AVAX traders bet on price drop despite positive market indicators – Why?

- Activity in the spot market did not align with the bearish expectations in the derivatives market.

- Open Interest increased and might back a continuation of the the price increase.

Altcoins including Avalanche [AVAX] have been able to hold on to the recent upswing after prices crashed a few days ago. However, AMBCrypto found that traders in the market decided to place bets in the other direction.

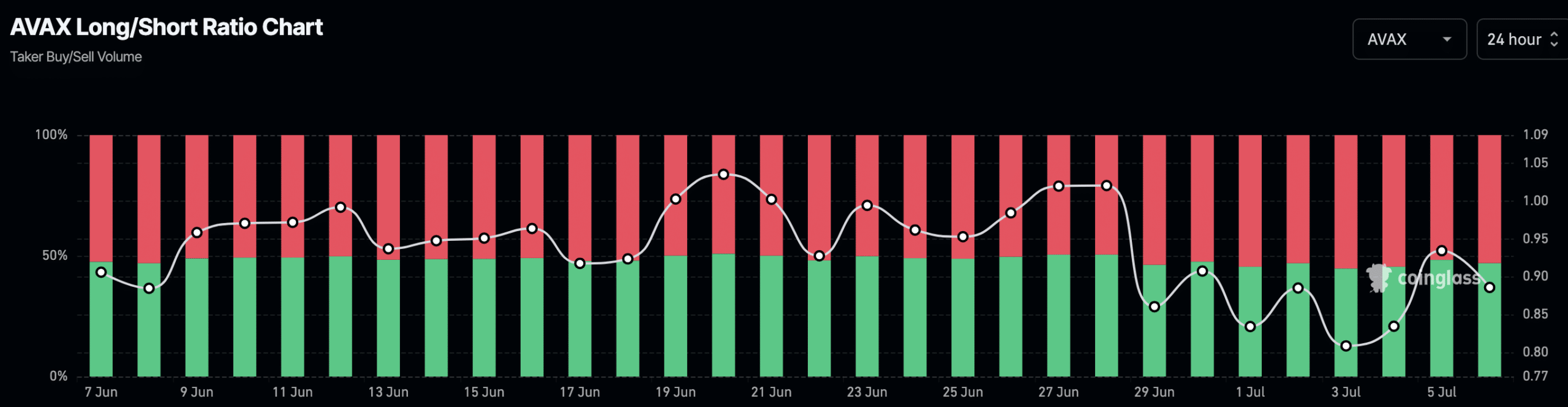

At press time, AVAX’s Long/Short Ratio was 0.88, serving as proof of the sentiment. The Long/Short Ratio acts as a barometer of investor expectations.

To arrive at the result, one has to divide the number of long positions by the number of shorts.

No trust in the uptrend

For context, longs are traders predicting a price increase while hoping to profit from it. Shorts, on the other hand, are traders betting on a decrease.

When the Long/Short Ratio is above 1, it means that the average market participants expects the price to increase.

However, if the ratio is below the threshold, it means the broader expectation is a price decrease, which was the situation with the token.

As of this writing, AVAX changed hands at $27.44. This was a 9.09% increase in the last 24 hours. Before that, the price had dropped to $22.25. Therefore, the data above suggests that traders expect the value to trend toward this area again.

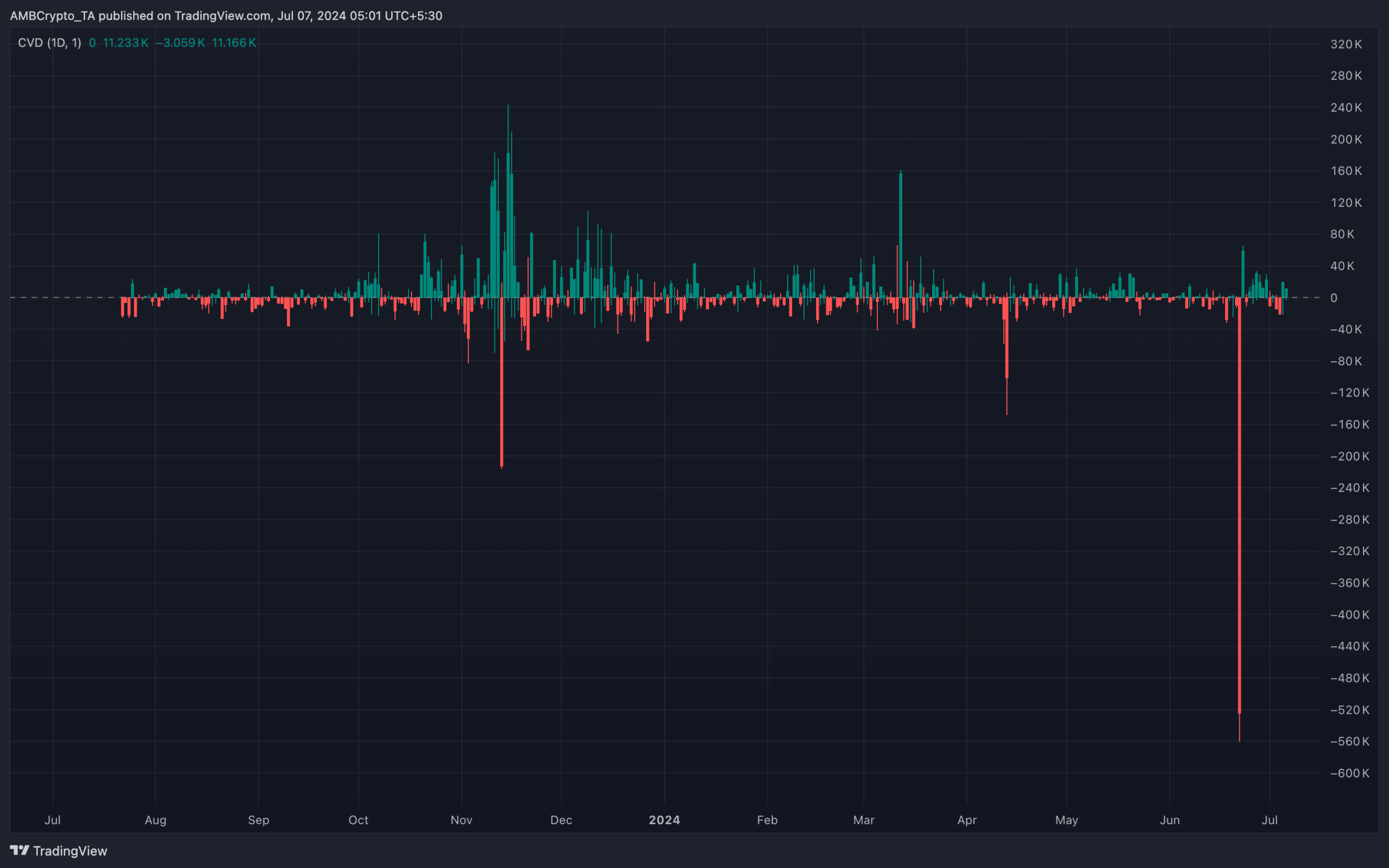

However, this might not happen, according to data from the Cumulative Volume Delta (CVD). The CVD displays the volume of a cryptocurrency based on the buying and selling orders in the market.

AVAX wants $30 back

If the CVD is positive, it means that buying volume in the spot market is higher than the sell volume.However, if the value is negative, it means that there is aggressive selling in the market.

According to AMBCrypto’s analysis, AVAX’s CVD on the daily chart was positive, suggesting an increase in buying pressure.

If this remains the same, AVAX price could rally toward $30, and traders choosing the short the cryptocurrency might not be rewarded.

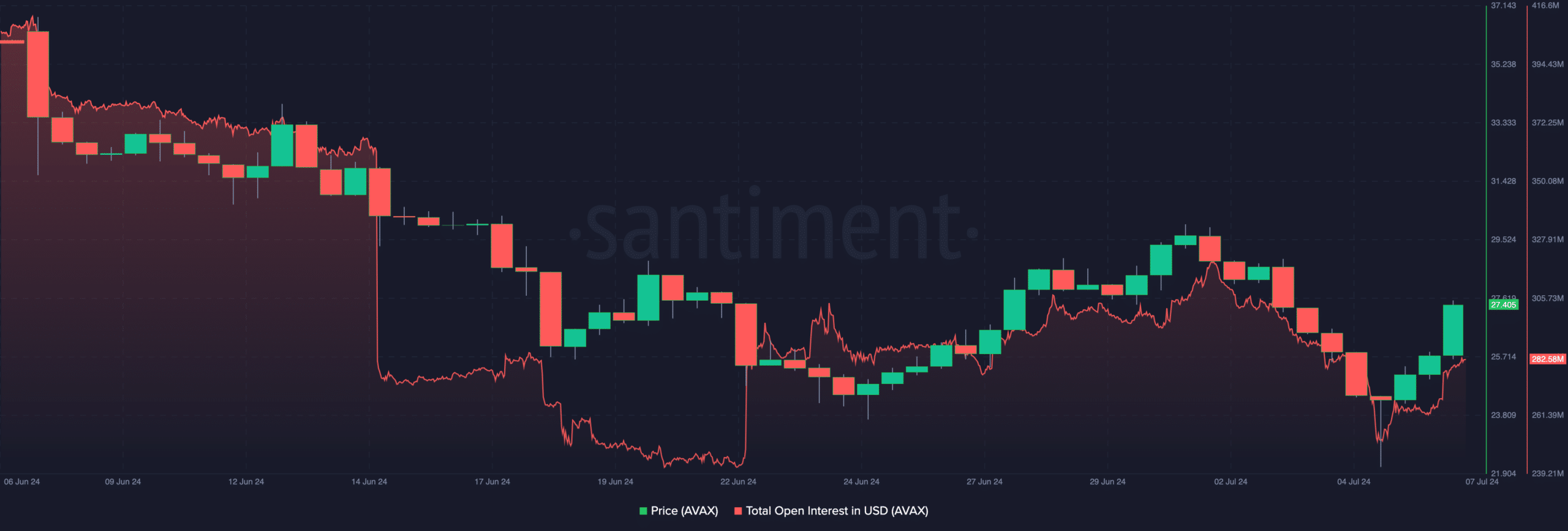

In addition to the indicator above, AMBCrypto looked at the Open Interest (OI). The idea behind assessing the OI is to check if truly AVAX would go against the wishes of traders in the derivatives market.

At press time, the OI had increased $267.12 million and was inches away from hitting the $300 million market. Open Interest refers to the sum of all open contracts in the market.

When it increases, it means money is coming into the market and net positioning is rising. However, a decrease implies a decrease in net positioning as traders take out liquidity.

For AVAX price, the increase is a good indicator of a further hike. That would only be the case if it is sustained.

Is your portfolio green? Check the Avalanche Profit Calculator

Going by the inflow of capital into the derivatives market, and the buying pressure on the spot end, the cryptocurrency’s price might continue to jump.

If this is the case, the token might hit $30 in a few days. meaning bears would not get any reward.