Altcoin

AVAX’s 40% decline since July: A setup for a bullish reversal?

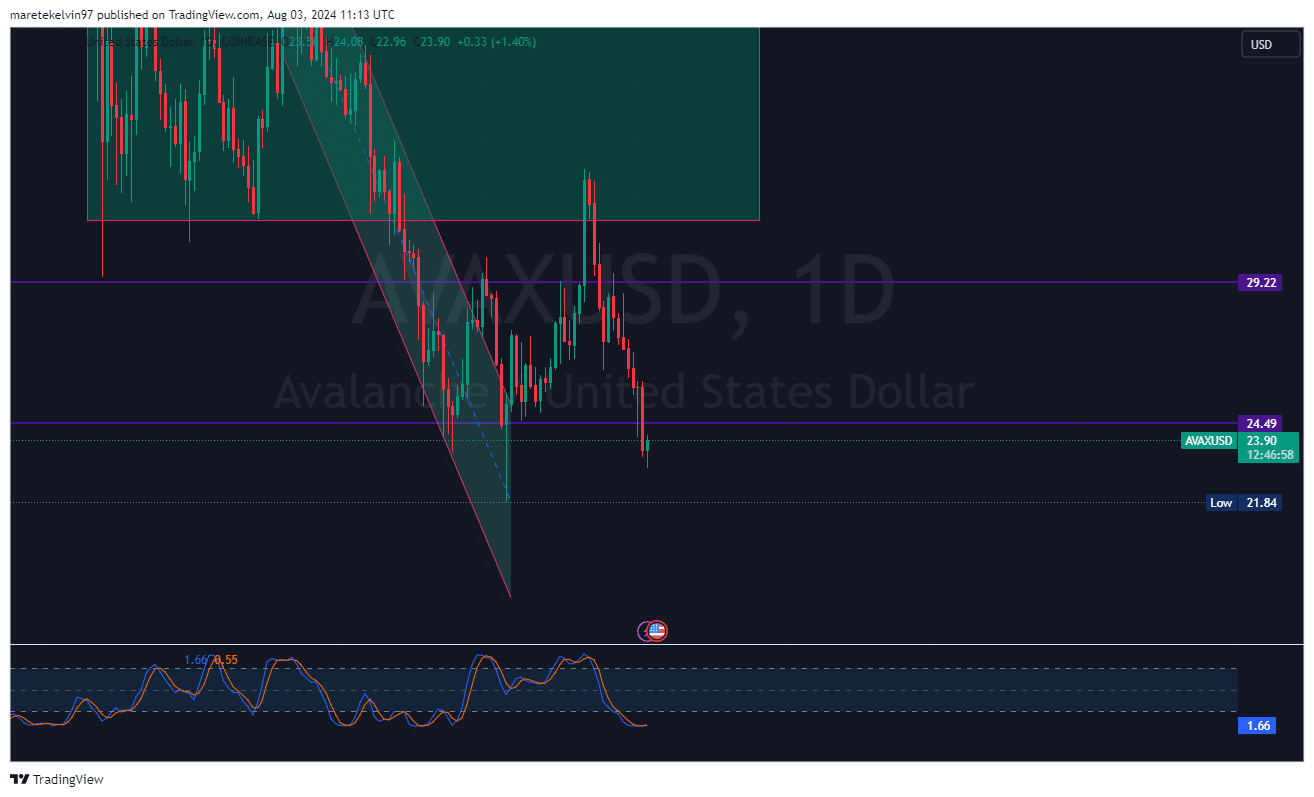

AVAX is approaching a key level, which hints at a potential price reversal.

- AVAX price approaches key resistance at $24.9.

- Liquidation data indicates increased market activity.

The Avalanche [AVAX] token is currently hovering around the key price level of $23.5, and this has sparked talks of potential price reversals.

AVAX has declined by over 40% since the 22nd of July. Market participants are observing closely for patterns of waning bearish pressure.

The recent 4% price movement implies that bullish momentum may be forming, which may in turn rise as it approaches the critical resistance level at $24.9.

The stochastic RSI indicates an oversold market, which further fuels a potential reversal to upside momentum.

Liquidation heatmap signals increased AVAX activity

According to liquidation heatmap data from Coinglass, market activity has increased. The data indicate a concentration of liquidations around the $23–$24 zone.

Market participants are observing this price level, anticipating potential breakouts or rejections.

Long-term holder behavior hints at bullish sentiment

Interestingly, the long-term holder behavior for AVAX indicates a potential bullish run. The distribution of AVAX among whales, investors, and retail holders indicates a steady increase in investor holdings since mid-2022.

The IntoTheBlock data on the large number of transactions indicates a positive trajectory. Despite the fluctuations in the large transactions, there is an overall increase, suggesting an increased interest in the Avalanche token at current levels.

Source: IntoTheBlock

Market participants are keenly observing for signs of a potential price reversal as AVAX approaches the key resistance level of $23.5.

Is your portfolio green? Check the Avalanche Profit Calculator

The recent 4% spike in price and the accumulating bullish momentum fuel this possibility. The long-term holder data and recent price actions signal a potential bullish run.

However, a rejection at the $23.5 level could lead to a short-term pullback.