Axelar crypto pumped by 43% in October – Time for a cool-off now?

- AXL’s recovery hit over 40% in October

- However, the altcoin still faces short-term headwinds amid reduced market interest

Axelar [AXL], a protocol that offers cross-chain communication like Chainlink [LINK], surged by over 40% during October amid a broader market rebound.

The aforementioned recovery pushed AXL to a multi-month high and a previous Q2 support below the $1. Hence, the question – Can AXL move forward now?

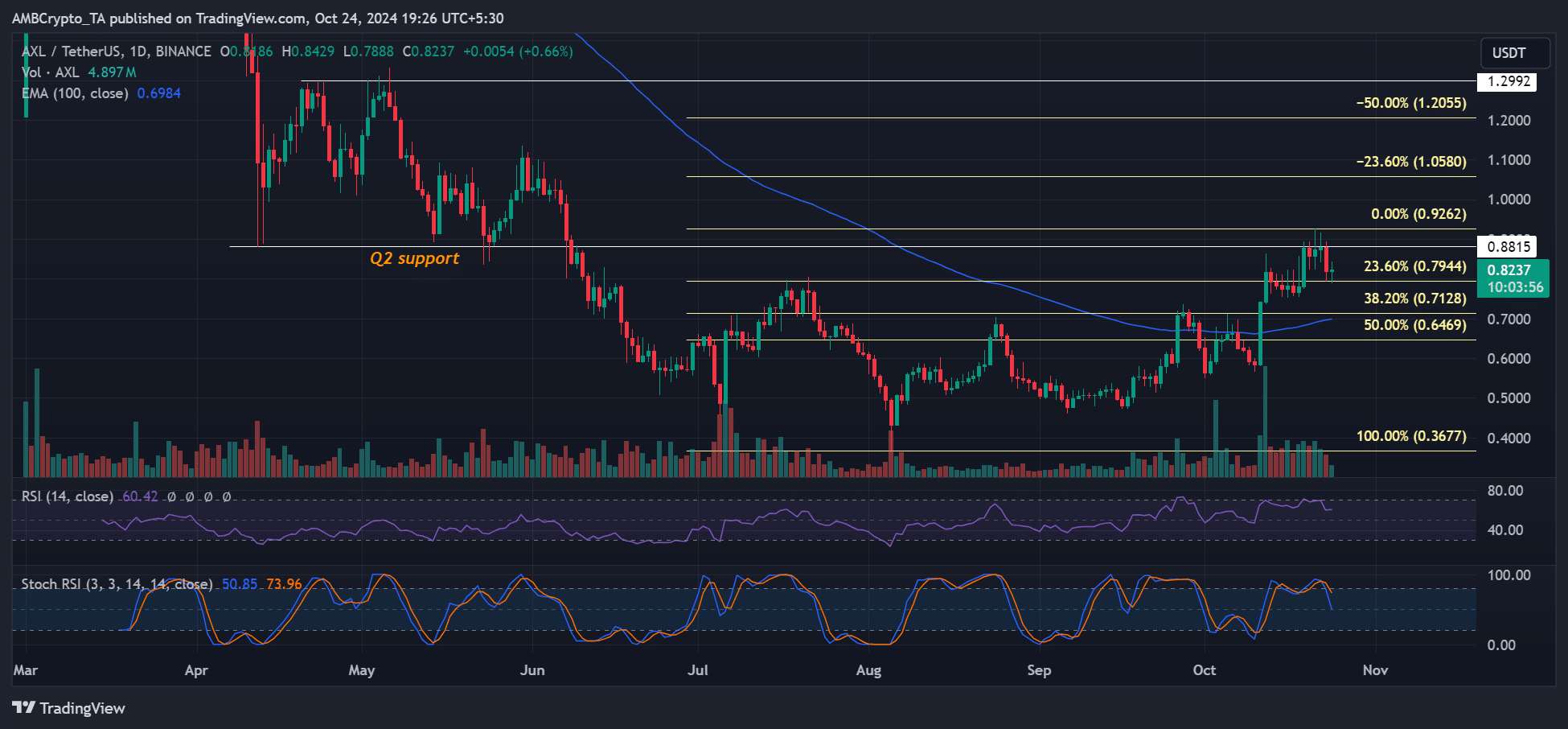

AXL’s uptrend status

Since late September, AXL has been making higher highs and lowers – A bullish market structure perfect for long positions as the price surged.

However, at press time, AXL faced price rejection at the Q2 support-cum-resistance level of $0.88.

With technicals flashing overheated signals, a strong extended recovery might be delayed. Especially if Bitcoin fails to crack $70k mark in the short term.

That being said, AXL might extend its correction to 38.2% Fib level before gaining momentum to crack the Q2 support. If so, the level could offer a discounted re-entry point.

However, a firm reclaim of the Q2 support could increase the odds of it hitting $1.29 on the charts. The immediate bullish target of $1.12 would offer extra 20% potential gains if hit.

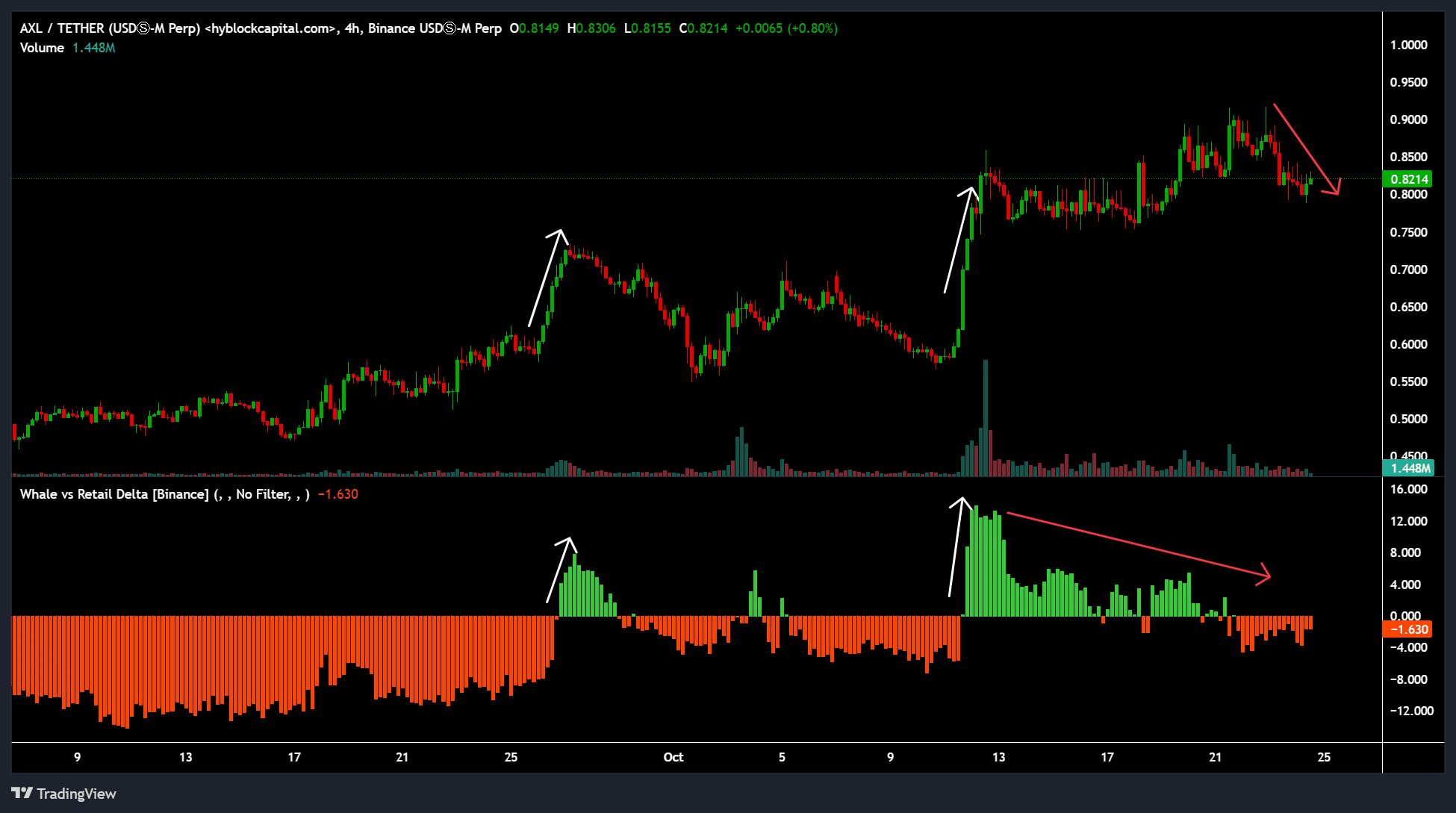

Whales reduce exposure

Another data point that suggested low odds of AXL clearing the overhead roadblock was declining whale interest.

Whales have trimmed their long positions since mid-October. This might explain the range formation seen afterwards. The declining Whale vs. Retail Delta showed this too.

However, a reversal on the metric could increase the chances of AXL cracking its former Q2 support-turned-resistance level.

Read Aexlar [AXL] Price Prediction 2024-2025

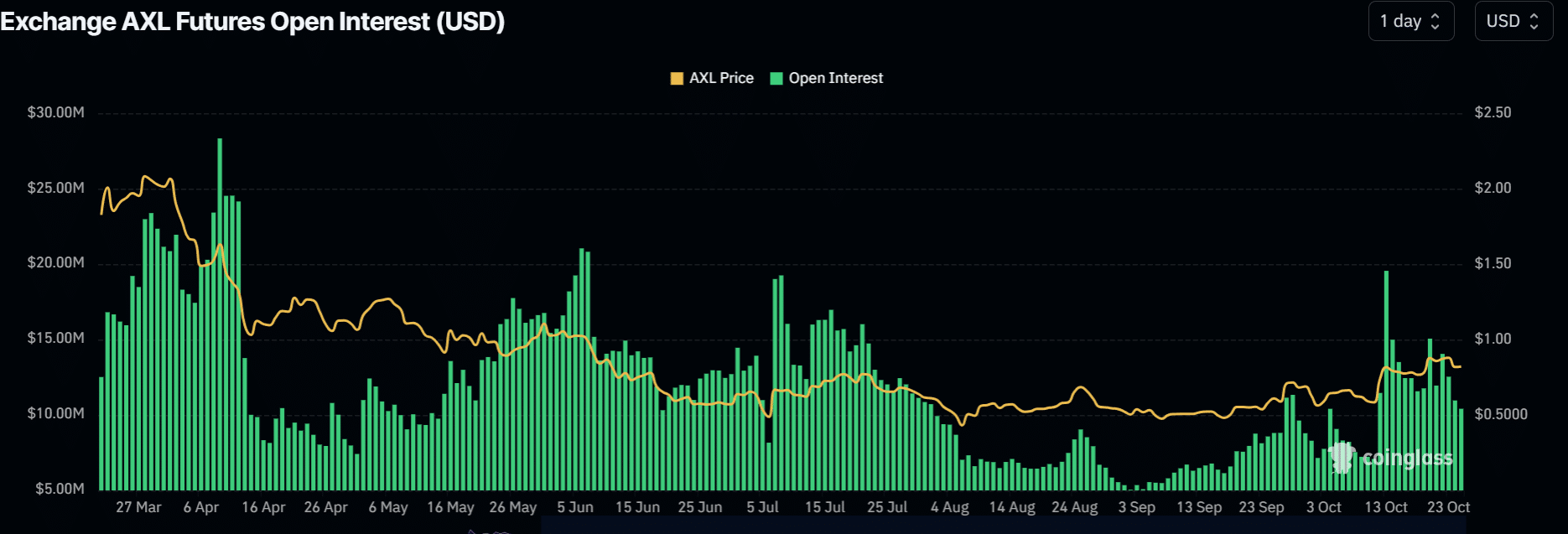

Additionally, the declining Open Interest (OI) rates also painted a short-term headwind for AXL.

In mid-October, the OI stood at nearly $20 million. However, it had fallen by half to $10 million at press time.

This highlighted reduced market interest by nearly 50% for the altcoin. Worth noting though that this could change if BTC reverses its recent losses and surges above $70k.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)