Is Axie Infinity [AXS] still in shock after two weeks of the Ronin hack

As the Axie Infinity market attempts to recover from the effects of the Ronin hack, Sky Mavis’ Chief Operating Officer (COO), Alexsander Larsen, has come forward to take complete responsibility for the events that transpired on the night of 23 March.

Axie Infinity losers panicking still

However, while the accountability is appreciated, it won’t be able to replace the $625 million investors lost during the hack. But the company is doing its best to reimburse its investors and even managed to raise $150 million in funds to compensate for the loss.

Regardless, the panic that spread throughout AXS investors since that night is worsening as the coin continues to lose value not only in terms of price but also as an investment option due to the receding market value of the same.

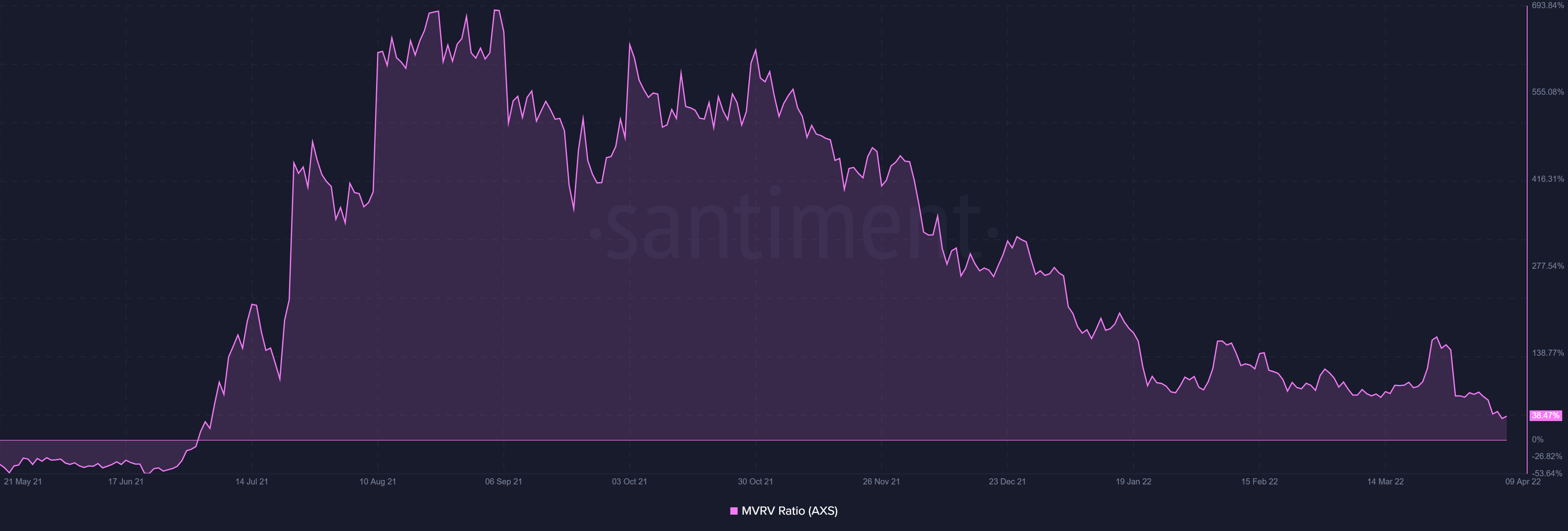

The MVRV ratio of the coin, which was already dropping since the beginning of November, fell to its lowest on 13 March but was seen to be recovering soon after.

Alas, its journey was cut short by the hack’s announcement, and the following fall created the lowest point for AXS in over a year. Inching closer to the neutral zone, AXS does not appear to be in a good position.

Axie Infinity MVRV ratio | Source: Santiment – AMBCrypto

Coincidentally the HODLing sentiment investors had for AXS also diminished as investors rushed to sell. As mentioned in a previous analysis by AMBCrypto, the hack triggered the long-term holders (LTHs), who, out of sheer panic, ended up consuming 21.78 billion days.

But it still doesn’t take away from the fact that now might be just as good a time as any since AXS is displaying positive signs for an entry at the moment.

Trading at $52.29, AXS has already lost almost 27%. However, since this is just panic-induced bearishness and not a natural development, the red candles will subside, and prices will recover soon.

Axie Infinity price action | Source: TradingView – AMBCrypto

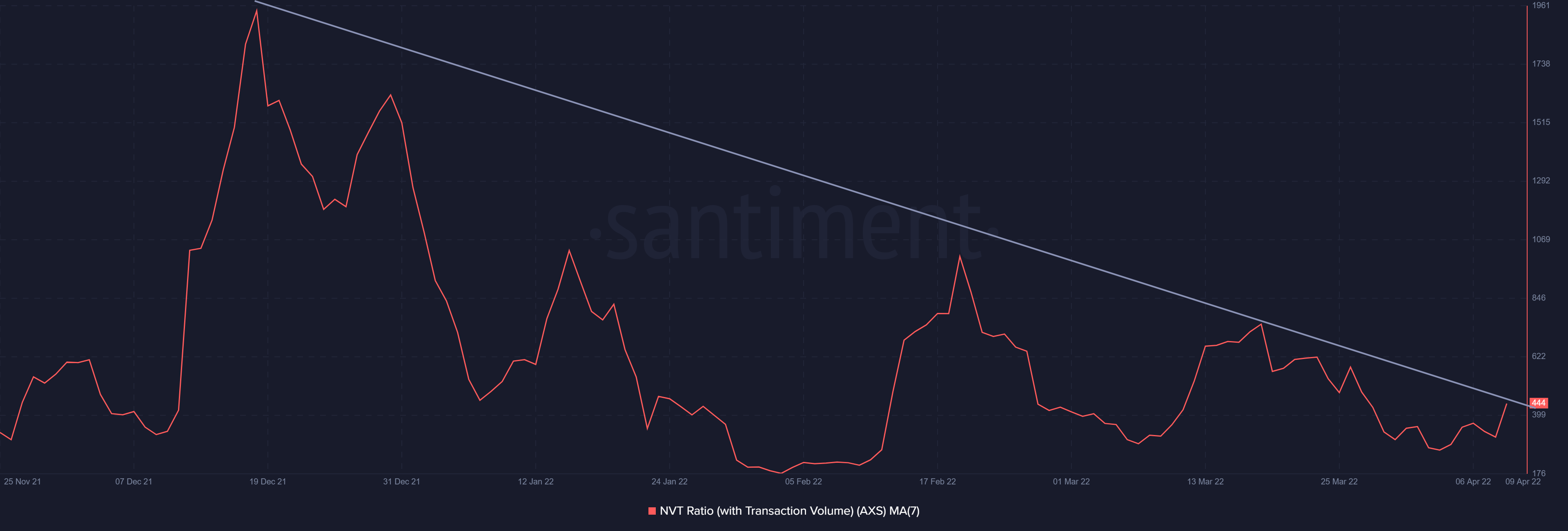

This is also because AXS is highly undervalued at the moment, the NVT circulation, which has been on a gradual decline since December, has placed the altcoin in the undervalued zone. Breaking this pattern could prepare AXS for a rise soon.

Axie Infinity NVT ratio | Source: Santiment – AMBCrypto

Furthermore, since the Relative Strength Index is far underneath in a bearish-neutral zone, it opens up a more extended timeframe for a rally to take place and helps AXS in recovering all its recent losses before overheating the market.