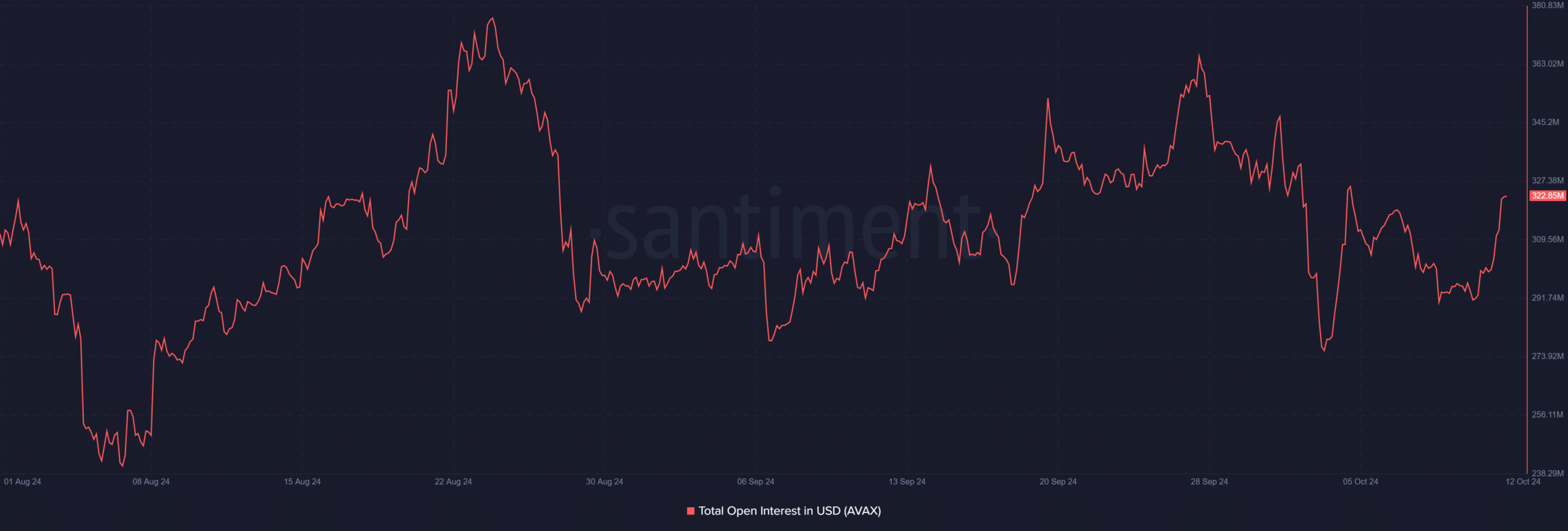

Finally, an analysis of its total Open Interest on Santiment indicated that it too rose significantly over the aforementioned period. In fact, the chart showed that its Open Interest climbed from around $292.6 million to around $312.4 million by the end of 11 October.

At the time of writing, the Open Interest had a reading of over $322 million.