AVAX gone wrong – Why is it suddenly out of the top 10?

- AVAX’s price fell, with its market cap dropping below $19 billion

- Signals from AMBCrypto’s analysis revealed that the price might recover soon

After trying so hard not to fall out of the group, Avalanche [AVAX] dropped out of the top-10 cryptocurrencies by market cap. At the time of writing, AVAX’s market cap had fallen to $18.31 billion.

This value was $5 billion shy of Toncoin’s [TON] own market cap, which was largely responsible for the change in position. In fact, in the last 24 hours alone, AVAX depreciated by 3.93%. TON, on the other hand, climbed by 15.45% as it moved to 9th on the standings.

AVAX’s latest performance has been contrary to how it did some months back. Back then, AVAX was one of the market’s top performers, alongside Solana [SOL]. Now that the tides have changed, there are chances that AVAX could continue dropping down the chart. But, will it?

Frail AVAX ready to bounce

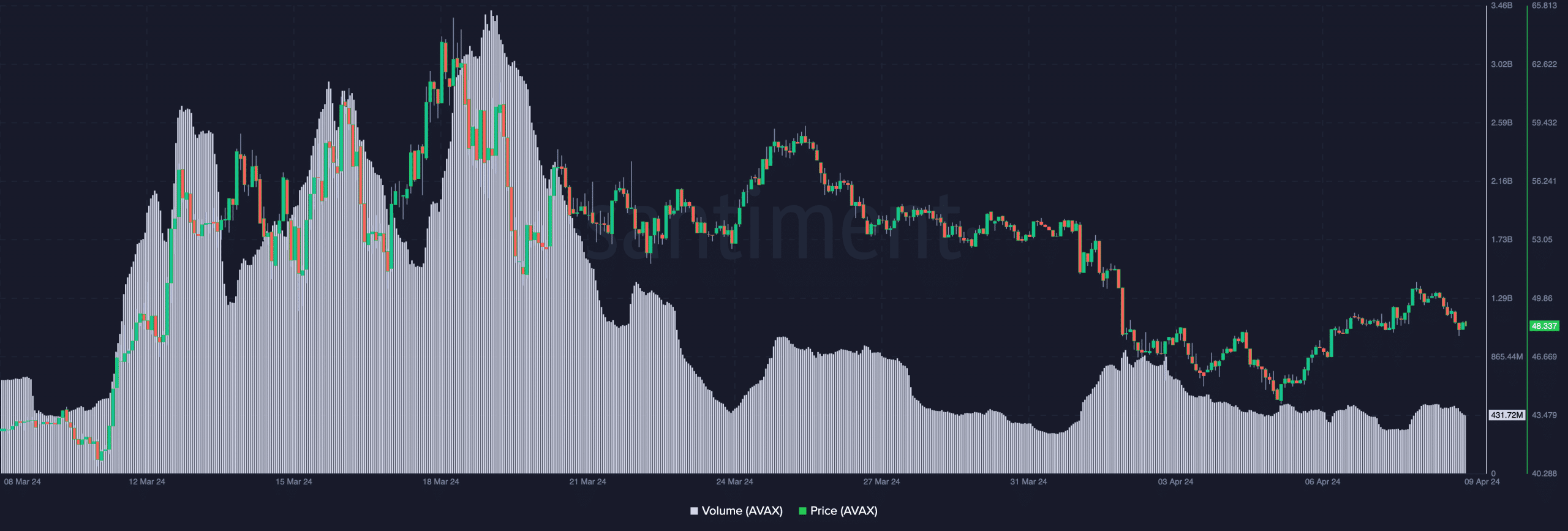

AMBCrypto looked at the possibility by considering the volume first. Volume measures buying and selling and is an indicator of interest in a token.

According to Santiment, AVAX’s volume was nothing compared to what it was on 19 March. At that time, the volume was about $3.42 billion. At press time, however, the same metric was a little over $400 million.

The decline in volume was proof of decreasing interest in the token. However, the price of the token might bounce considering the trend underlined by the price. Should the volume continue to fall like the price, the downtrend might become weak, Ergo, the price of AVAX might rebound on the charts.

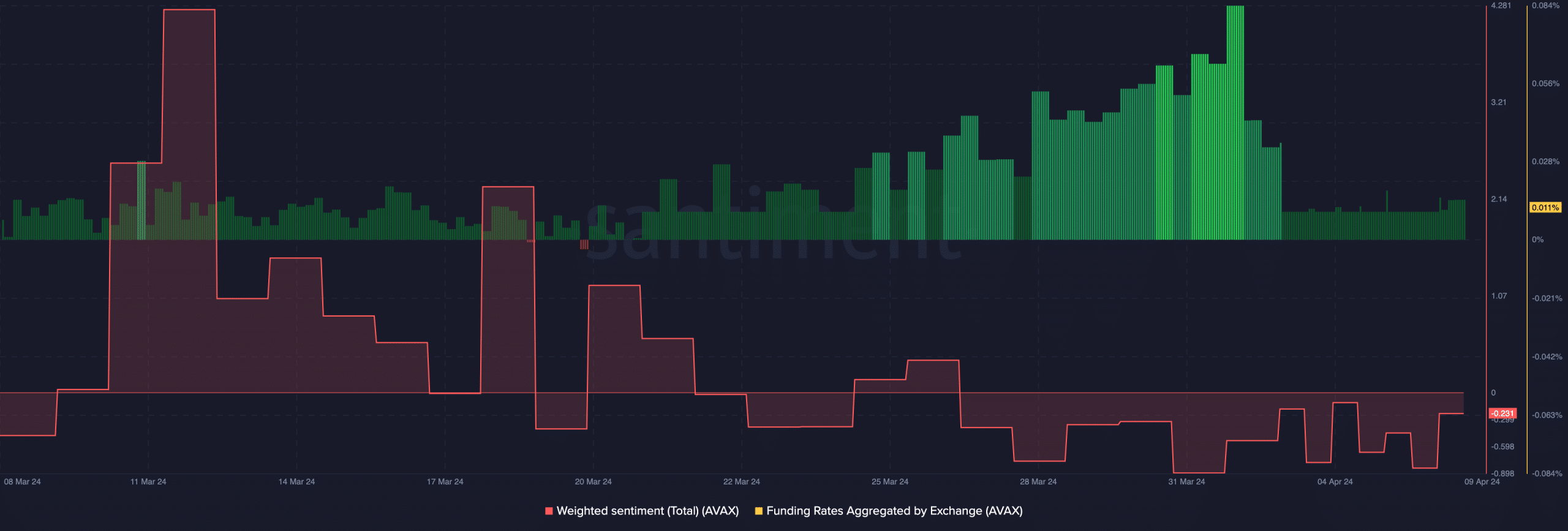

Not everyone is confident

Evidence of this perception was highlighted by the Weighted Sentiment. At the time of writing, the Weighted Sentiment was -0.231, indicating that most comments about AVAX were pessimistic. Despite this, the price of the cryptocurrency could bounce if the sentiment reading drops lower than the one mentioned above.

Another metric AMBCrypto looked at was the Funding Rate. Funding Rate is the cost of holding an open position in the derivatives market.

At press time, funding was positive, indicating that the perp price was trading meaningfully above the spot price. This also means that it has become more expensive for longs to keep their positions open.

From a price point, the increasing Funding Rate as AVAX’s price trades lower meant longs are aggressive. However, the issue with this was that they were not being rewarded for it.

Is your portfolio green? Check the AVAX Profit Calculator

For the price, this trend is potentially bearish. Should the position hold for the next few days, the price of AVAX might decline, and the market cap could fall even more.