AXS saw massive demand, but is it enough to overcome $13 hurdle?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- AXS posted 30% gains in the past week.

- It also recorded massive demand despite mounting selling pressure.

Axie Infinity [AXS] has been recording impressive weekly performances. It posted 30% gains in the past week alone. But its consistent rally saw it hit a key October peak value of $13 that could prove a significant resistance to AXS’s upward momentum.

Read Axie Infinity [AXS] Price Prediction 2023-24

At press time, AXS traded at $11.83 after facing a price rejection on a bearish order block at $11.98. The GameFi coin could oscillate between $10.87 and $12 in the short term before attempting a retest of the October high.

The October high of $13: Can bulls bypass it?

Is your portfolio green? Check out the AXS Profit Calculator

AXS reached a high of $13.94 after Bitcoin [BTC] hit $23.5K. The above AXS move saw it break above the October high of $13.However, a price correction followed afterward, forcing AXS to retest the $10.87 support level.

AXS could retest the $13 level in the next few days, but bulls must clear the obstacle of $11.98. Besides, a BTC surge beyond $23.5K could see AXS overcome the $11.98 and $13 hurdles.

But a break below the $10.87 support level would invalidate the above bias. But the downtrend could be kept in check by the 26-period EMA (exponential moving average) or the $10.02 support level.

However, an extreme downtrend could be highly unlikely because the Relative Strength Index (RSI) was bullish, and the On Balance Volume (OBV) has been making higher lows, showing genuine demand.

AXS saw massive demand despite mounting selling pressure

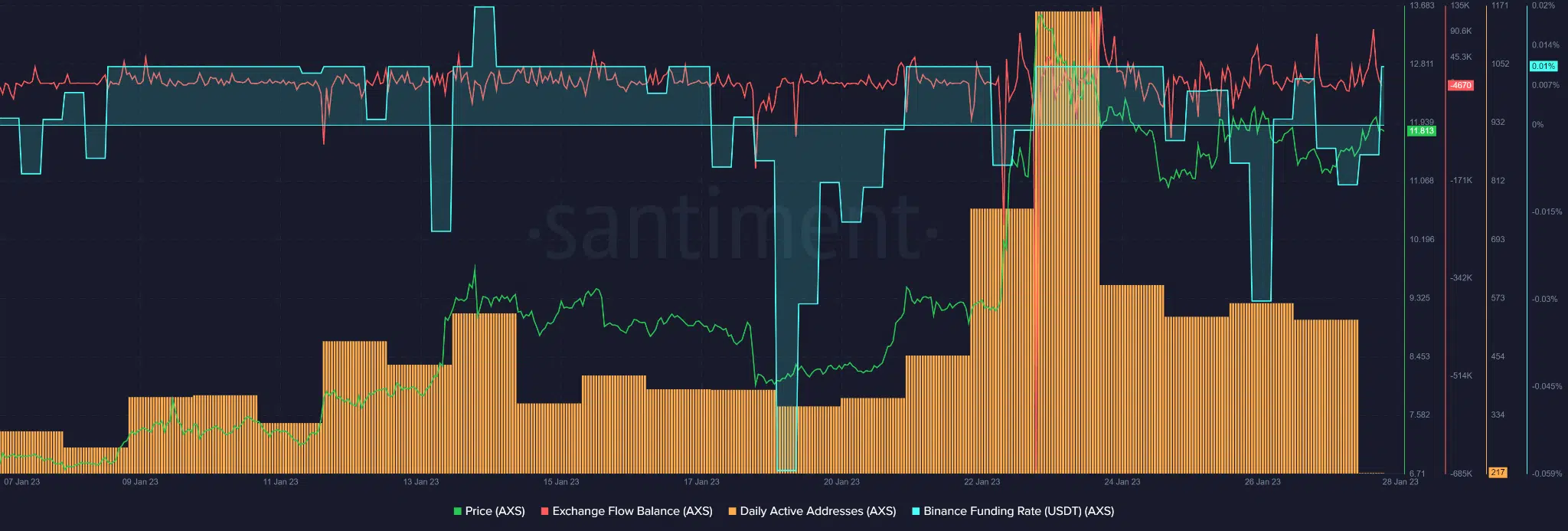

AXS saw more demand in the derivatives market, as evidenced by an increase in Binance Funding Rate and a subsequent flip to the positive side. Further increase in demand could prop up AXS prices.

However, the Exchange Flow Balance was positive, indicating a short-term distribution as more AXS moved to exchanges as short-term holders sought to sell their holdings for a profit. The short-term selling pressure could make overcoming the $11.98 and $13 hurdles more challenging.

In addition to the short-term selling pressure, AXS’s trading volumes also dipped slightly, as shown by the daily active addresses. This could delay a strong uptrend momentum in the short term, but an improvement could be recorded if BTC reclaims the $23.5K level.