Altcoin

AVAX’s short-term forecast – Should traders be worried about something?

AVAX is at in interesting point on the charts right now, but where will it go next?

- AVAX struggled with direction, with the RSI near 50 and mixed moving average signals on the charts

- Higher trading volume suggested heightened interest, but bearish sentiment prevailed

Avalanche (AVAX)’s price has been moving without a clear direction, and it is staying flat on the charts. The excitement from 20 May’s breakout attempt has faded, with AVAX seemingly going down on the charts now.

The current hype surrounding the broader market hasn’t affected the altcoin either. Is there a sign anywhere that the bulls might take over in the near future?

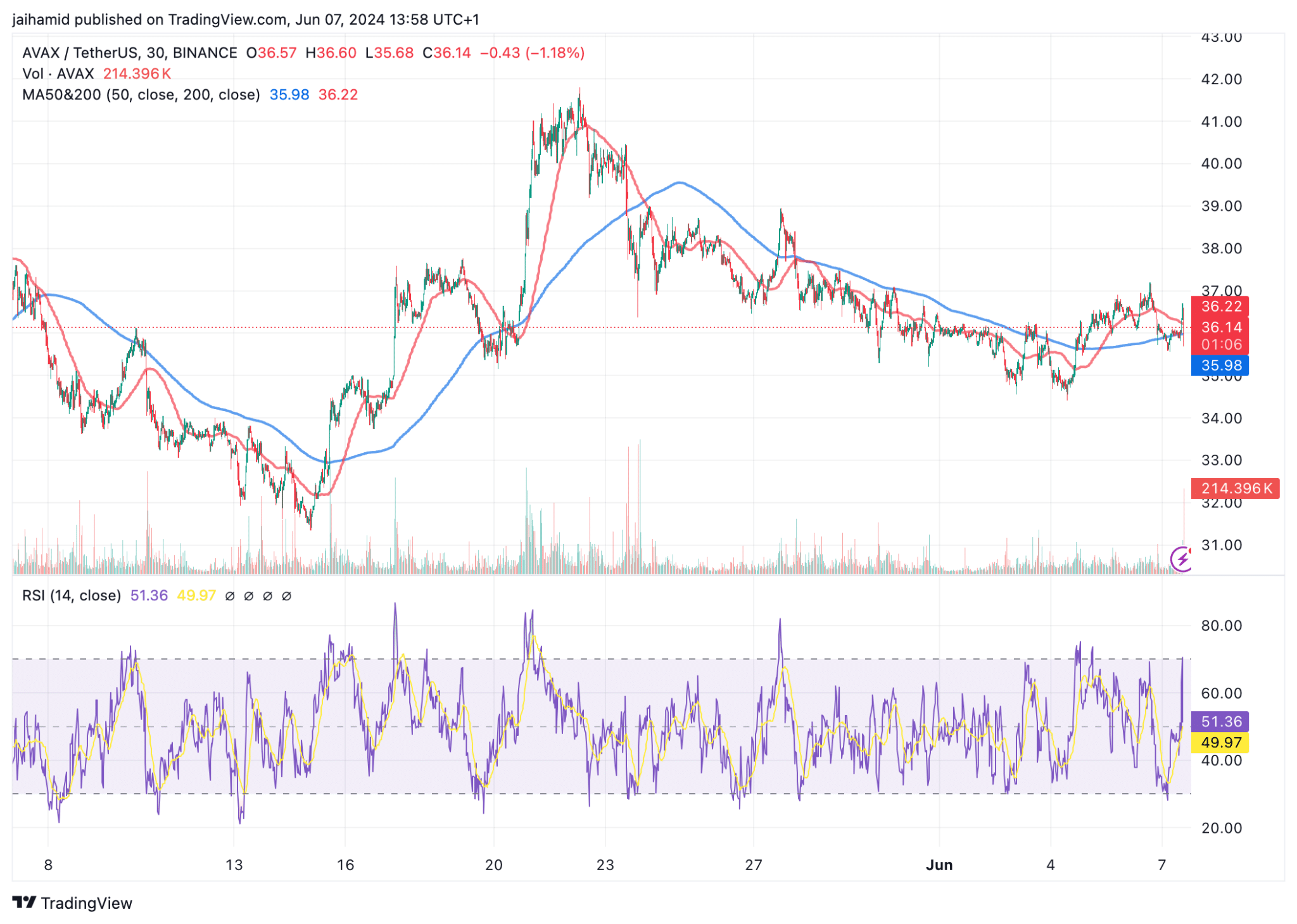

When analyzing AVAX/USDT’s monthly chart, we can see the Relative Strength Index (RSI) oscillating near the midline, primarily hovering around 50 – Indicating a lack of strong momentum in either direction. This RSI’s neutrality typically suggests a balance between buying and selling pressures, confirming the observed flat price action.

The 50-period moving average (red line) and the 200-period moving average (blue line) saw multiple crossovers too, which typically signal shifts in short-term momentum.

However, the lack of sustained direction after these crossovers is a sign of the bulls’ uncertainty to step in.

AVAX’s price, at press time, was below the 200-period moving average, but attempting to stay above the 50-period moving average – An indefinite bullish impulse.

Here, it’s worth noting that the trading volume for AVAX derivatives rose by 26.30% to $422.67 million. This meant that there seemed to be heightened trading activity and more interest in the altcoin’s price movements.

Still, the overall long/short ratio was 0.935, with a slightly higher number of short positions relative to longs in the market. This seemed to imply bearish sentiment among AVAX’s traders.

Given the dominance of long positions over shorts and the relatively stable price line, AVAX appears to have solid underlying support. While they have been major, the brief spikes in short positions might not really disrupt the overall bullish bias.

Interestingly, at press time, AVAX’s Fear and Greed Index was at ‘Greed,’ meaning investors are quite bullish right now. However, contrasting signals such as negative search interest and very negative whale activity can gave traders a more nuanced answer.

In fact, despite the overall market enthusiasm, there’s reduced interest in online searches and potential selling pressure from large holders.

This complex mix of indicators points to a cautiously optimistic short-term outlook for AVAX.