Axie Infinity faces resistance, but here’s where you can profit

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Axie Infinity showed strong short-term bullish momentum, but prices could tumble over the weekend.

- In the event of such a drop, the former resistance in the $5.1 region could be retested as support.

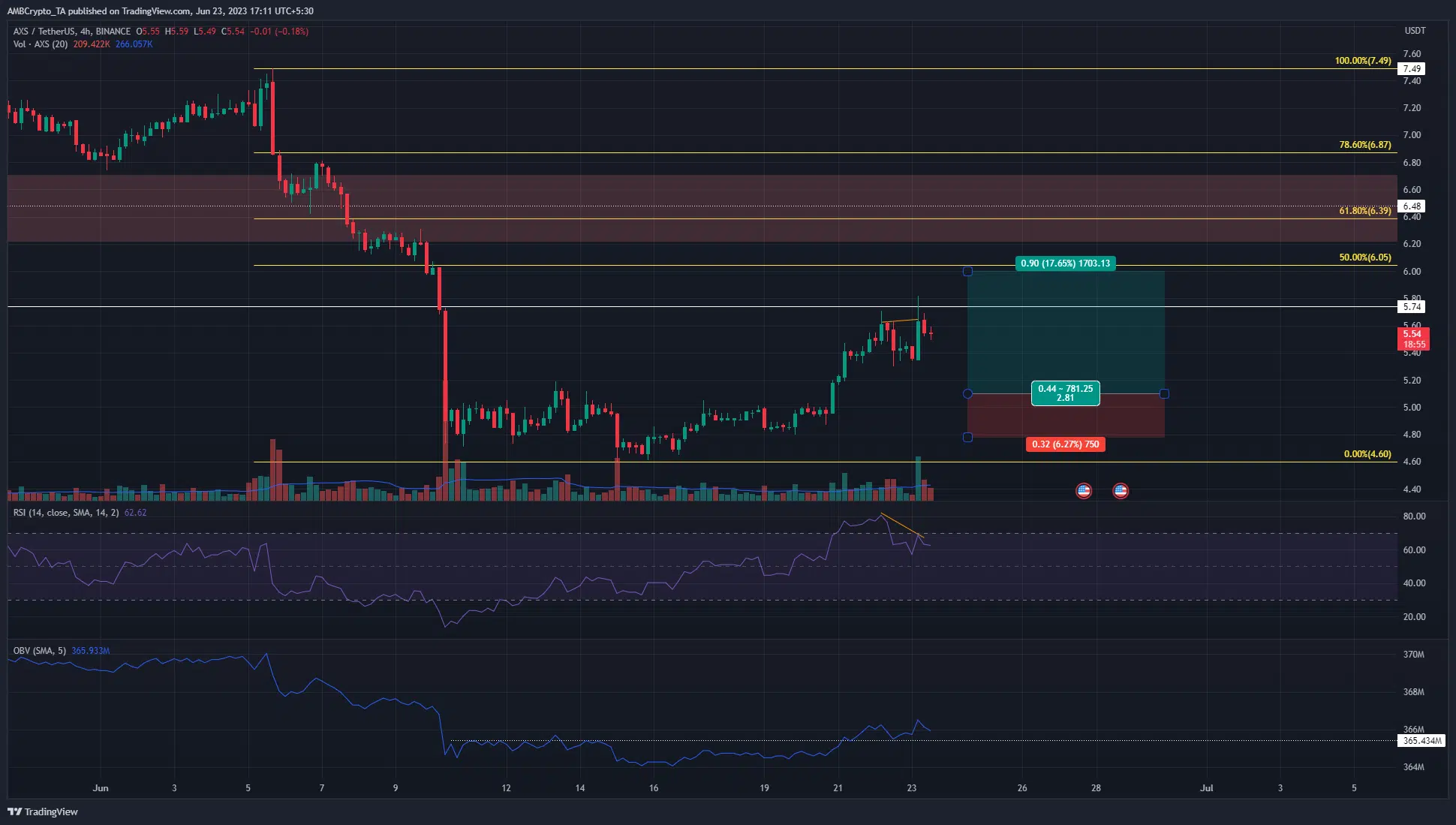

Axie Infinity [AXS] was able to climb past a local resistance at the $5-$5.2 region on Tuesday, 20 June. This region had acted as resistance from 10 June. At the time of writing, the H4 price charts of most altcoins were bullish, having seen a pullback over the past 36 hours.

Read Axie Infinity’s [AXS] Price Prediction 2023-24

AXS also followed a similar trajectory and posted a bearish divergence with the price. While its higher timeframe structure remained bearish, in the shorter timeframes, such as 1-hour and 4-hour, the bulls showed promise.

A pullback before a foray toward $6 could materialize next week

The trajectory of Bitcoin [BTC] remained bullish at press time. BTC’s bulls held on to the $30k level after a brief dip to $29.6k-$29.8k. This was important for the altcoin market. Axie Infinity and other alts are riding the bullish wave from the shift in sentiment behind BTC and Ethereum [ETH].

If this were to change, AXS could easily lose the gains the bulls fought so far to establish. Yet, the evidence at hand was in bullish favor. The bearish divergence (orange) between price action and RSI showed a drop was likely for Axie Infinity.

Yet the H4 market structure remained bullish and trading volume was climbing. The OBV has flipped a resistance level from the past ten days to support, and its upward trajectory showed buying pressure was rising.

From the perspective of where prices could go in search of liquidity, the approaching weekend could induce volatility in the market, as could Monday’s trading session. AXS could dip beneath the H1 short-term support at $5.35 to hunt stop-loss orders.

It could also drop back to the $5-$5.1 region to fill the imbalance it left on the pump to $5.5. Such a dip could provide a buying opportunity targeting the $6 area.

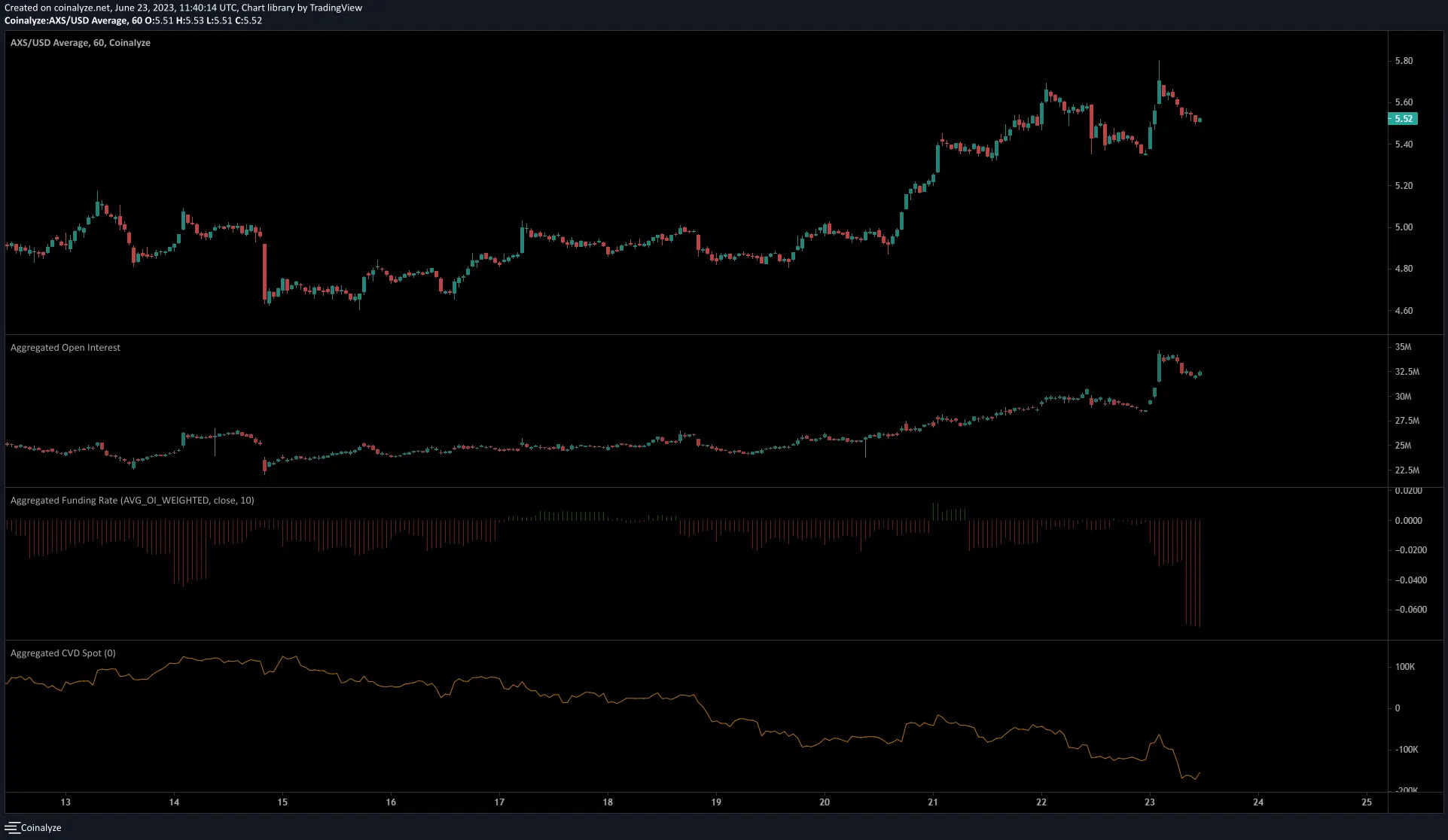

The negative funding rate showed AXS speculators were convinced the upward move was only temporary

Source: Coinalyze

The Open Interest rose by close to $7 million over the past three days. During this time, Axie Infinity posted gains measuring 14%. While the OBV showed strong buying pressure, the spot CVD from Coinalyze highlighted the exact opposite.

Realistic or not, here’s AXS’s market cap in BTC’s terms

A strong downtrend was seen over the past 48 hours, which reinforced the idea that a short-term pullback could occur. The severely negative funding rate also showed that the majority of the market was positioned short.

Overall, a revisit of the $5.1 region could provide a buying opportunity with a clear invalidation upon a further drop below $4.8.