AVAX – An 86% revenue drop in Q1 means THIS for Q2

- Unlike Q1, AVAX’s network activity dropped in Q2.

- AVAX’s price was up by over 2% in the last seven days, and metrics looked bullish.

Avalanche [AVAX] blockchain’s performance in terms of captured value dropped during Q1. However, upon checking the larger picture, a different story was revealed. Let’s have a closer look at AVAX’s state in Q1 to better understand its overall performance.

Avalanche’s revenue in Q1 dropped

Coin98 Analytics, a data analytics platform, recently posted a tweet mentioning Avalanche’s Q1 stats. As per the tweet, the blockchain’s fees and revenue both touched $7.5 million, which was an 86% drop compared to the previous quarter.

Similarly, the blockchain’s total earnings also plummeted by over 80% in Q1.

However, if we compare Q1 2024’s stats with those of Q1 2023, we find that Avalanche’s captured value increased fourfold, which was commendable year-on-year growth.

AMBCrypto’s analysis of Artemis’ data revealed that things in Q2 began on a good note as AVAX’s fees and revenue spiked in the last seven days.

Apart from earnings, the blockchain’s network activity grew sharply in Q1. As per the report, AVAX’s daily active addresses crossed 54,700 in Q1, which was a 23% quarter-on-quarter rise.

Despite the rise in active addresses, Avalanche’s daily transactions declined by nearly 35% during the last quarter. The trend continued in Q2, as after a rise on the 9th of April, both AVAX’s active addresses and transactions dropped.

Avalanche bulls dominated Q1

The quarterly report also mentioned stats related to the token’s price action. During Q1, AVAX’s circulating market capitalization surged by nearly 100%, allowing it to exceed $15 billion.

While its market cap grew, its P/F ratio dropped by 16%. A decline in the metric suggests that an asset is undervalued, hinting at a bull rally in Q2.

CoinMarketCap’s data revealed that AVAX’s price did increase by over 2% in the last seven days. At the time of writing, the token was trading at $46.16 with a market cap of over $17.4 billion, making it the 11th largest crypto.

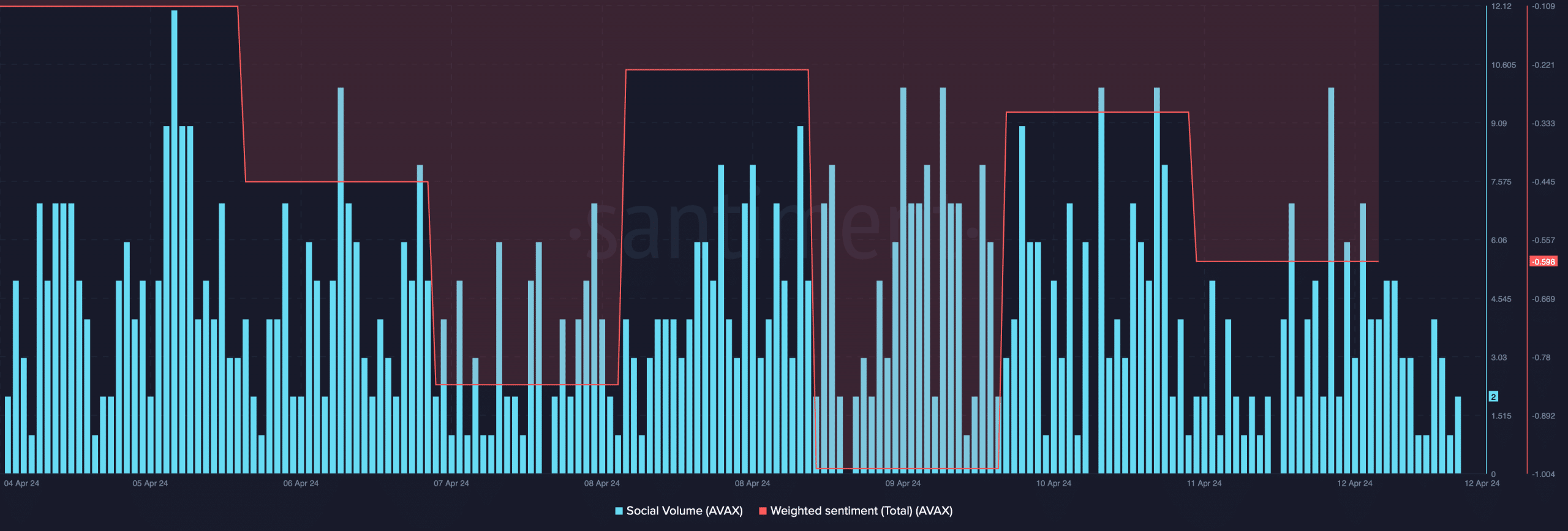

Thanks to the price uptick, AVAX’s social volume remained high, reflecting its popularity in the crypto space.

Read Avalanche’s [AVAX] Price Prediction 2024-25

Additionally, investors’ confidence in AVAX also went up slightly, which was evident from the improvement in its weighted sentiment.

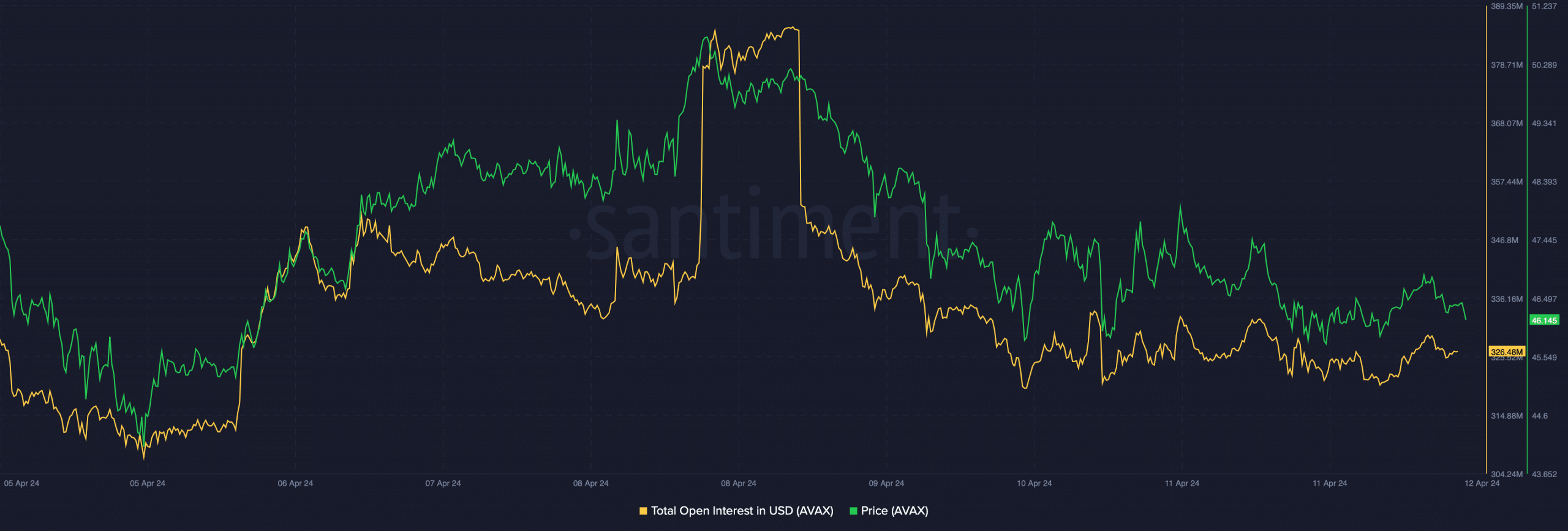

Avalanche’s derivatives market stats also looked bullish. After AVAX’s price started to drop on the 9th of April, its open interest also fell. This indicates that the chances of a trend reversal are high.