AVAX under pressure? Traders, THESE are the key price levels to watch!

- Trading at approx. $36.72, AVAX/USDT showed signs of a prevailing bearish trend

- Decline in OI seemed to be in line with AVAX’s inability to sustain its upward momentum above $55 in November

Avalanche (AVAX), a blockchain platform renowned for its high-speed transactions, is currently undergoing a major price correction on the charts. With a value of $36.72, AVAX/USDT seemed to be showing signs of a bearish trend at press time.

In fact, the broader market decline, coupled with technical signals, painted a rather challenging picture for the altcoin.

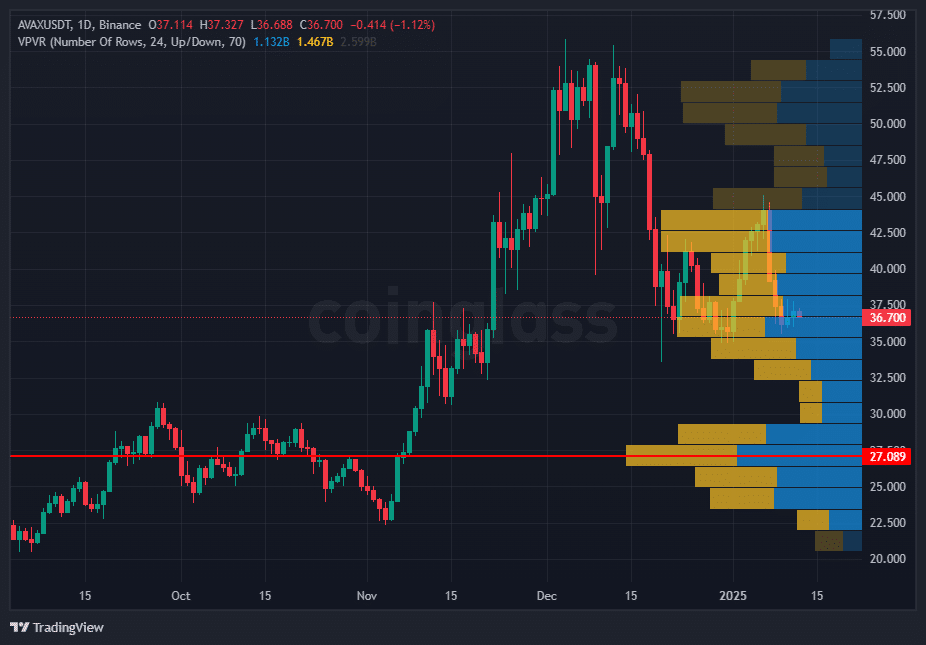

VPVR indicates strong resistance

The analysis revealed a significant cluster of trading activity between the $40 and $42-levels, highlighted by the Volume Profile Visible Range (VPVR).

This region reflected strong resistance, where a significant number of traders previously executed buy or sell orders. Despite attempts to break above this range during December’s rally, AVAX faced consistent rejection, reinforcing bearish sentiment.

On the downside, the VPVR highlighted a key support level around $27. This level aligned with a previous accumulation zone marked by high historical activity, indicating potential buying interest. A breach of this support could lead to further downside, possibly targeting the $25 range.

Given AVAX’s recent failure to sustain momentum near $55, it also formed a pattern of lower highs and lower lows. This classic bearish setup suggests continued downward pressure, unless a catalyst propels the token above its resistance zone.

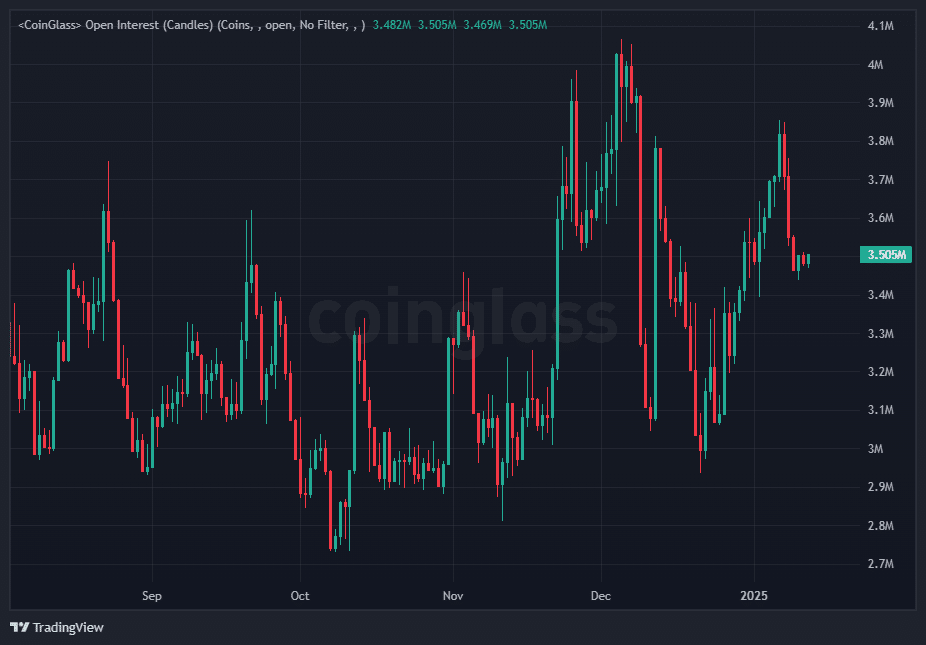

Gauging market participation

Recent data revealed a decline in OI, alongside the price drop, signaling a reduction in speculative interest. This trend suggested that traders may be exiting positions, possibly due to diminished confidence in AVAX’s short-term recovery.

The decline in OI was consistent with AVAX’s inability to sustain its upward momentum above $55 in November.

A falling OI during a price correction often points to long positions being closed, reflecting uncertainty and bearish sentiment. Additionally, it could indicate that traders are waiting for stronger directional cues before re-entering the market.

To reverse this sentiment, AVAX would need a sustained hike in both price and OI. Rising OI accompanied by a move above the $40-$42 resistance zone would suggest renewed confidence among market participants.

However, if the OI continues to drop while the price tests lower support levels, it could confirm the dominance of bearish momentum, with the $27-zone becoming the next focal point for traders.

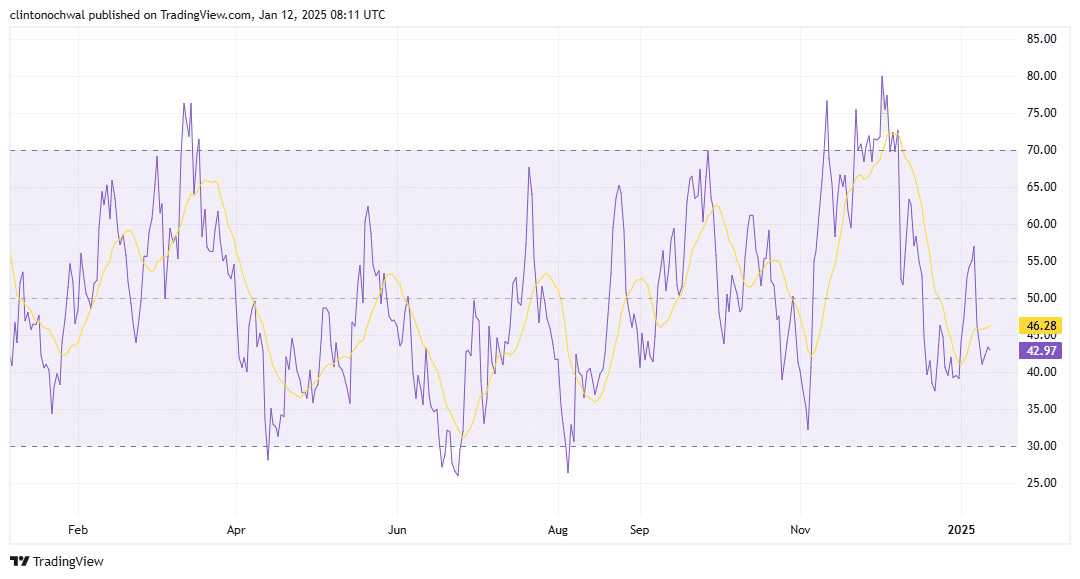

Oversold or room for further declines?

On the daily chart, AVAX’s RSI has been trending below the neutral 50-level – A sign of ongoing bearish momentum. At the time of writing, the RSI was hovering near 35 – Inching closer to the oversold threshold of 30.

This reading highlighted weakening buying pressure, which aligned with the token’s lower highs and lower lows pattern. While an oversold RSI can sometimes trigger a short-term bounce, the lack of strong bullish catalysts pointed to limited upside potential in the immediate term.

If the RSI falls below 30, it could indicate an oversold condition, attracting bargain hunters and potentially leading to a temporary recovery. However, a failure to regain strength above 45 could reinforce the bearish trend, with further downside likely.

For bulls to regain full control, the RSI would need to climb decisively above 50, coinciding with a breakout above key resistance zones like $42.

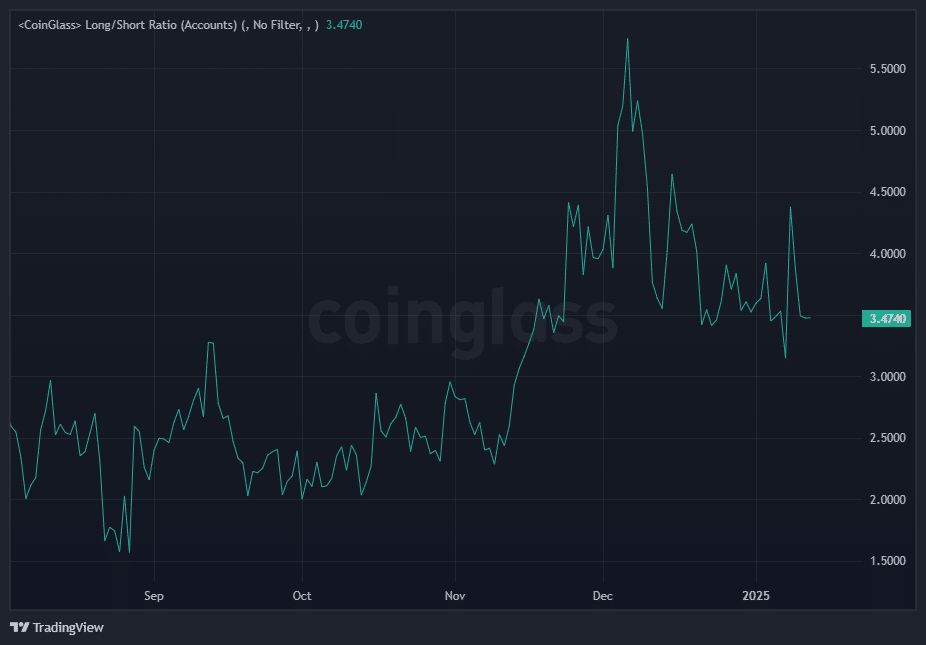

Sentiment and market bias

Finally, recent data indicated a growing number of short positions relative to longs in the AVAX/USDT market – Another sign of bearish sentiment among market participants.

At the time of writing, this hike in short positions was in line with the broader downward trend and the rejection from the $40-$42 resistance zone.

A rising shorts ratio means that traders are positioning themselves for further downside, anticipating a potential breakdown below the $27-support level.

However, extreme imbalances in the Long/Shorts Ratio can sometimes act as a contrarian signal. If shorts become overly dominant, short squeezes where the price rises sharply to liquidate excessive short positions can occur – Leading to temporary price spikes.

For a bullish shift, the Long/Shorts Ratio would need to stabilize or show a preference for long positions, indicating renewed confidence among traders. Until then, the growing short interest would support the prevailing bearish outlook, with price action likely to remain under pressure.