B2Broker updates its liquidity offering for effective risk management

B2Broker, a tier-1 provider of liquidity in the Forex and cryptocurrency markets, has expanded its range of liquidity offerings to include Non-Deliverable Forwards (NDFs), giving clients even more asset options and enabling them to control risk more effectively.

B2Broker sets industry standards by offering clients a wide range of liquidity options across all major asset classes. Now, among them are:

- Rolling Spot FX & Precious Metals

- Equity Indices

- Energies

- Commodities

- Crypto Derivatives/CFDs

- Single Stocks/CFDs

- ETFs

- NDFs

By offering richer liquidity capabilities, B2Broker strives to remain one step ahead of its competitors in meeting the liquidity needs of its clients.

What are NDFs?

An NDF is a type of financial derivative used in international trade to manage currency risk. These contracts enable parties to minimize potential losses resulting from changes in exchange rates between two currencies.

NDFs let participants exchange the difference between an agreed-upon fixed exchange rate and the current market exchange rate on a specific future date. They are cash settlements and do not involve the actual exchange of underlying currencies.

Using NDFs can help manage risk in emerging markets where traditional local currency forwards may not be an option. By taking advantage of the NFD technique to reduce foreign currency exposure, businesses protect themselves from potential losses related to international deals.

NDF currencies B2Broker offers

B2Broker supports various NDF currencies, enabling clients to take advantage of low-risk hedging opportunities. The NDF currency list includes the following:

- USD/BRL

- USD/CLP

- USD/COP

- USD/IDR

- USD/INR

- USD/KRW

- USD/TWD

B2Broker liquidity offer advantages

B2Broker has reshaped the way NDFs are traded by providing clients with NFD contracts as CFDs. These allow for faster and more secure settlements, with money changing hands within one business day instead of having to wait 30 days, as is typically the case for traditional NDFs.

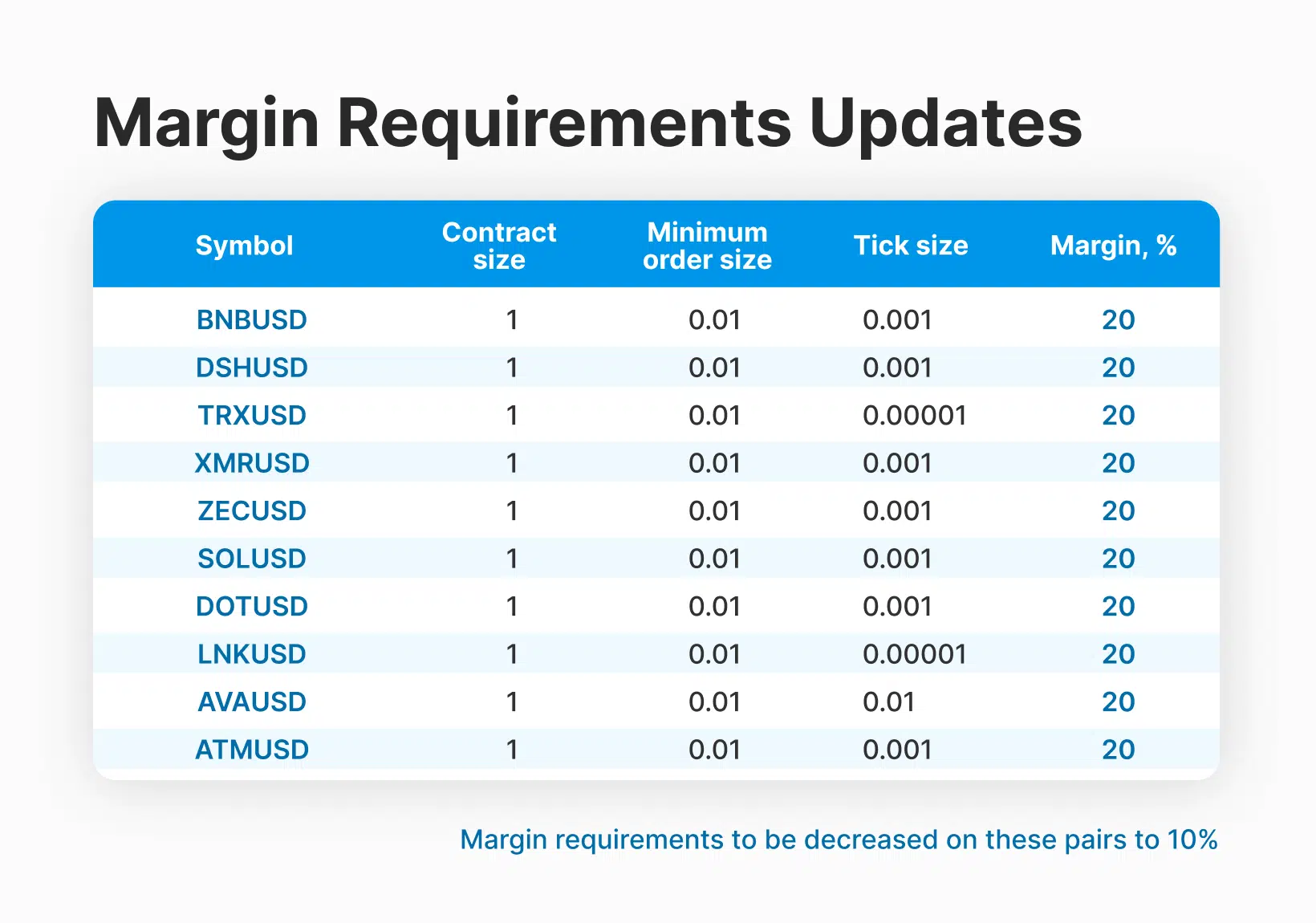

Reduced margin requirements on additional 10 crypto CFD pairs

In order to make services more accessible, B2Broker has lowered margin requirements from 20% to 10% on certain assets:

- BNB/USD

- DSH/USD

- TRX/USD

- XMR/USD

- ZEC/USD

- SOL/USD

- DOT/USD

- LNK/USD

- AVA/USD

- ATM/USD

Updated prime of prime institutional liquidity offer

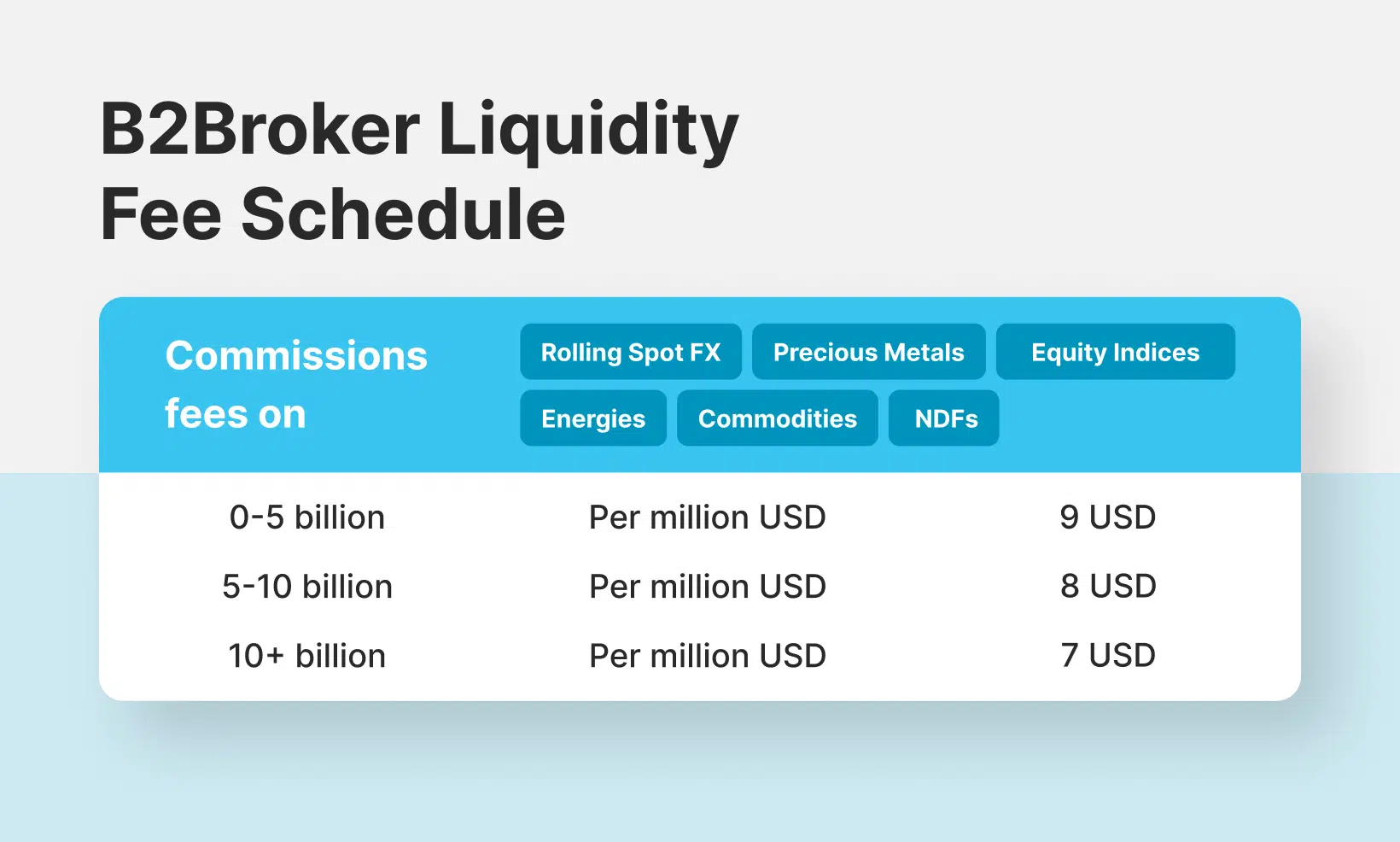

Furthermore, B2Broker has added Prime Margin Account connectivity points (OneZero, PrimeXM, and Centroid) to its PoP institutional liquidity packages, allowing clients to offer users STP/DMA (A book) trading with higher execution quality. To top it off, clients will benefit from a monthly minimum liquidity fee based on the amount traded.

B2Broker offers a smooth onboarding process by setting up the Prime Margin Account at no cost and providing round-the-clock technical support to ensure seamless brokerage operation.

Conclusion

B2Broker is the go-to provider of technology and liquidity solutions for financial institutions, crypto exchanges, and brokers. Through its expansive suite of services, businesses can access over 800 trading instruments across eight asset classes – allowing their clients to trade confidently.

The most recent updates to its liquidity offerings further solidify B2Broker as a leading crypto and forex liquidity B2B player.

Disclaimer: This is a paid post and should not be treated as news/advice.