AVAX plunges amidst suspicious whale transactions: What now?

- AVAX plummeted by 10% due to massive shady whale transactions.

- Despite the sharp decline, the derivatives market showed a bullish inclination among traders.

Avalanche [AVAX] has experienced a sharp decline, dropping 10% in just a few hours, largely attributed to significant whale transactions.

A notable entity transferred 1.96 million AVAX, valued at $54.2 million, to major exchanges Coinbase, Binance, and Gate, as well as through THORChain.

Are we headed for a massive crypto market sell-off?

Is AVAX in trouble?

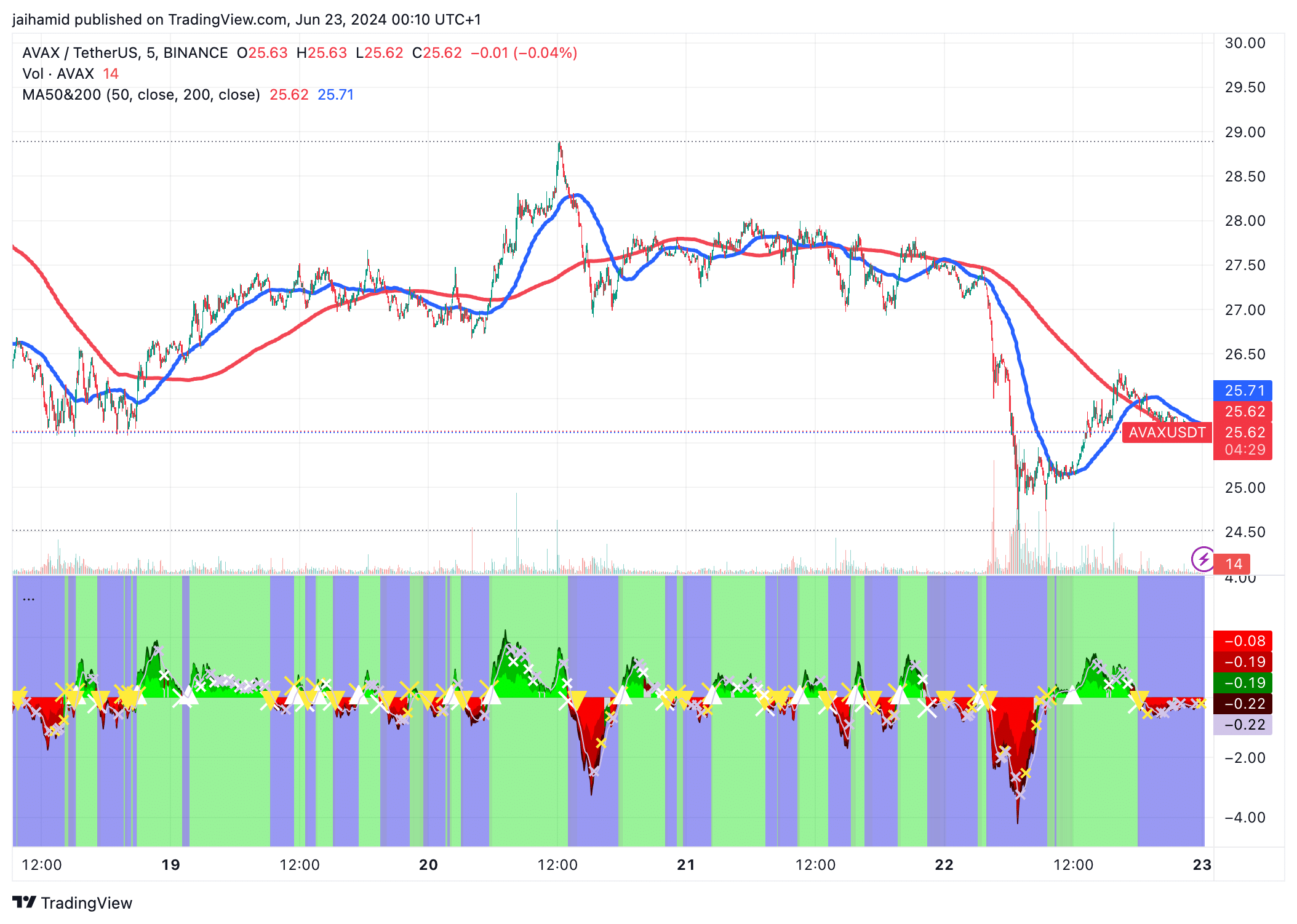

AVAX’s 50-period MA has crossed below the 200-period MA, indicating a bearish signal commonly referred to as a “death cross.”

The price was hovering around the 200-period MA at press time, suggesting a key level of resistance at approximately $25.73.

Increased volume is visible during the sharp price drops, particularly around the time the price sharply fell from approximately $28 to under $26. This suggested active selling pressure.

All hope is not lost

There is still hope for a swift recovery for AVAX.

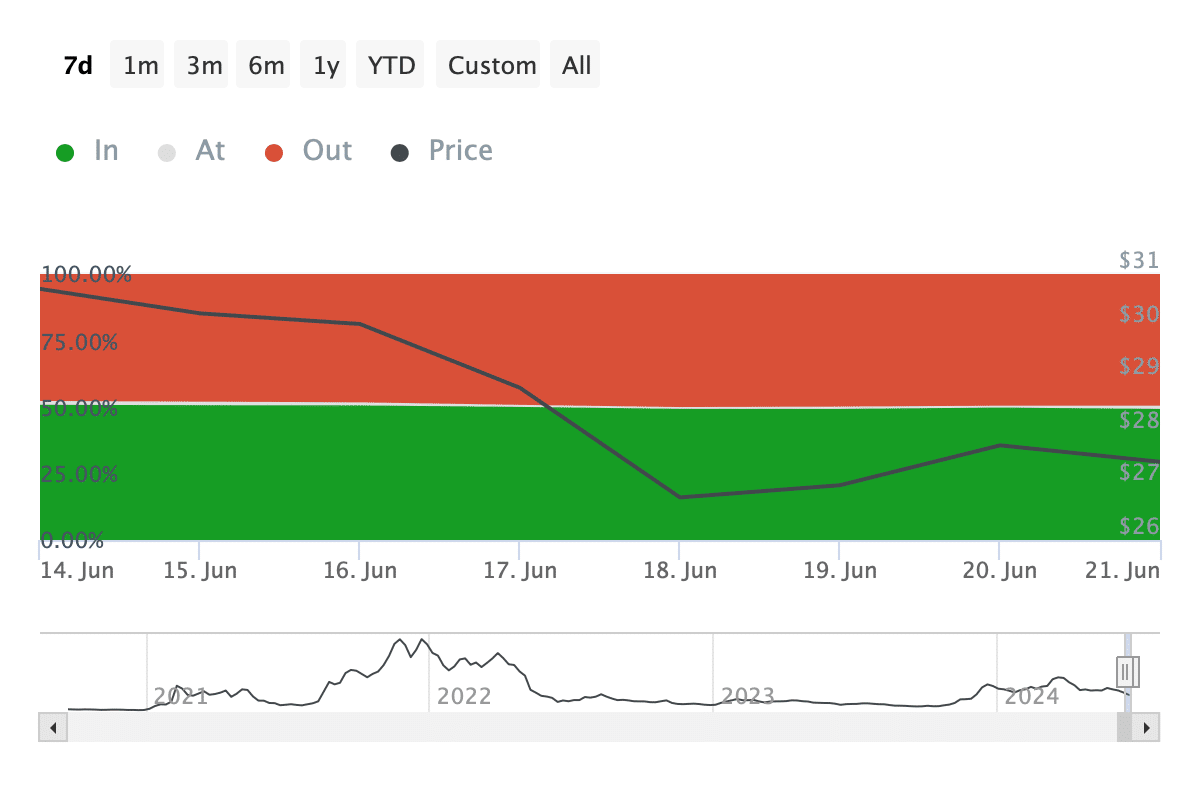

‘In the Money’ investors have seen a huge decrease in their investments, indicating that these holders have sold off their positions, possibly at a loss.

If the number of ‘Out of the Money’ addresses continues to decline or stabilize, and the ‘In the Money’ addresses increase, AVAX may see a sustained recovery period.

However, external market factors or another wave of large-scale sell-offs may disrupt this.

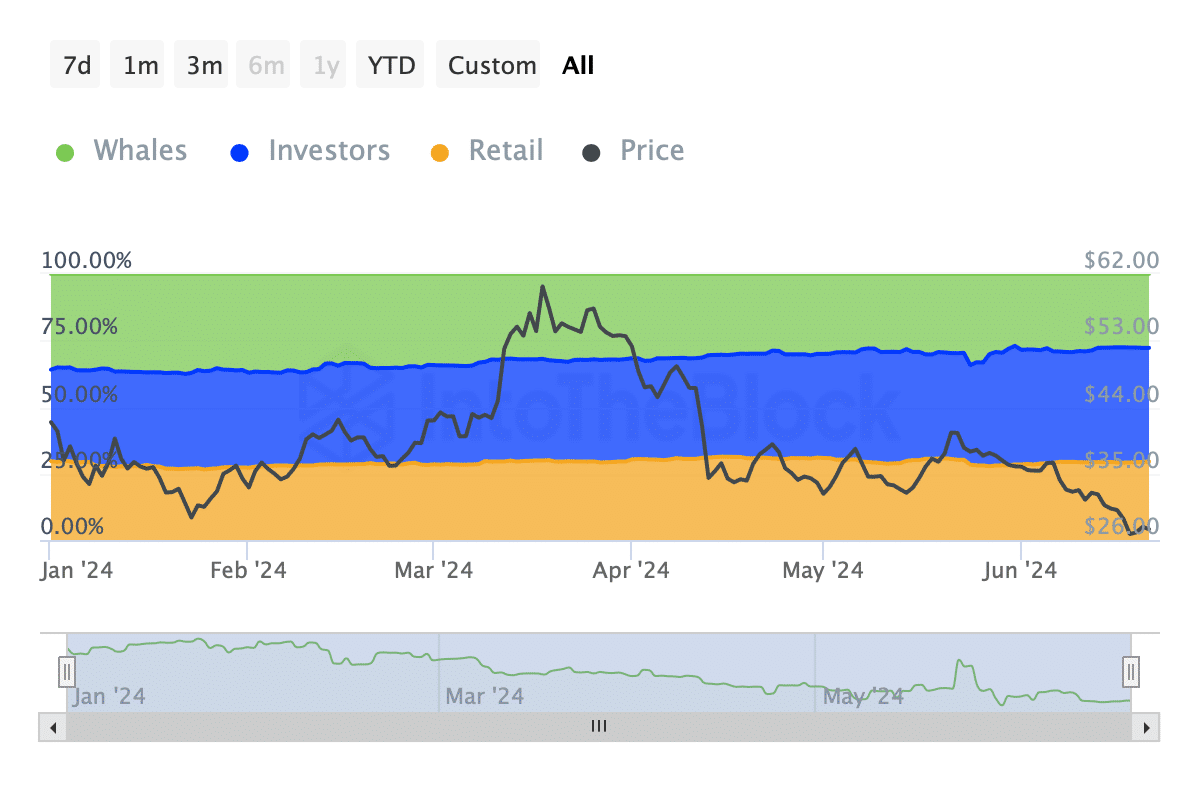

Data shows a mixed sentiment, with potential stability from whales and increased investor interest, which could counterbalance the negative impact of retail sell-offs.

The relatively stable netflow ratio, alongside the declining price, suggests that the price drop has not influenced large holders to cash out, as one might typically expect.

The whales are neither depositing a huge amount of AVAX into exchanges for selling nor withdrawing in large amounts, which usually signifies preparation for a price increase or avoiding a sell-off.

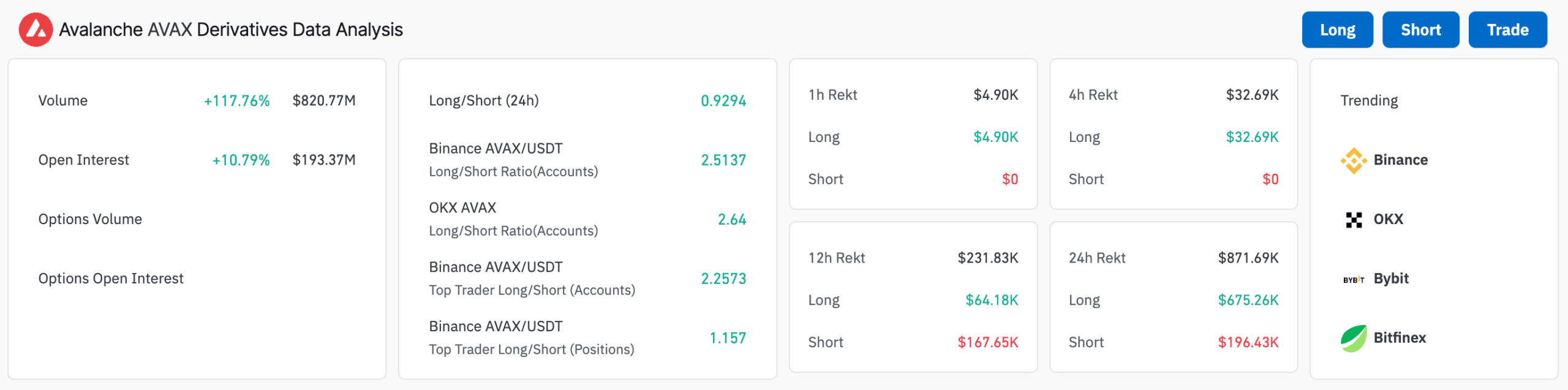

However, Avalanche’s derivatives market is currently experiencing a high level of activity, with a bullish inclination among traders.

Realistic or not, here’s AVAX market cap in BTC’s terms

There is a strong bullish sentiment among both retail and top traders on major exchanges. Still. Recent losses are predominantly on the long side, with $675.26K lost in the last 24 hours, compared to $196.43K on the short side.

This indicates that the market’s recent moves were unexpectedly against the dominant bullish sentiment.